Table of Contents

- Crypto Market Kicks 2023 Off Strong

- Top Growing Sectors

- Bitcoin and Ethereum Developments

- CMC’s Top Views

- Best Performing Coins

- Key Themes for H2

- Bitcoin ETFs

- Decentralized Public Infrastructure Networks

- Real World Assets (RWAs)

- Liquid Staking Derivative (LSDs)

- Restaking

- zkSync

- Modular Blockchains (Celestia)

- FTX Bankruptcy Developments

- Bitcoin Remains Most-Viewed Crypto Across All Regions

CoinMarketCap has released a report on the global crypto market after H1. The report delves into a general market overview, recent key events, and what it expects H2’s key themes will be.

Today, CoinMarketCap, the world’s leading price-tracking website for crypto assets, released its 2023 H1 Crypto Market Analysis Report.

Crypto Market Kicks 2023 Off Strong

The crypto market started this year with a bang witnessing the bitcoin price doubling, the rise of L2s such as Arbitrum and ZK, and the NFT market showing signs of improvement. By the end of Q2, the global crypto market capitalization reached an impressive $1.17 trillion, marking a 48% YTD increase. Q1 and Q2, however, concluded with similar total market caps, meaning Q2 showed much less growth.

Q2 was instead characterized by trends such as the “memecoin” frenzy and the rise of BRC20 tokens, which, despite being noteworthy, did not garner the same excitement as the previous quarter’s developments.

Market sentiment improved significantly by the end of Q1, with the CMC Crypto Fear and Greed Index registering at a neutral 52 – a vast improvement over the start of the year, which registered a fearful 30.

According to CMC’s report, the Total Spot Trade Volume of the Top 20 Crypto Exchanges peaked in March but declined by around 36% quarter-on-quarter.

Top Growing Sectors

Despite what can only be called challenging market conditions, certain industry sectors witnessed remarkable growth in market cap year-to-date. VR/AR (704%0 and AI & Big Data (323%) exceeded expectations, while blue-chip decentralized finance (DeFi) projects appear to be making a strong comeback.

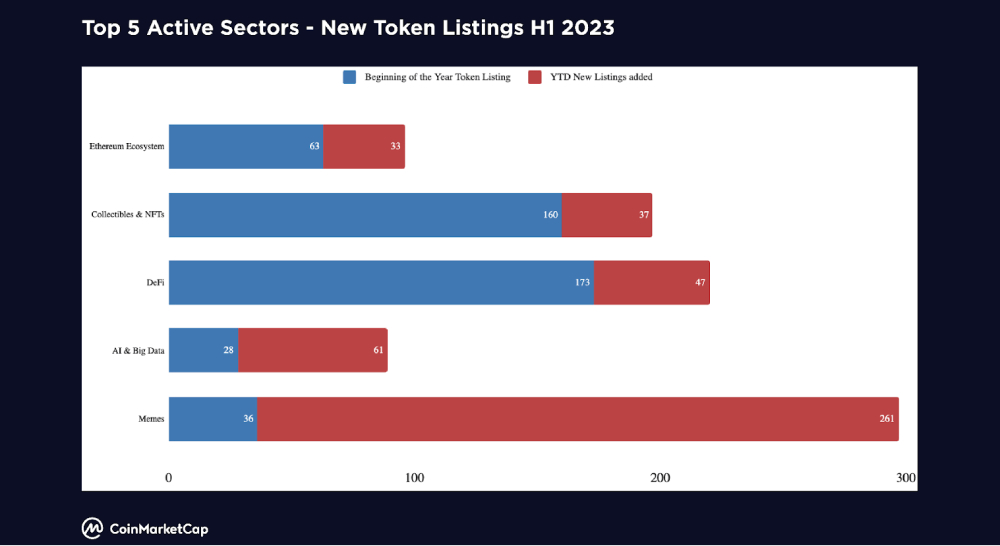

The “memecoin” frenzy saw the sector add over 260 new coins YTD, with AI & Big Data taking second place, adding 61 coins. DeFi ranked third, adding 47 new listings YTD.

Bitcoin and Ethereum Developments

The market’s top tokens, Bitcoin (BTC) and Ethereum (ETH) experienced several events, resulting in noteworthy price fluctuations.

CMC’s Top Views

CoinMarketCap saw a surge in views from the memecoin sector as $PEPE took the industry by storm. PEPE’s explosive rally of over 3700x from April to May sparked particular interest in the sector, and it joined CMC’s “Most Added to Watchlist.” Memes also registered the most engagement in CMC Community.

The DeFi sector registered sustained interest throughout the year’s first half to become the second most viewed. Sector interest largely focused on Terra Classic (LUNC) as Binance burned 2.65 billion LUNC tokens, worth approximately $236,000.

AI and Big Data have undoubtedly marked 2023 following the launch of OpenAI’s revolutionary ChatGPT, and it is reflected in views.

Best Performing Coins

Arbitrum ecosystem tokens such as Pendle (PENDLE) and Radiant Capital (RDNT) appeared to be H1’s top gainers, along with Optimist ecosystem tokens such as Velodrome Finance (VELO).

Other top gainers include layer-one blockchains, including Dione Protocol (DIONE), Conflux (CFX), and Injective (INJ). AI-related tokens such as SingularityNET (AGIX) and Render (RNDR) also performed well.

Key Themes for H2

CoinMarketCap identified the key themes for the second half of 2023.

Bitcoin ETFs

The crypto news cycle has recently been dominated by talks of Bitcoin ETFs after BlackRock, the world’s largest asset manager, filed for a Bitcoin spot ETF with the SEC. News of BlackRock’s application spurred a host of other firms, such as Valkyrie, Fidelity and 21 Shares, to announce they are also seeking ETF approval.

The SEC has yet to approve any of the applications. Should the regulator grant these ETFs, they could unlock substantial investor demand by offering regulated products for asset allocation.

Decentralized Public Infrastructure Networks

One of H2’s key themes will be Decentralized Physical Infrastructure (DePIN). DePIN is still in its early stages of expansion and aims to provide solutions for access sharing of physical assets or services like warehousing and data networks.

Real World Assets (RWAs)

The tokenization of assets has become an increasing focus for the crypto asset industry. Projects focused on making RWAs tradeable on-chain largely consist of credit market protocols such as Maple Finance and Goldfinch allow businesses to use DeFi to secure financing and loans.

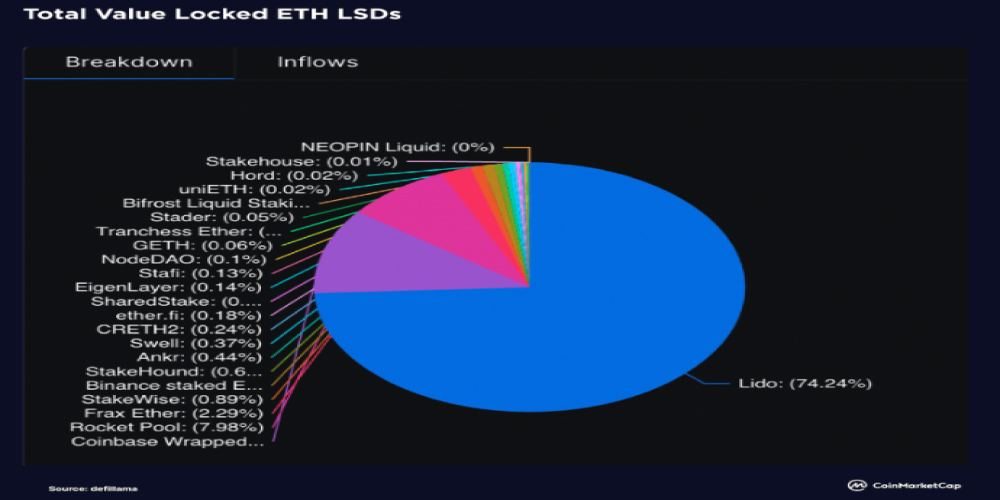

Liquid Staking Derivative (LSDs)

Liquid Staking Derivative witnessed a dramatic surge in activity in H1 owing largely to Ethereum’s Shapella upgrade. Market leaders such as Lido and Rocket Pool saw their TVLs rise 138% and 220%, respectively.

By the end of June, LSD platforms secured over a third of Ethereum’s Total Value Staked.

Restaking

The introduction of EigenLayer – a middleware platform which allows staked ETH or liquid staked ETH tokens to be reused on the consensus layer, prompted restaking as an emerging theme in H1.

Restaking was in demand after EigenLayer’s Restaking Smart Contracts were deployed and reached their maximum limits within a day of the mainnet launch.

zkSync

zkSync, a zero-knowledge roll-up solution, emerged as a popular Ethereum-based layer-2 solution and strong competitor against Ethereum optimistic roll-ups, including Optimism and Arbitrum.

zkSync utilizes zero-knowledge technology to offload traffic from Ethereum to an efficient second layer, helping to increase Ethereum’s throughput while enabling an array of new applications.

Modular Blockchains (Celestia)

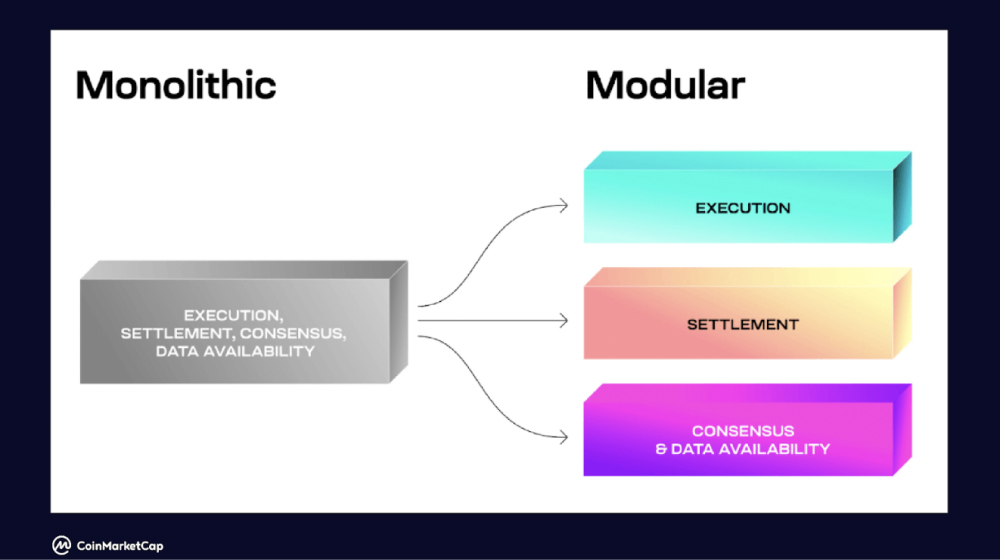

Most layer-1 blockchains are monolithic chains that result in issues surrounding efficiency, stemming from the blockchain trilemma of decentralization, security and scalability.

Modular blockchains like Celestia address these issues by separating blockchains into three layers: execution, settlement, consensus and data availability. In doing so, modular blockchains provide developers with modular data availability and consensus layers which dApps and sidechains can leverage to bootstrap development.

FTX Bankruptcy Developments

After FTX collapsed, its depositors could not determine how much of the almost $9 billion shortfall could be collected during the liquidation process.

In January, it emerged that more than $5 billion in liquid assets were collected, and this number subsequently increased to $7 billion. The firm overseeing FTX’s restructuring recently contacted creditors, giving them a “Customer Bar Date” of September 29, 2023.

Debtors are, however, unlikely to receive a payout until at least H2 2024.

Bitcoin Remains Most-Viewed Crypto Across All Regions

Regional differences in interest in various crypto sectors were insignificant. Bitcoin continues as the most-viewed crypto across all regions in H1 2023, similar to data from Q4 2022. Bitcoin’s dominance over altcoins increased by 25% from 40.09% at the beginning of the year to 50.39% at the end of H1.

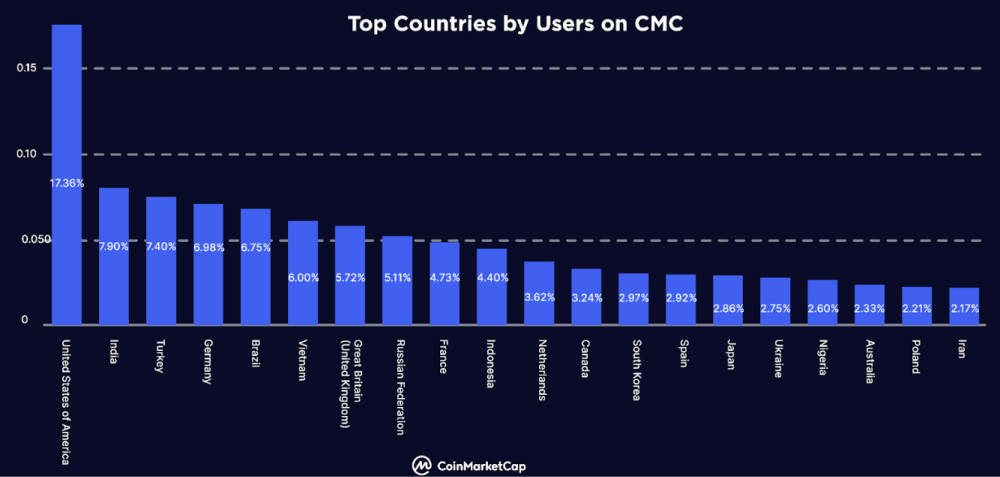

As expected, the US continues to dominate the distribution of crypto users worldwide.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Investment Disclaimer