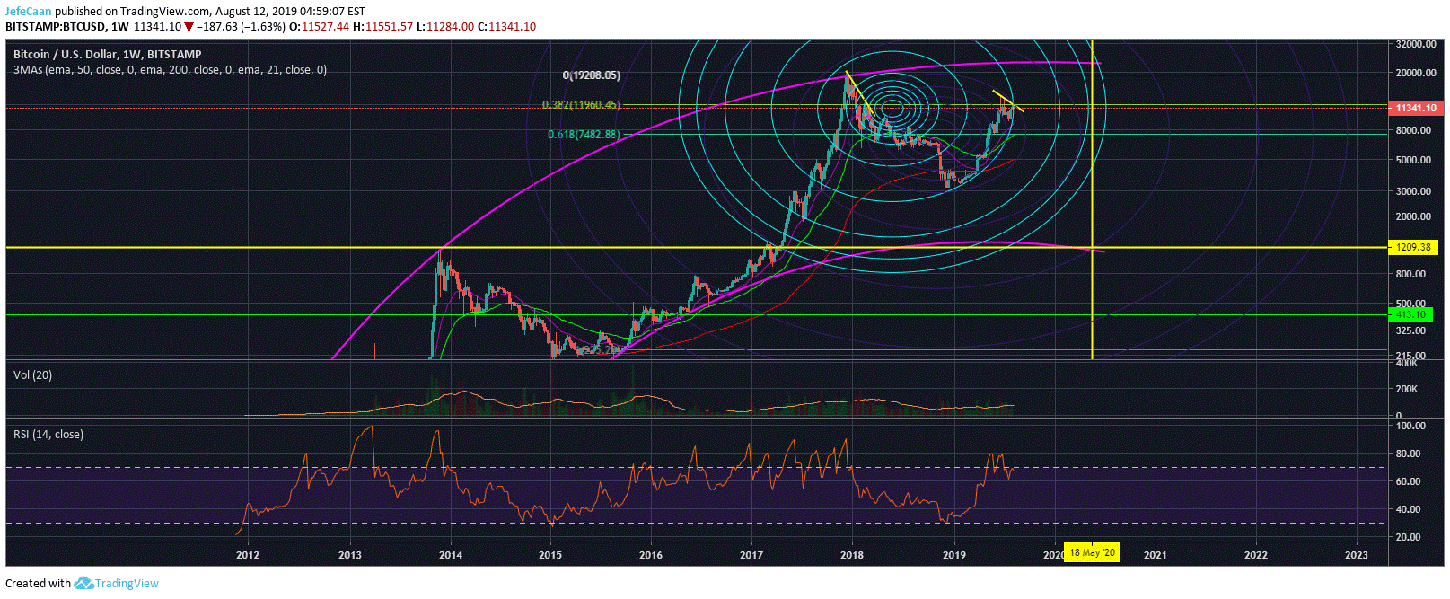

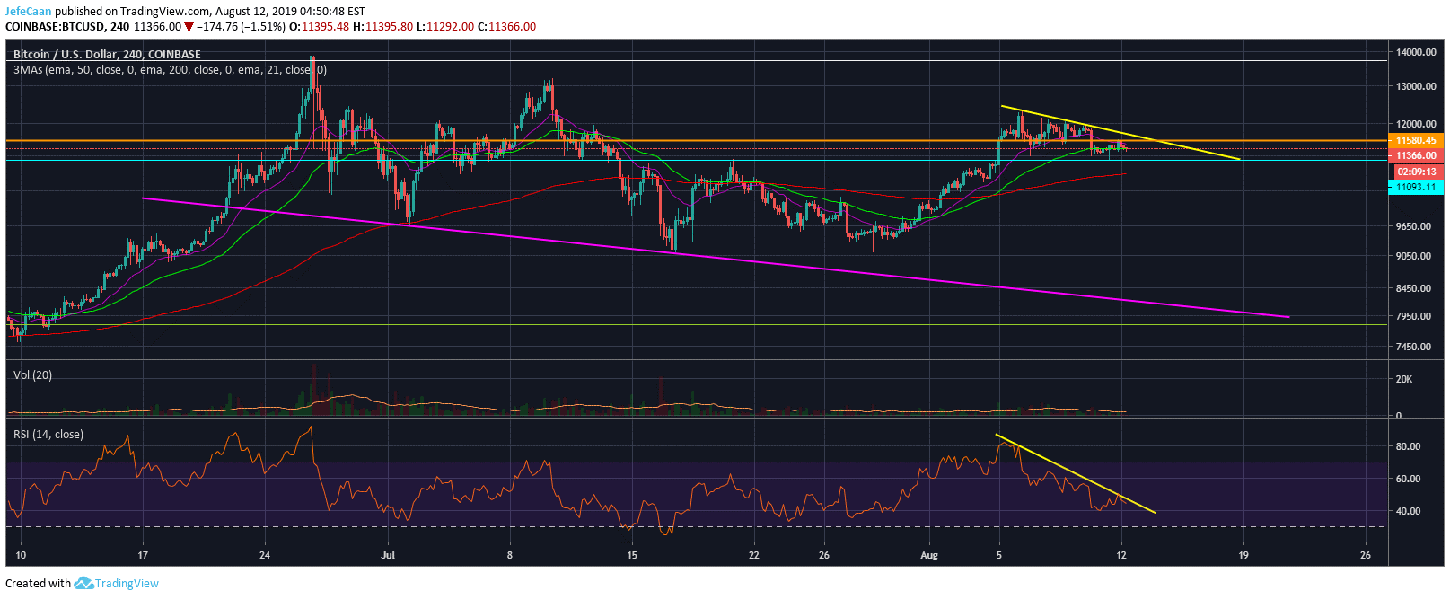

Bitcoin (BTC) is ready to crash hard soon as it breaks below the fib circle that the price is trading close to. On smaller time frames, we can see that the price is in fact trading within a large descending triangle which is very likely to break to the downside and trigger the next downtrend. For seven weeks now, BTC/USD has been consistently trying to break past the 38.2% fib extension level but it has failed miserably. This shows us that the price is not ready to break above $12k as there are a lot of seller eager to sell around those levels. That has not however stopped the bulls from testing it over and over again. The market makers are having fun with the bulls buying the dips over and over again.

The optimism is still too high which is why this bear market is far from over yet. We are currently around ten months away from Bitcoin (BTC)’s next halving. This is plenty of time for the price to find its true bottom. A lot of traders are very optimistic and they expect the price to begin its rally from here and then keep rising further as the halving nears. I do not know what their price targets for that are but I’m pretty sure that as we head down from here, a lot of them are going to reconsider the effect of halving seeing how Litecoin (LTC) declines with the rest of the market. There is a difference between an event factoring in long term and short term. Halving is a big deal because when the block reward is reduced by half that means it costs twice as much to mine one Bitcoin (BTC). However, that does not mean that the price is going to just keep on rising in anticipation of that.

When Bitcoin (BTC) was trading around $1,200 in November, 2013 most people knew that the next halving is in July of 2016. However, that did not stop the price from going through a brutal downtrend. Similarly, the next halving is still far away and there is a lot that could happen between then and now. If we take a look at the 4H chart for BTC/USD, we can see that the price is close to crashing hard below the descending triangle. Not only does it risk falling below the descending triangle but it has also had a hard time breaking past the resistance at $11,580.

We have yet to see a bearish EMA alignment that we have seen in the case of most altcoins. Believe it or not, this recent decline in the price of Bitcoin (BTC) is nothing compared to what is going to happen next. That being said, make no mistake, there is still plenty of time between now and Bitcoin (BTC)’s next halving and while a lot of traders are waiting for the price to just crash in one go or rally in one go, I think we are well past those days. This decline is going to take its time and eventually we are very likely to see Bitcoin (BTC) find its true bottom between $1,200 and $1,800.

Investment Disclaimer