Table of Contents

Do Kwon, the CEO of Luna, has matched 2 bets that wager the LUNA price will be below $88, and $92.48 in a year from now. The $22 million amount of both sides of the bet are now in an escrow under the control of Crypto Cobie, co-host of the UpOnlyTV podcast.

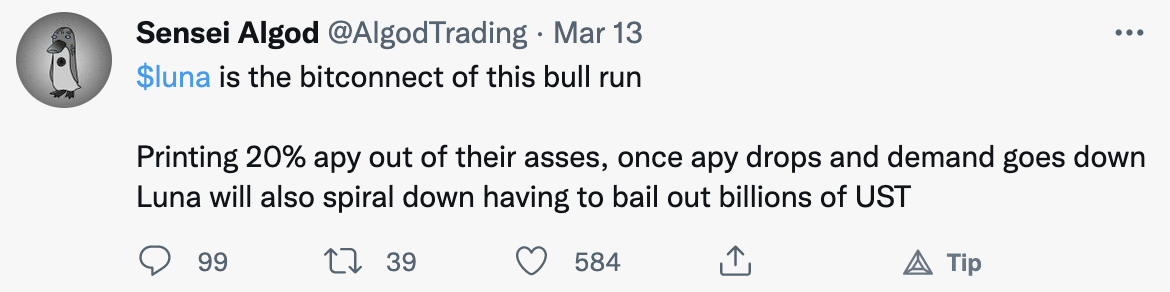

The bet began yesterday, as the Twitter account called Sensei Algod was tweeting out his views that Luna was a ponzi scheme, and that it was “the bitconnect of this bull run.”

The bet became on as Do Kwon replied that he was “in”.

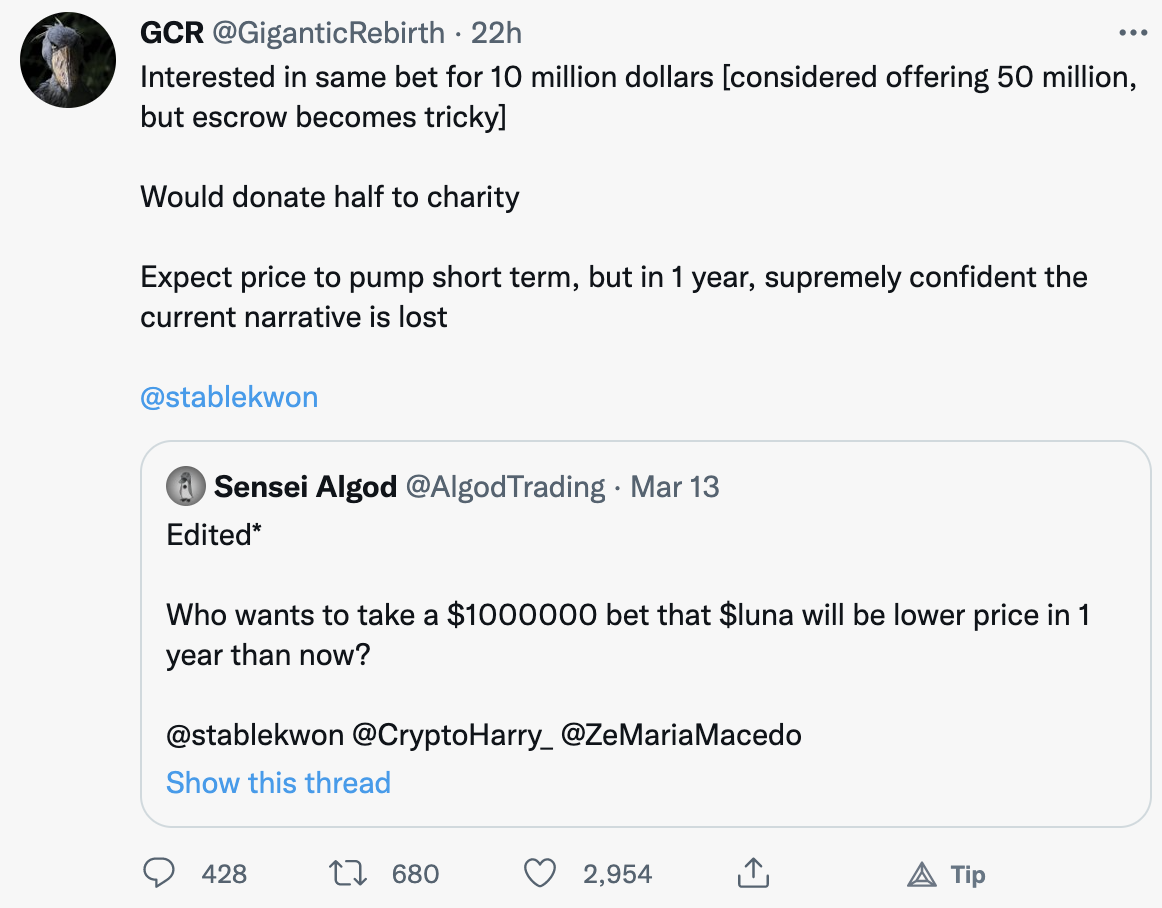

Crypto Cobie agreed to be an intermediary and set up a wallet, into which both Sensei Algod, and Do Kwon deposited 1$ million. It was then that a third party entered the scene. Sensei Algod had tweeted out asking if there was anyone else who would take a $1 million bet with him.

The tweet was seen by the Twitter account GCR, who originally wanted to go as high as $50 million, but said that the escrow would prove difficult, and then agreed to put $10 million on a wager if Do Kwon would match it. He did.

So what are the bull and bear cases for LUNA?

Starting with the bull case for LUNA, it needs to be recognised that demand for the UST stablecoin is what drives the LUNA price. Every time one UST is minted, the equivalent amount of LUNA is burned, so the system relies on increasing adoption of UST in order for it to survive and flourish.

Currently, most of the LUNA/UST adoption is being driven by Anchor Protocol, which offers around 20% yield on UST stablecoins. The key to Anchor is its yield reserve, which had been depleted not too long ago, but had then received a $450 million top up from Terraform labs.

Even with this, the yield reserve is starting to deplete again, and probably only has 2 to 3 months before going to zero.

How the Terraform team aims to ameliorate this issue is by AVAX, BTC, SOL, and other cryptocurrencies being used as further collateral options, which is expected to incentivize more borrowing.

All this mostly depends on the crypto market going up over time. As long as this happens, there is likely to be more demand for borrowing, and the Anchor Protocol becomes more and more sustainable.

Also on the side of LUNA is the Luna Foundation Guard, which is an organisation dedicated to supporting the Terra ecosystem. So if the UST peg to the dollar were in danger, then this organisation would step in to support it.

A recent move from the organisation is the creation of a Bitcoin reserve fund, which adds a far greater level of stability to the Terra ecosystem. Minted UST was used to buy $1 billion in BTC, which was the biggest private token sale at the time.

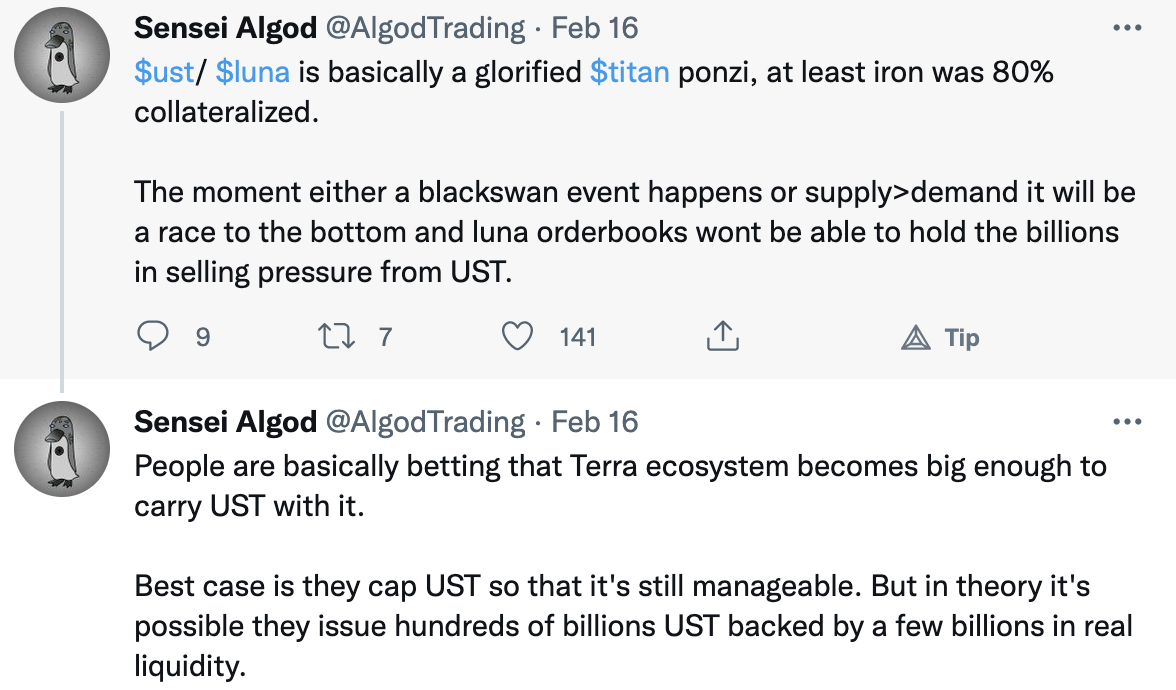

In answer to the bullish case for LUNA, Sensei Algod replied the following:

It remains to be seen who will win the bet and be proved right. For the sake of having a decent alternative to the US dollar, it is perhaps arguable that the survival and success of UST and LUNA would be preferred. We await the results in one year’s time.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Investment Disclaimer