Table of Contents

- Nvidia stock price history

- Nvidia stock forecast for 2040

- Nvidia stock forecast for 2050

- Nvidia's potential catalyst for growth

- Nvidia price prediction for 2025

- The bottom line

Nvidia (NVDA) is a world leader in designing and developing graphics and computational technologies, with an estimated market capitalization of over $1.8 trillion. The company operates through two main business segments: Graphics and Compute & Networking. With these segments, the company provides graphic solutions for gaming, data centers, artificial intelligence, and the automotive industry.

Nvidia owns and innovates several key technologies that consumers and businesses utilize on a regular basis. These technologies include GeForce GPUs, CUDA parallel computing, and TensorRT for deep learning. By delivering outstanding performance and continual innovation, Nvidia has fueled consistent growth and created value for customers and shareholders alike.

Now, let’s explore Nvidia’s stock price forecast for 2040 and 2050, as well as factors that could influence the stock’s future growth.

Key takeaways:

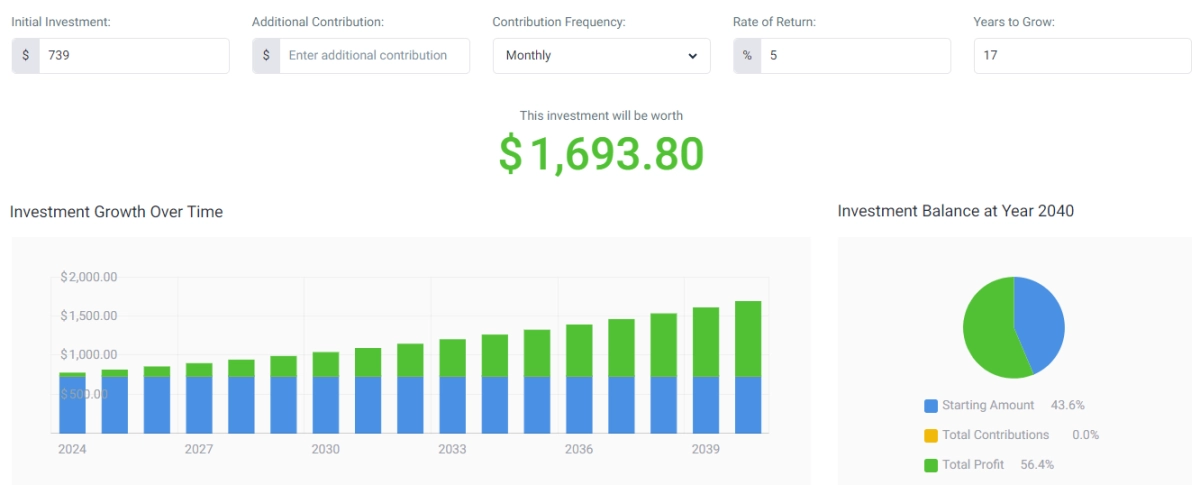

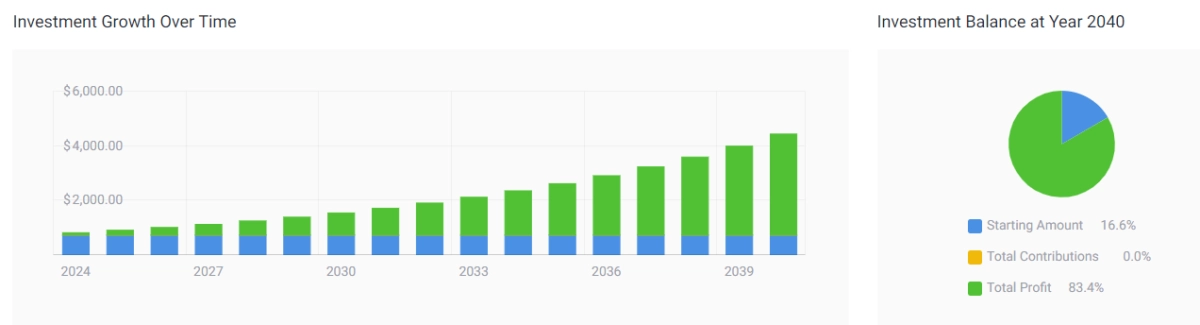

- We created three forecast scenarios for Nvidia's potential price, each with a different annual growth rate: 5% yearly growth, historical S&P 500 ROI (11.1%), and historical Nasdaq-100 ROI (15.2%).

- Based on these scenarios, the stock prices forecast for 2040 range between $1,694 and $8,191.

- Extending the same growth rates to 2050, the stock price forecast models span from $2,759 to $33,718 per share.

- Nvidia is expected to reach $1,160 per share by Q1 2025, according to the CoinCodex algorithm, reflecting approx. 57% upside.

- Growth drivers include Nvidia's leadership in AI, graphics processing, and emerging platforms like the metaverse, autonomous vehicles, and data centers.

Here’s an overview of Nvidia stock’s price prediction under different growth scenarios.

| 2025 | 2030 | 2040 | 2050 | |

|---|---|---|---|---|

| Nvidia Stock Forecast (5% yearly growth) | $776 | $1,040 | $1,694 | $2,759 |

| Nvidia Stock Forecast (S&P 500 historical 11.13% ROI)* | $821 | $1,547 | $4,444 | $12,767 |

| Nvidia Stock Forecast (QTEC historical 15.2% ROI)** | $851 | $1,990 | $8,191 | $33,718 |

Based on NVDA's stock price of $739.

*The S&P 500 Index has increased at a compound average rate of 11.13% over the past 50 years.

**First Trust NASDAQ-100-Technology Sector Index (QTEC) has increased by 15.2% CAGR since its inception in 2006.

Buy Nvidia stock

*Your capital is at risk.

Nvidia stock price history

Nvidia (NVDA) first launched its stock on the Nasdaq exchange on January 22, 1999, at an initial price of $12 per share, raising over $63 million in its IPO. Since then, the company has experienced tremendous stock growth, undergoing four splits in 2000, 2006, 2007, and most recently in 2023.

Despite its overall upward trajectory, Nvidia's stock has weathered challenges like the dot-com crash of 2000-2001, which saw shares plunge 83% from the March 2000 peak to the September 2001 trough. However, the stock rebounded steadily throughout 2002. More recently, Nvidia enjoyed a prolonged bull run from 2016 until late 2023, when its price steeply corrected before regaining most losses. The stock started off this year on a notably bullish note, gaining +49% and becoming the 3rd most valuable public company. Currently, NVDA is selling at $739 per share.

Nvidia stock forecast for 2040

Nvidia’s stock price prediction for 2040 is uncertain and depends on many factors, such as market conditions, competition, and also global events. However, one way to estimate the future value of Nvidia’s stock is to look into its historical performance or the overall stock market. You can also use various ways and models. For example, you can also use our profit calculator to estimate how much money you could make by investing in Nvidia based on your starting investment.

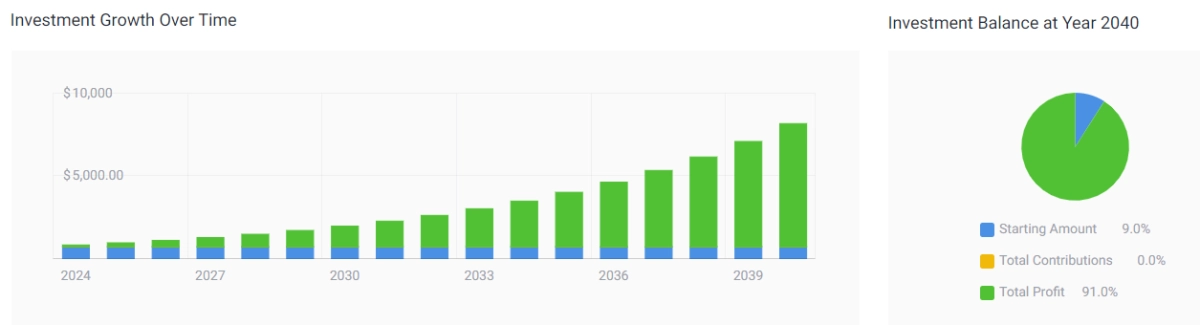

So, using a conservative 5% annual growth rate, which is close to the average growth of the world economy, we can project that Nvidia’s stock price could reach about $1,694 per share by 2040. This would be more than double the current price.

Meanwhile, the S&P 500 index boasts a historical average annual return of 11.13% over the past 50 years. If Nvidia’s stock were to grow at the same rate as the S&P 500 index until 2040, Nvidia’s stock price could reach $4,444 per share by 2040.

If Nvidia can match the 15.2% average annual return that the tech-focused NASDAQ-100 index has achieved historically since its inception in 2006, its stock price could reach over $8,191 per share by 2040, appreciating more than 1,000% from current levels.

Nvidia stock forecast for 2050

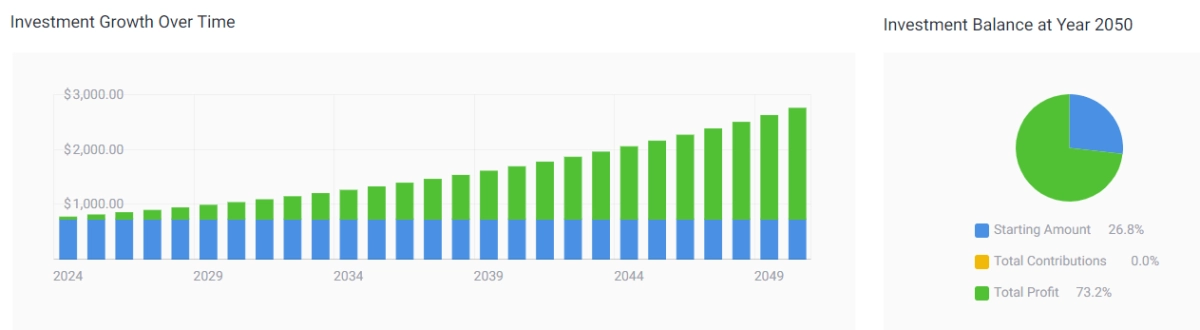

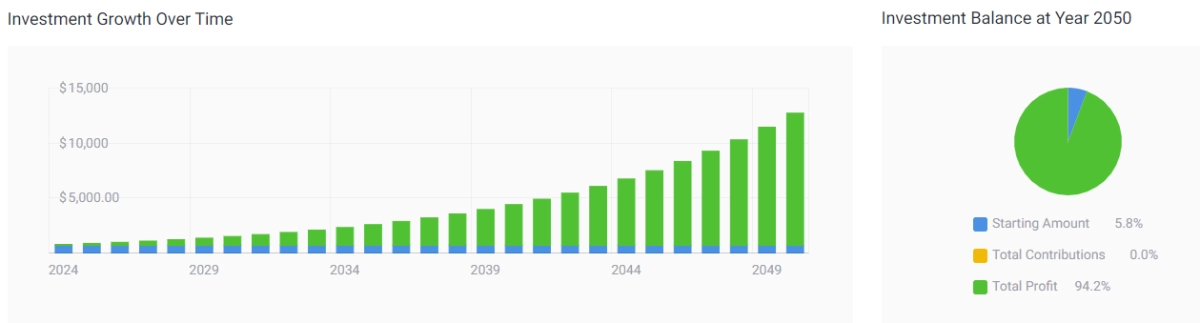

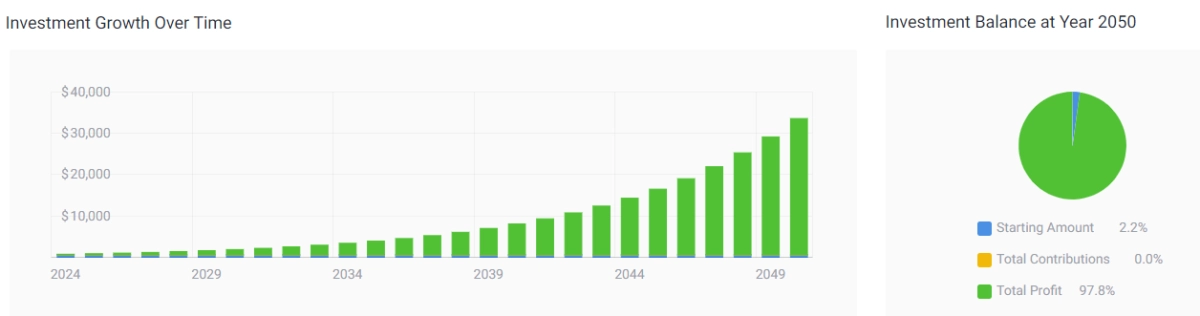

If we retain our moderate 2040 prediction's assumption of 5% annual Nvidia revenue and earnings growth, we can extrapolate this scenario further out to estimate the stock price in 2050.

Nvidia's share price could reach approximately $1,924.67 by the year 2050 if the stock maintains a 5% annual growth trajectory over the next two and a half decades. This would represent substantial appreciation from current levels based on our initial 2040 forecast scenario extended through 2050.

Applying the S&P 500's 11.13% historical average annual return to Nvidia would result in a potential 2050 stock price of $12,767.

Meanwhile, the NASDAQ-100 has delivered a 15.2% average annual return over time. If Nvidia matched this robust tech index pace through 2050, its stock could hit approximately $33,718 per share by that time.

Buy Nvidia stock

*Your capital is at risk.

Nvidia's potential catalyst for growth

Nvidia is strongly positioned to be a prime enabler of the emerging metaverse and virtual worlds, representing immense revenue opportunities in the coming years. Through the ongoing advancement of its Omniverse platform for simulating and collaborating within 3D environments, Nvidia has managed to address a metaverse market that could generate billions in annual value by 2030. Capturing even a fraction of this projected market would massively compound Nvidia's top and bottom lines.

Furthermore, Nvidia is rapidly growing its automotive technology footprint through its Drive platform and partnerships with automakers such as Mercedes-Benz, Toyota, and Volvo. By providing AI, data processing, infotainment, and automation technologies to power next-gen vehicles, Nvidia expanded its automotive revenue pipeline from $8 billion in 2020 to $11 billion in 2021. As autonomous and software-defined vehicles go mainstream in the 2020s, Nvidia is well-placed to be the AI brain powering the future of transportation.

Additionally, Nvidia’s entrenched position providing GPUs and Grace CPUs to data centers also foretells strong growth as demand surges for accelerating AI workloads, machine learning models, and other data-intensive applications. With data center revenue targeted for 30% CAGR through 2025 amid booming cloud infrastructure investment, Nvidia enables and benefits from AI and big data growth trends, making it one of the best stocks overall.

Nvidia price prediction for 2025

According to our NVDA stock forecast, the value of NVIDIA shares will rise by nearly 57% and reach $1,160 per share by the start of 2025. It's worth noting that the forecast is based on the state of technical indicators as of February 15 and could considerably change in the future.

The bottom line

If Nvidia maintains leadership in AI, graphics, and key emergent immersive platforms like the metaverse over the next quarter-century while also capitalizing on booming autonomous vehicle adoption and surging demand for data center GPUs to power real-time experiences, the company seems positioned to sustain robust revenue growth and stock price exponential upside through 2040, 2050 and potentially beyond.

If you are looking to invest in Nvidia stock, check out our article explaining the step-by-step guide on how to buy Nvidia stock. You can also read our forecasts for how high Google and Rivian stock prices could go in 20 to 30 years.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Read on CoinCodex Investment Disclaimer