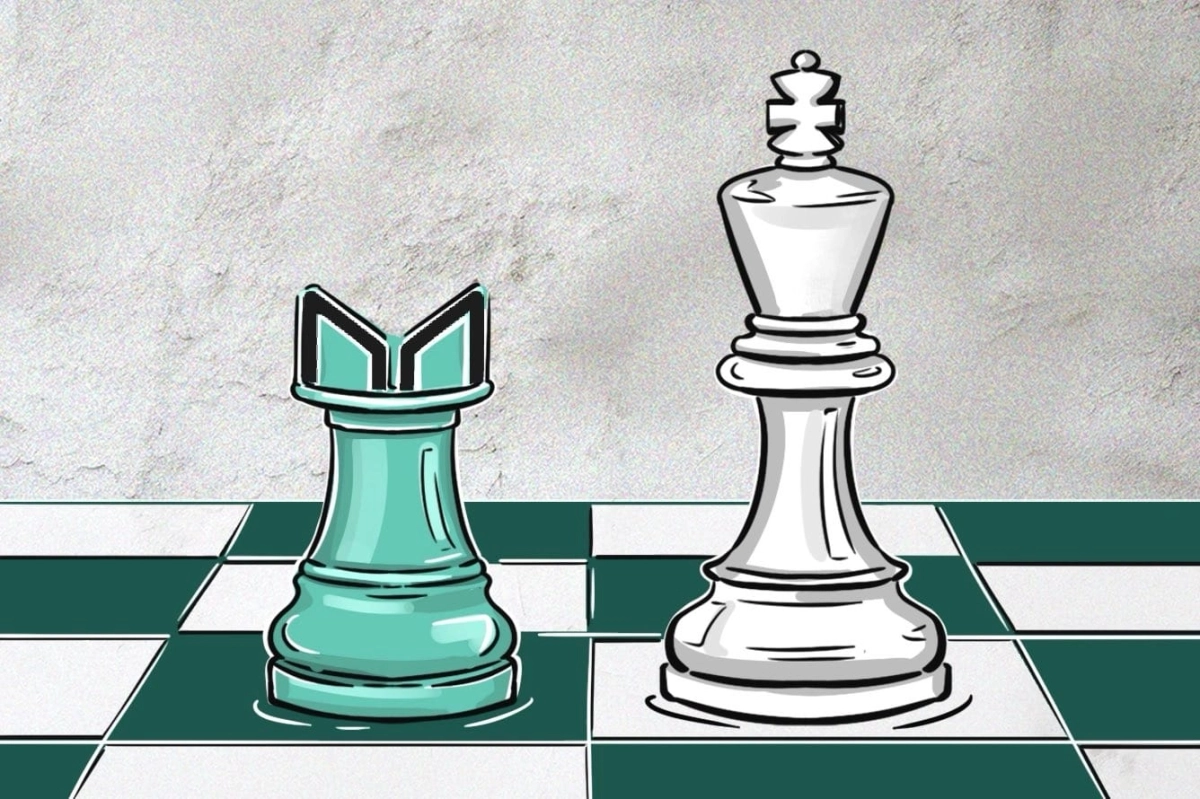

MakerDAO co-founder Rune Christensen announced the Endgame Plan in a May 2022 forum post, with a comprehensive DeFi overhaul that they hope will prioritize long-term growth. After nearly two years of development focused on building its foundation, Endgame is finally approaching launch, with a "Launch Season" set for this summer.

"During the Launch Season, all of Endgame's major features will be released in rapid succession. This phase is planned to start by the summer of 2024," Maker reported on X earlier this year.

The Endgame update was planned around a five-step launch process, with a roadmap posted on Maker's forum in May last year. It focuses on the launch of a new, secure blockchain called NewChain, which Maker claims will ensure the system's stability and decentralization by providing a safety net against extreme governance attacks. This should allow Maker to rapidly expand the DAI stablecoin supply—targeting over $100 billion in 3 years—while maintaining a healthy and engaged community.

Last September, Maker discussed incorporating Solana's technology into NewChain for its efficiency and robust support ecosystem. The integration would not signify a departure from Ethereum, as Maker would continue to leverage Ethereum and other Layer-2s for user-facing functionalities, ensuring continuity and stability across its operations. This dual-chain approach would allow Maker to harness Solana's strengths for backend processes while keeping the user experience anchored in the familiar Ethereum ecosystem.

That said, no final decision has been made. "NewChain will be built several years out in the future as a fork of a suitable best-in-class blockchain codebase. Which codebase to use will be decided after a long period of research to ensure that the best possible architecture is chosen," Christensen said on March 12.

According to Spot On Chain data, Endgame's first phase coincides with the sale of $31.20 million of its governance token MKR over the past two months. Such sales often precede price declines, suggesting that the DAO is freeing up resources for the upcoming token launches.

On May 3, Maker announced two new tokens, nicknamed NewStable and NewGovToken, to join DAI and MKR.

NewStable is an enhancement to the existing MakerDAO ecosystem. The token will offer improved stability features that could attract a wider user base, including those less familiar with cryptocurrencies. NewStable is not a direct successor to DAI but an upgraded stablecoin aimed at broader adoption for everyday transactions and financial applications.

NewGovToken will reshape the governance structure within MakerDAO. It is designed to increase community involvement by providing more opportunities for token holders to participate in decision-making processes. This approach seeks to further decentralize governance, making it more democratic and potentially leading to more sustainable and community-aligned decisions.

Additionally, DAI holders will apparently be given the flexibility of upgrading to NewStable and reverting to DAI at any point. The hope is to ensure users retain control over their holdings while allowing them to experience the benefits of the upgraded token.

The conversion process for MKR holders has promised to be straightforward, with each token equating to 24,000 NewGovTokens. NewStable holders (besides USA residents and VPN users) may start farming immediately after launch to earn a share of the 600 million NewGovToken tokens distributed annually.

Maker is the backbone of its ecosystem and focuses on the stability of its DAI stablecoin on Ethereum. The DAO recently shared on X that the second phase of Endgame will introduce self-governing entities, called SubDAOs, to which many peripheral strategies vital for DAI's growth will be delegated.

"SubDAOs unlock the potential for even greater agility, experimentation, and long-term success by fostering a dynamic, multi-layered ecosystem."

SubDAOs are specialized, self-governing teams that will act as the arms and legs of the MakerDAO ecosystem. They operate with a high degree of autonomy, allowing for:

— Maker (@MakerDAO) May 7, 2024

• Faster experimentation: SubDAOs can explore emerging ideas and technologies without slowing down the core…

SubDAOs, like SparkDAO, are specialized teams within the MakerDAO ecosystem designed to function autonomously. They enhance the system's efficiency by allowing Maker to quickly test new ideas without disrupting the main governance workflow and focus on specific risks, improving mitigation strategies. Additionally, SubDAOs handle complex decision-making within their domains, freeing up the core MakerDAO team to address broader strategic concerns. This structure streamlines operations and bolsters responsiveness across the ecosystem. Maker reported that SparkDAO recently surpassed $3 billion in supplied assets and over $2 billion in total value locked just one year after its launch.

The March 2020 market crisis dubbed "Black Thursday" revealed weaknesses in the Maker's governance and operational resilience, as a rapid drop in Ethereum's price led to excessive liquidations, compounded by network congestion and oracle failures. These issues underscored the vulnerability of DAO systems to extreme market conditions and showed the need for more robust governance mechanisms.

In a September 2022 comment on Discord, Christensen described Maker's status quo as "untenable" due to internal political and structural issues. "MKR is near valueless because of the compounding multidimensional risk," he added. Community members' disagreements had led to voter apathy and ineffective decision-making, compromising the DAO's ability to respond to crises and adapt effectively to new regulations or market conditions.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Read on Observers Investment Disclaimer