Table of Contents

- In Todays Headline TV CryptoDaily News:

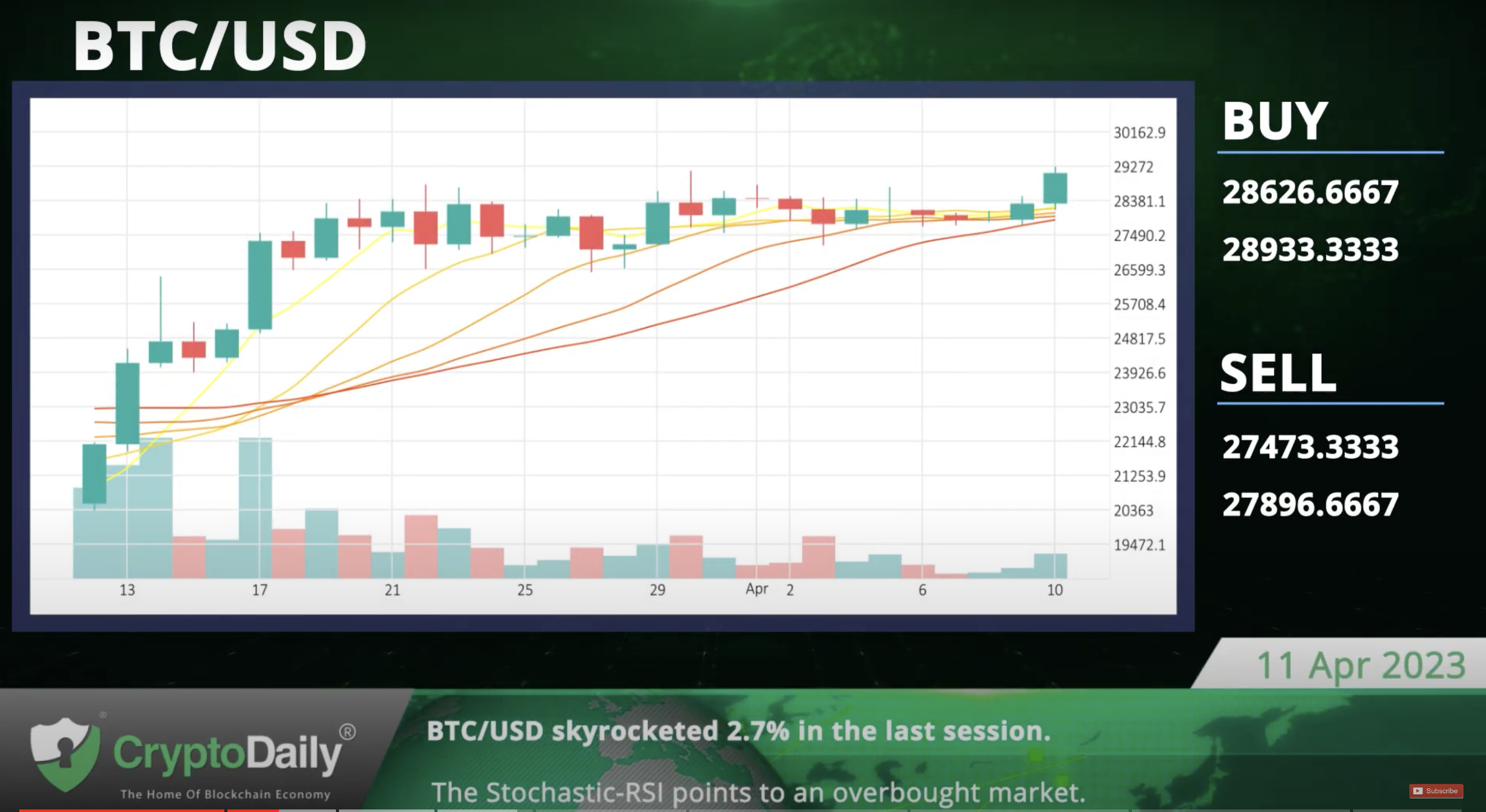

- BTC/USD skyrocketed 2.7% in the last session.

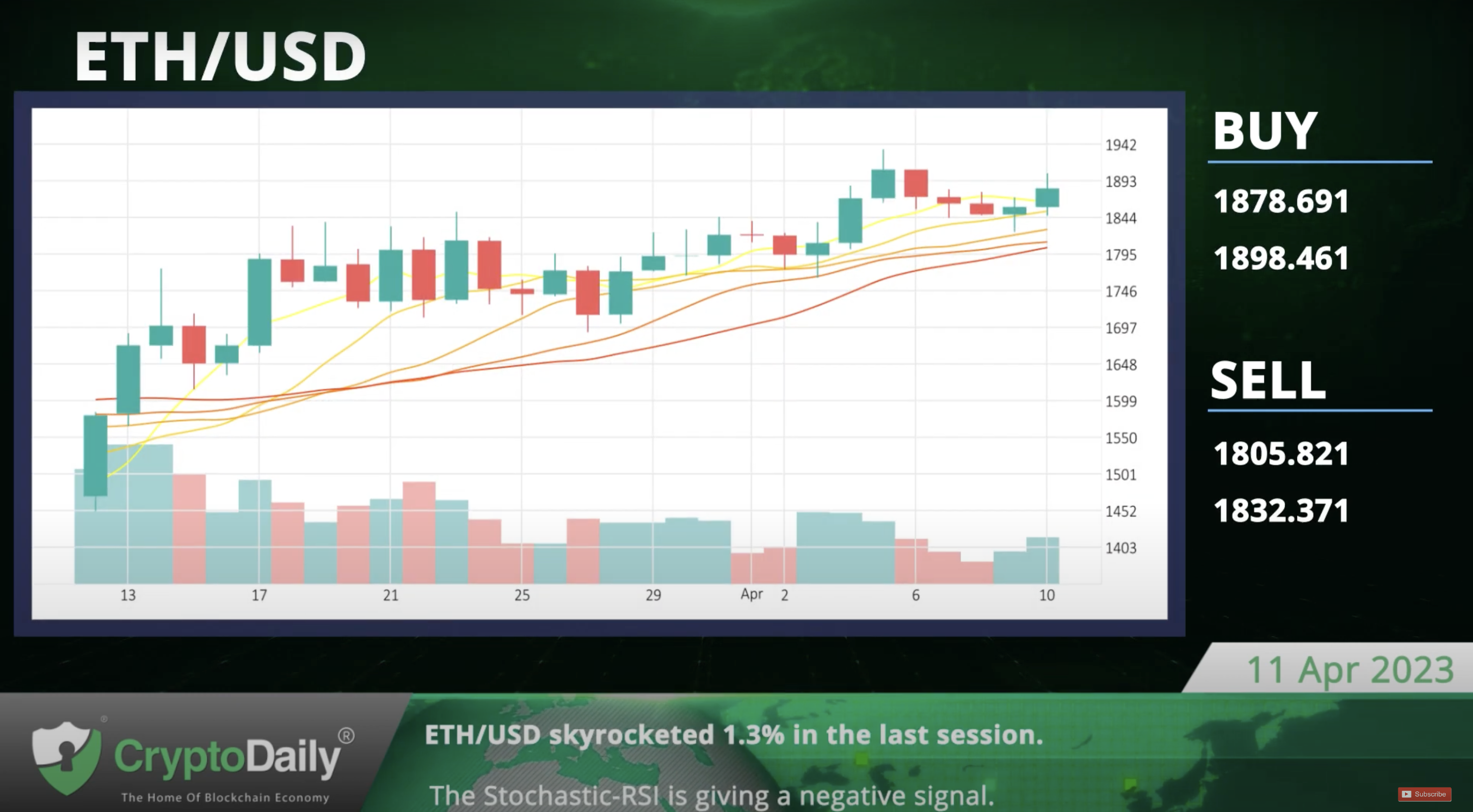

- ETH/USD skyrocketed 1.3% in the last session.

- XRP/USD exploded 1.3% in the last session.

- LTC/USD skyrocketed 2.2% in the last session.

- Daily Economic Calendar:

In Todays Headline TV CryptoDaily News:

Euler Finance community weighs plan to return recovered money.

The community behind Euler Finance, the decentralized finance lending protocol that suffered a $200 million hack in March, will soon be asked to vote on how to distribute recovered funds to users. The proposal aims to let Euler users redeem their capital as soon as possible.

Bitcoin faces low risk of 'liquidations-induced' price volatility.

Bitcoin has surged 70% this year, hitting nine-month highs of over $29,000. While the sharp rally has brought the derivatives market back to life, the overall use of leverage remains muted, suggesting a low risk of "liquidations-induced" wild price swings.

Bitcoin price hits highest point since June 2022.

Coinbase and MicroStrategy are among the names making big moves as bitcoin rose more than 4% to top $29,200 for the first time since June 2022. Coinbase is up 5.5% and MicroStrategy has gained more than 6%.

BTC/USD skyrocketed 2.7% in the last session.

The Bitcoin-Dollar pair skyrocketed 2.7% in the last session. According to the Stochastic-RSI, we are in an overbought market. Support is at 27473.3333 and resistance at 28933.3333.

The Stochastic-RSI points to an overbought market.

ETH/USD skyrocketed 1.3% in the last session.

The Ethereum-Dollar pair skyrocketed 1.3% in the last session. The Stochastic-RSI is giving a negative signal. Support is at 1805.821 and resistance at 1898.461.

The Stochastic-RSI is giving a negative signal.

XRP/USD exploded 1.3% in the last session.

The Ripple-Dollar pair exploded 1.3% in the last session. The Ultimate Oscillator is giving a positive signal. Support is at 0.4939 and resistance at 0.515.

The Ultimate Oscillator is currently in the positive zone.

LTC/USD skyrocketed 2.2% in the last session.

The Litecoin-Dollar pair exploded 2.2% in the last session. The Ultimate Oscillator is giving a positive signal. Support is at 88.391 and resistance at 92.111.

The Ultimate Oscillator is currently in the positive zone.

Daily Economic Calendar:

US Redbook Index

The Johnson Redbook Index measures the year-over-year same-store sales growth from a sample of large general merchandise retailers. The US Redbook Index will be released at 12:55 GMT, Japan's Machinery Orders at 23:50 GMT, the US USDA WASDE Report at 16:00 GMT.

JP Machinery Orders

The Machinery Orders measure the total value of machinery orders placed at major manufacturers.

US USDA WASDE Report

The World Agricultural Supply and Demand Estimates report, published on a monthly basis by the United States Department of Agriculture, provides forecasts for agricultural commodities' supply and demand.

US NFIB Business Optimism Index

The NFIB Business Optimism Index results from Small Business Economic Trends data collected from quarterly surveys since 1974 and monthly surveys since 1986. The US NFIB Business Optimism Index will be released at 10:00 GMT, Japan's Machine Tool Orders at 06:00 GMT, and Japan's Producer Price Index at 23:50 GMT.

JP Machine Tool Orders

The Machine Tool Orders shows movements in tool orders by manufacturers. It indicates the state of the Japanese economy.

JP Producer Price Index

The Producer Price Index measures the average changes in prices in primary markets by producers of commodities in all processing states.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Investment Disclaimer