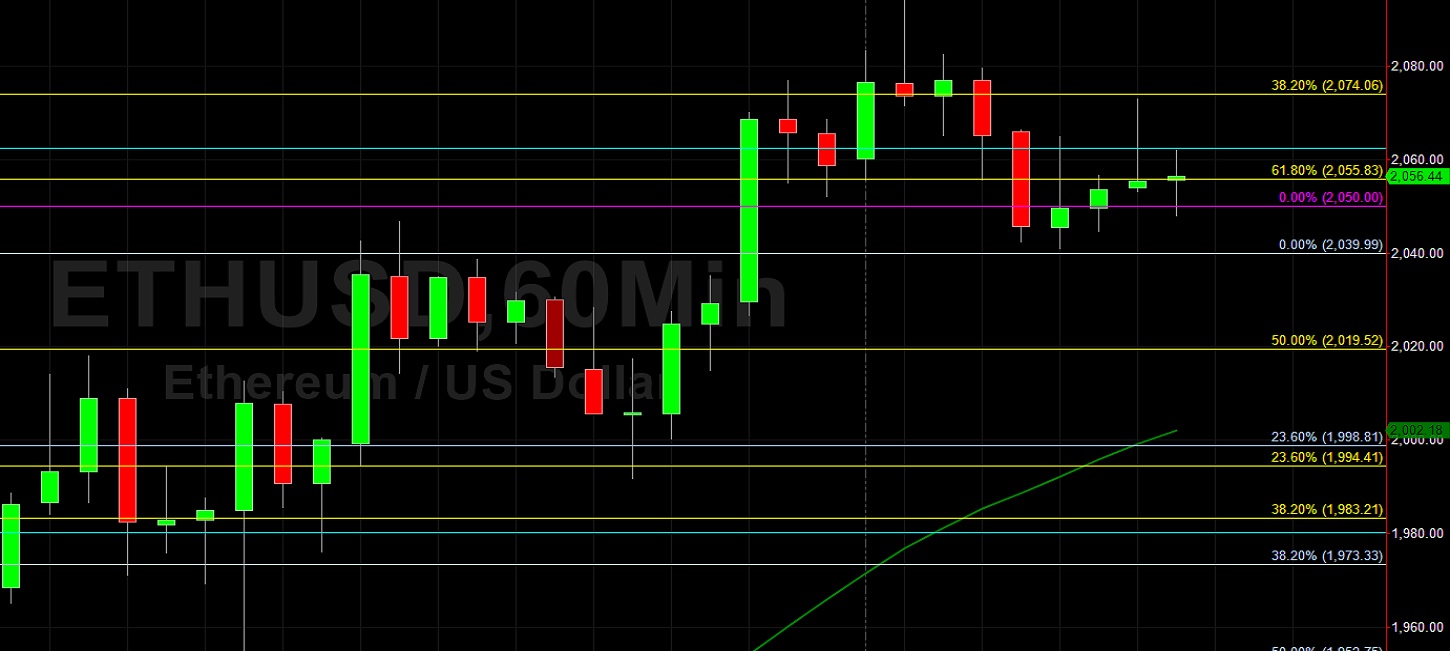

Ethereum (ETH/USD) continued to trade above the psychologically-important 2000 figure early in the Asian session as the pair ascended to the 2094.46 level during the European session before backing off to the 2041 level, a recent area of technical resistance. Some Stops were elected above the 2068.23 area, representing the 50% retracement of the recent depreciating range from 2411.19 to 1725.26. The pair recently traded as low as the 1718.41 area, representing a test of the 38.2% retracement of the appreciating range from 1206.05 to 2041.42. Also, interday buying pressure was also seen around the 50% retracement of the appreciating range from 1865.50 to 2039.99.

If ETH/USD extends its recent weakness, downside areas of technical significance include the 1702.67, 1667.09, 1633.51, and 1545.77 levels. If ETH/USD is able to find a bid, upside areas of technical significance include 2068.23, 2149.16, 2249.31, and 2264.40. Traders are observing that the 50-bar MA (4-hourly) is bearishly indicating below the 100-bar MA (4-hourly) and below the 200-bar MA (4-hourly). Also, the 50-bar MA (hourly) is bullishly indicating above the 100-bar MA (hourly) and above the 200-bar MA (hourly).

Price activity is nearest the 200-bar MA (4-hourly) at 2040.12 and the 50-bar MA (Hourly) at 2002.17.

Technical Support is expected around 1700/ 1633.51/ 1456.03 with Stops expected below.

Technical Resistance is expected around 3122.22/ 3420.10/ 3788.66 with Stops expected above.

On 4-Hourly chart, SlowK is Bearishly below SlowD while MACD is Bullishly above MACDAverage.

On 60-minute chart, SlowK is Bullishly above SlowD while MACD is Bearishly below MACDAverage.

Investment Disclaimer