The European Union’s securities, banking, and insurance watchdogs said in a joint statement today that consumers who buy cryptocurrencies could risk losing everything. They made no mention of the dangers of holding euros in the bank.

According to Reuters, the joint statement did not mince its words for those who bought cryptocurrencies.

"Consumers face the very real possibility of losing all their invested money if they buy these assets,"

The statement also alluded to the fact that under existing EU financial services law, consumers who bought and held cryptocurrencies would have no protections or recourse to compensation if anything went wrong with these investments.

This is unlike in the case of a bank failure, whereby the European Union scheme protects deposits up to a maximum of €100,000, and in the UK, deposits are protected up to £85,000 by the Financial Services Compensation Scheme (FSCS).

However, it is not mentioned how these schemes will operate if more than one or two big banks were to fail at the same time - quite a realistic scenario given the worsening state of the financial system.

The Reuters article also mentioned:

“Regulators are increasingly worried that more consumers are buying 17,000 different cryptoassets, including bitcoin and ether, which account for 60% of the market, without being fully aware of the risks,”

Lumping in bitcoin and ether with 17,000 other cryptocurrencies is an almost childlike ploy to tar all cryptocurrencies with the same brush. Warning consumers to be aware of cryptocurrencies that pop up overnight, and are hyped by paid YouTube influencers, is vastly different to warning against such solid and respectable cryptos as bitcoin and ether.

Also taken from the statement was the usual warcry against energy usage of cryptocurrencies (such as bitcoin) that use the proof-of-work consensus mechanism.

“Consumers should also be aware of that energy consumption for producing some crypto assets is high and the environmental impact this has,”

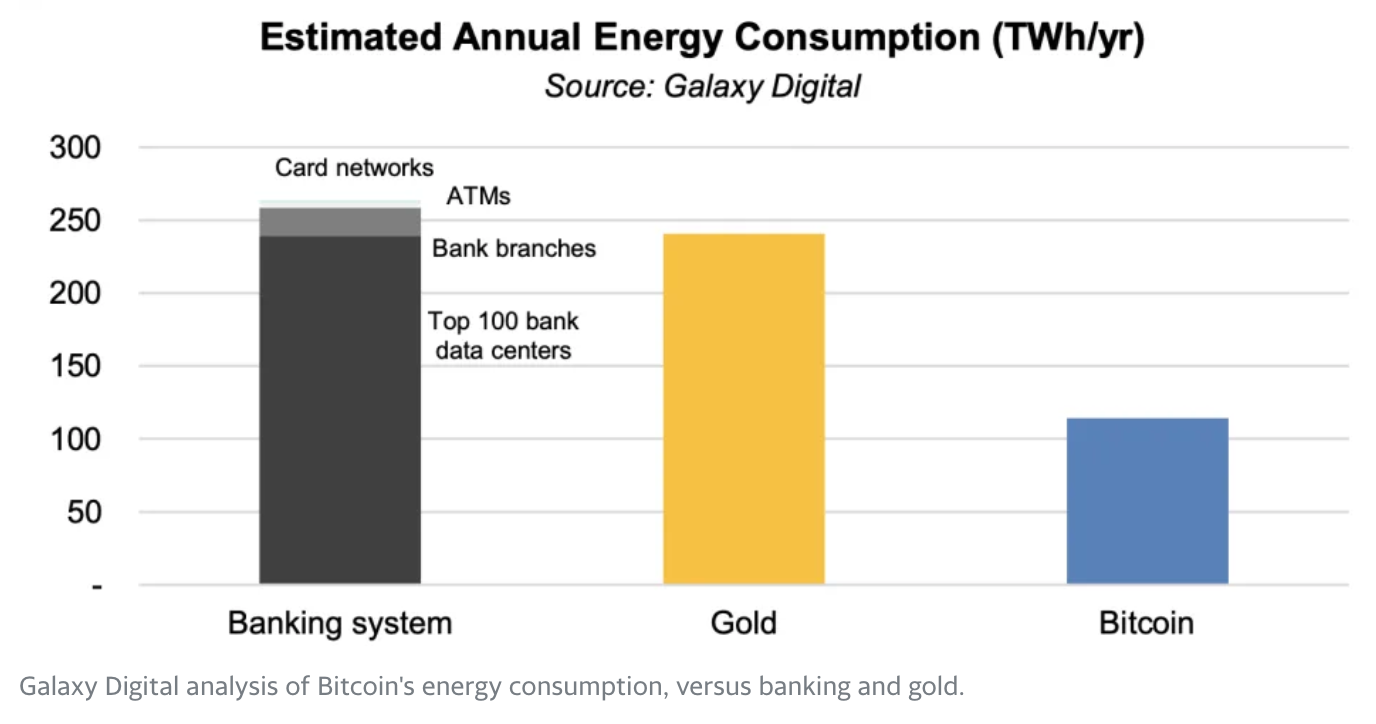

Once again, there is no mention of how much energy the traditional banking system uses. There is zero mention across the whole of the world’s media that it uses a lot more energy than bitcoin.

The EU will no doubt continue to malign bitcoin and cryptocurrencies whenever it can, given that the time is approaching when people just will not use banks anymore, given their lack of transparency, and their inability to offer anything approaching a decent yield on savings.

As an old system goes into its death throes, those who have an interest in it will do anything to prop it up. The cries against sound money will become ever more strident, but at the end of the day banks are becoming obsolete. They will need to change or fail, and the world will need to move to safer and more secure financial foundations.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Investment Disclaimer