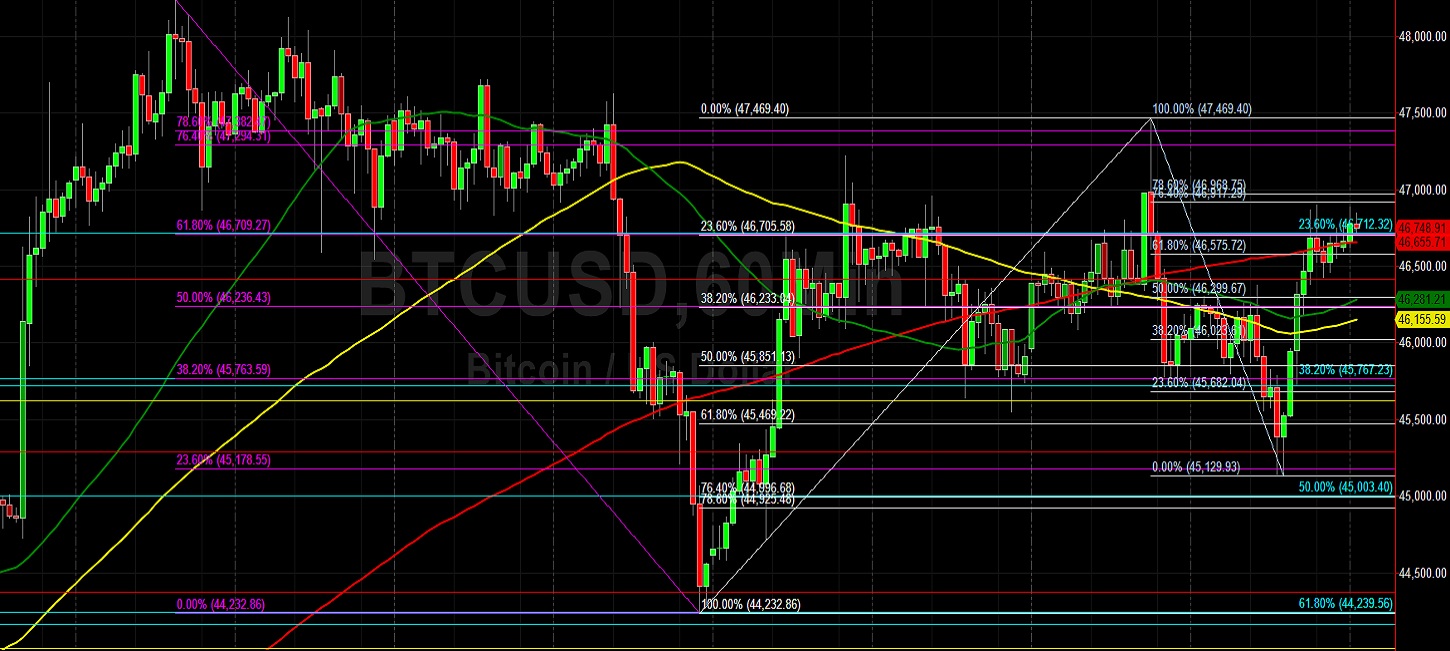

Bitcoin (BTC/USD) worked to sustain recent gains early in the Asian session as the pair gained traction back above the 46500 level after trading as low as the 45129.93 area earlier this week, a level that represented a test of the 23.6% retracement of the recent depreciating range from 48240 to 44232.86. The move higher from the week-to-date low tested the 76.4% retracement of the recent narrower depreciating range from 47469.40 to 45129.93. The 47294.31 and 47382.47 areas represent additional upside retracement levels related to the depreciating range from 48240.

BTC/USD recently traded at a 2022 high around the 48240 area before ceding some gains. Additional upside price retracement levels that traders are closely monitoring include the 48574, 49774, 50362, 50636, and 50966 levels. Following the recent move higher, areas of potential technical support and buying pressure include the 45625, 45003, 44008, 43001, and 42700 areas. Areas of potential technical resistance and selling pressure include the 50966, 55222, 60488, and 61281 levels. Traders are observing that the 50-bar MA (4-hourly) is bullishly indicating above the 100-bar MA (4-hourly) and above the 200-bar MA (4-hourly). Also, the 50-bar MA (hourly) is bearishly indicating below the 200-bar MA (hourly) and above the 100-bar MA (hourly).

Price activity is nearest the 50-bar MA (4-hourly) at 46630.67 and the 200-bar MA (Hourly) at 46655.72.

Technical Support is expected around 45003.50/ 43001.25/ 41383.00 with Stops expected below.

Technical Resistance is expected around 48574.70/ 50966.67/ 51595.38 with Stops expected above.

On 4-Hourly chart, SlowK is Bullishly above SlowD while MACD is Bullishly above MACDAverage.

On 60-minute chart, SlowK is Bullishly above SlowD while MACD is Bullishly above MACDAverage.

Disclaimer: This trading analysis is provided by a third party, and for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

Investment Disclaimer