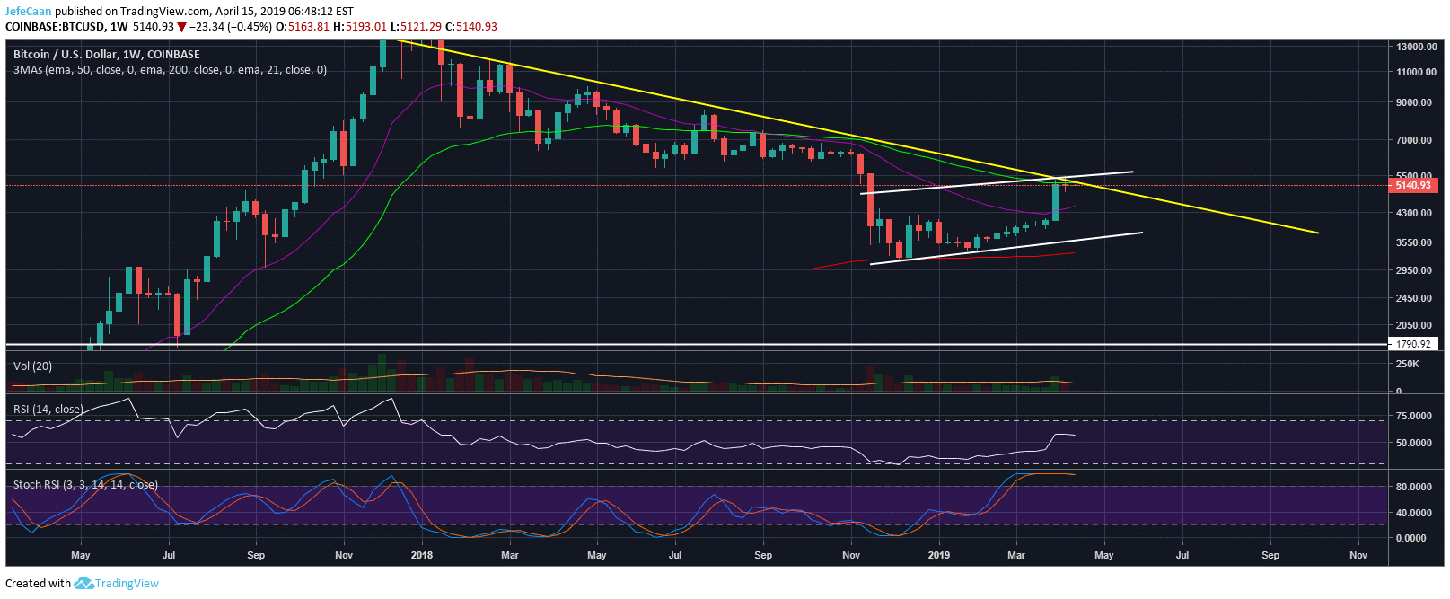

Bitcoin (BTC) has just closed the week below its 50 week exponential moving average. This confirms our bearish bias and points to a major decline in the weeks ahead. As long as the price remains below the 50 week EMA, there is no reason to be bullish on Bitcoin (BTC). That being said, technical indicators on shorter time frames now present the possibility of short term movements to the upside before the weekly close. In other words, BTC/USD could rally towards $5,300 in the days ahead as the daily Stochastic RSI is now near oversold territory. The price remains heavily overbought on the weekly time frame and investors who are more interested in buying and holding instead of trading would be better of waiting for the price to retrace in the weeks ahead.

The price has now closed below the 50 week EMA for the second time but it has also faced rejection at a trend line resistance that extends back early 2018. In our previous analyses, we have discussed how the ongoing cycle has to be longer than the previous cycle for us to consider that the bear market might be over. If the price were to recover from current levels and begin a new bullish cycle, Bitcoin (BTC) would be doing something it has not done in its entire trading history. In financial markets, one of the biggest mistakes an investor could make is to think that this time will be different because most of the times the same things repeat in slightly different ways. This is why the current market cycle is so similar to the previous market cycle. Yet most people are sitting at major losses from the previous all-time high because they “bought the dips” thinking this time will be different.

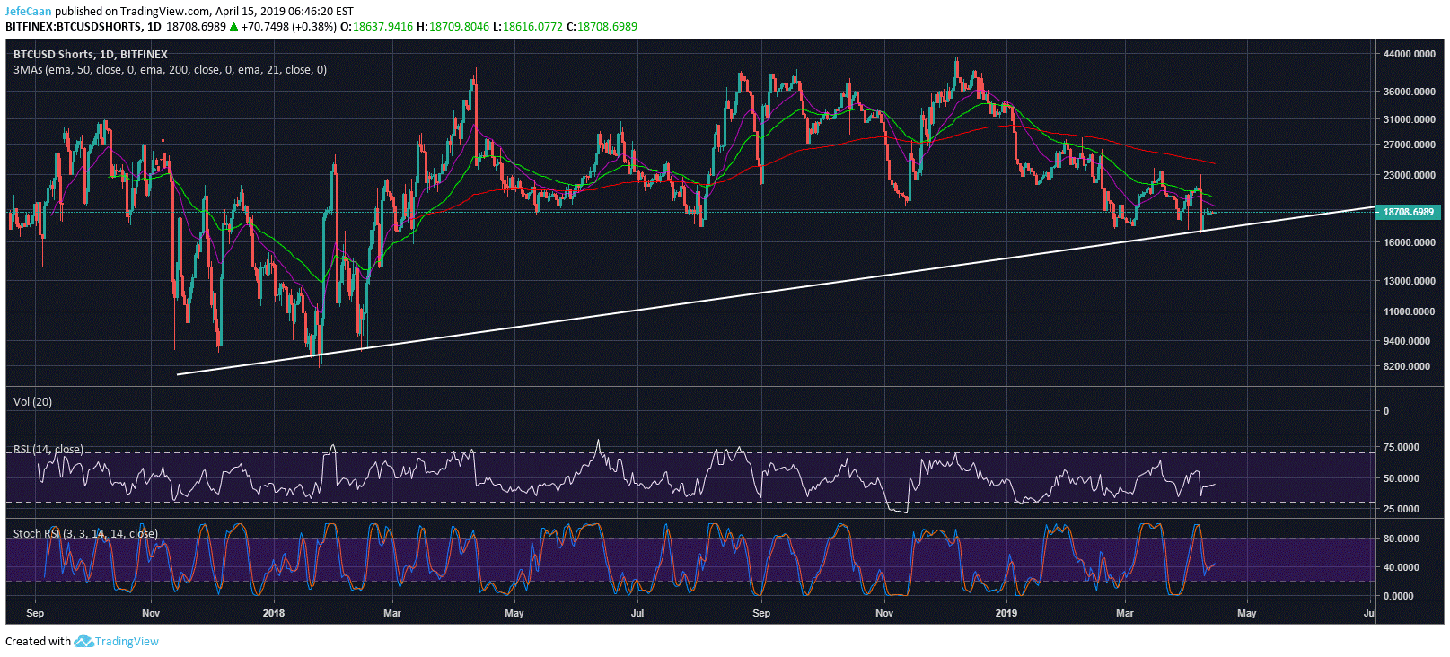

The daily chart for BTCUSDShorts shows that the bears are trying to regain control once again as the number of margined shorts is beginning to rise. BTCUSDShorts is expected to rise above the 50 day EMA by May which is when we will see a major rise in bearish momentum. This supports our view that the S&P 500 as well as Bitcoin (BTC) will experience maximum pain till the month of September. The cryptocurrency market in particular will be the one to see most uncertainty as it is a relatively nascent market with a small market cap.

As we saw towards the end of the previous market cycle, investors lost interest because the market was marred by fear and uncertainty. The same is expected to happen this time but for different reasons. Previously, it was the Mt. Gox hack that made the majority lose interest in the market, this time it will be something else. We have mentioned in our previous analyses that we expect BTC/USD to fall down to $1,800 during the next major decline but the price will most likely form a wick below $1,800. The interesting part is that this decline will not happen in a week or two weeks. It will happen such that investors lose interest in the market and buying at $1,800 does not appear to be so lucrative anymore.

Investment Disclaimer