Table of Contents

- In Todays Headline TV CryptoDaily News:

- BTC/USD rose 0.6% in the last session.

- ETH/USD exploded by 1.5% in the last session.

- XRP/USD gained 0.6% in the last session.

- LTC/USD gained 0.4% in the last session.

- Daily Economic Calendar:

In Todays Headline TV CryptoDaily News:

Portugal's to introduce 28% tax on short-term crypto holdings.

Portugal, a haven for crypto investors, has decided to tax cryptocurrencies at a rate of 28% on investors holding blockchain-based assets for less than a year. However, assets that are held beyond the one-year period will remain tax-free.

Bitcoin miner Crusoe Energy buys GAM.

Bitcoin miner Crusoe Energy has acquired peer Great American Mining, adding 9% to its capacity as the industry continues to consolidate amid a challenging market that is squeezing miners' margins.

Tether stablecoin issuer freezes 8.2M USDT.

Tether stablecoin issuer has frozen yet another batch of USDT on the Ethereum blockchain, blacklisting three wallets holding $8.2 million worth of the cryptocurrency.

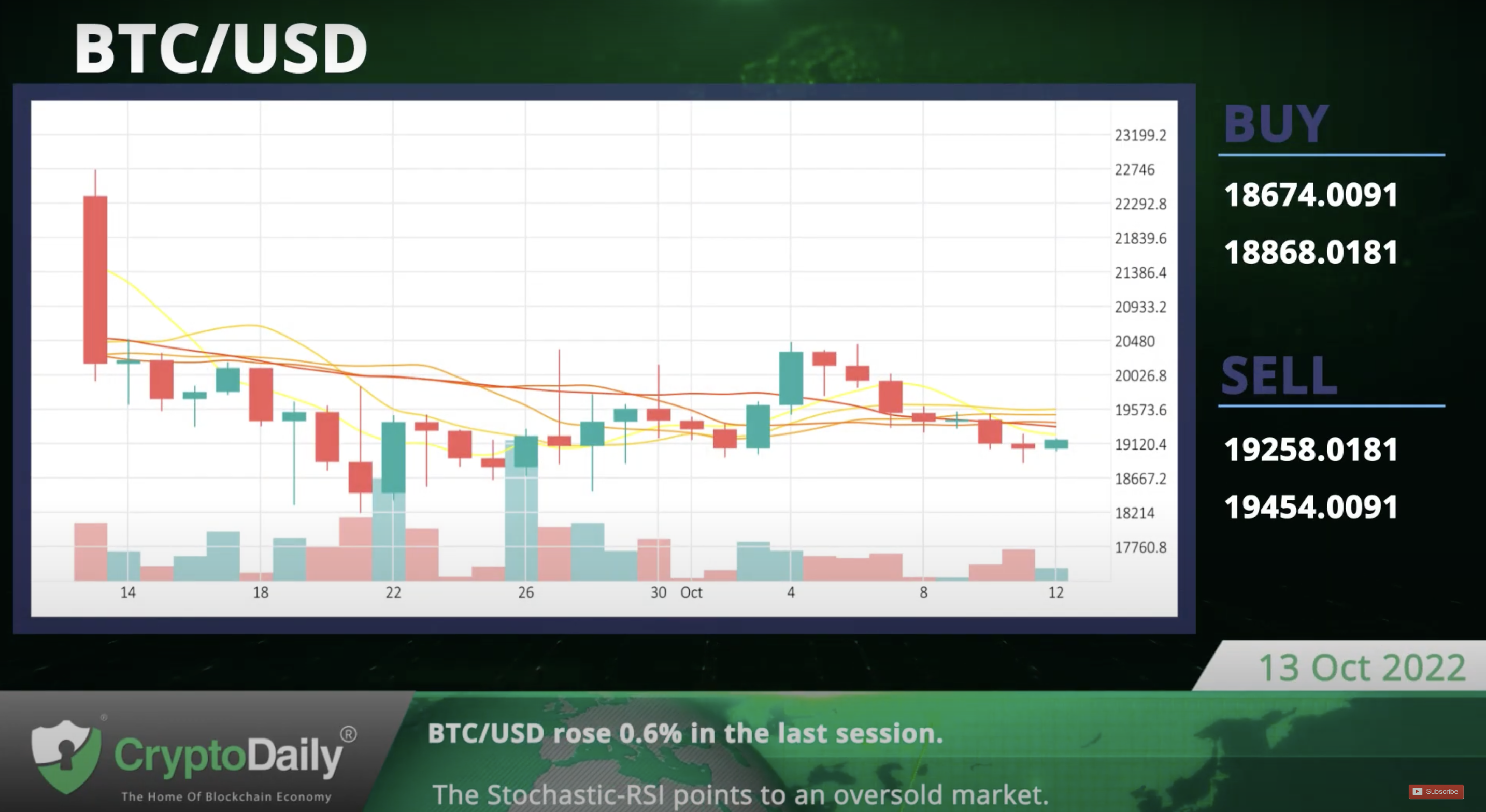

BTC/USD rose 0.6% in the last session.

The Bitcoin-Dollar pair rose 0.6% in the last session. According to the Stochastic-RSI, we are in an oversold market. Support is at 18674.0091 and resistance is at 19454.0091.

The Stochastic-RSI points to an oversold market.

ETH/USD exploded by 1.5% in the last session.

The Ethereum-Dollar pair exploded 1.5% in the last session. The CCI is giving a positive signal. Support is at 1254.1267 and resistance is at 1310.4467.

The CCI is currently in the positive zone.

XRP/USD gained 0.6% in the last session.

The Ripple-Dollar pair gained 0.6% in the last session. The RSI is giving a negative signal. Support is at 0.4642 and resistance is at 0.5132.

The RSI is currently in the negative zone.

LTC/USD gained 0.4% in the last session.

The Litecoin-Dollar pair rose 0.4% in the last session. The CCI indicates an oversold market. Support is at 50.7667 and resistance is at 53.2067.

The CCI points to an oversold market.

Daily Economic Calendar:

JP Foreign Bond Investment

Foreign Bond Investment refers to bonds issued in a domestic market by a foreign entity in the domestic market’s currency. Japan's Foreign Bond Investment will be released at 23:50 GMT, the US Consumer Price Index Core at 12:30 GMT, and the US Consumer Price Index at 12:30 GMT.

US Consumer Price Index Core

The Core Consumer Price Index (CPI) measures the changes in the prices of goods and services, excluding food and energy.

US Consumer Price Index

The Consumer Price Index measures price movements by comparing the retail prices of a representative shopping basket of goods and services.

JP Foreign Investment in Japanese Stocks

Securities investment refers to bonds issued in a domestic market by a foreign entity in the domestic market’s currency. Japan's Foreign Investment in Japan Stocks will be released at 23:50 GMT, Germany's Harmonized Index of Consumer Prices at 06:00 GMT, and Australia's Consumer Inflation Expectations at 00:00 GMT.

DE Harmonized Index of Consumer Prices

The HICP measures price movements or inflation harmonized across the EU Member States. It is similar to the national Consumer Price Indices (CPI).

AU Consumer Inflation Expectations

The Consumer Inflation Expectation presents the consumer expectations of future inflation for the next 12 months, which may influence rate decisions.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Investment Disclaimer