The Bitcoin price has fully covered its two-years gap and keeps growing at the full scale. On Thursday, December 17th, it is generally trading at 22,193 USD.

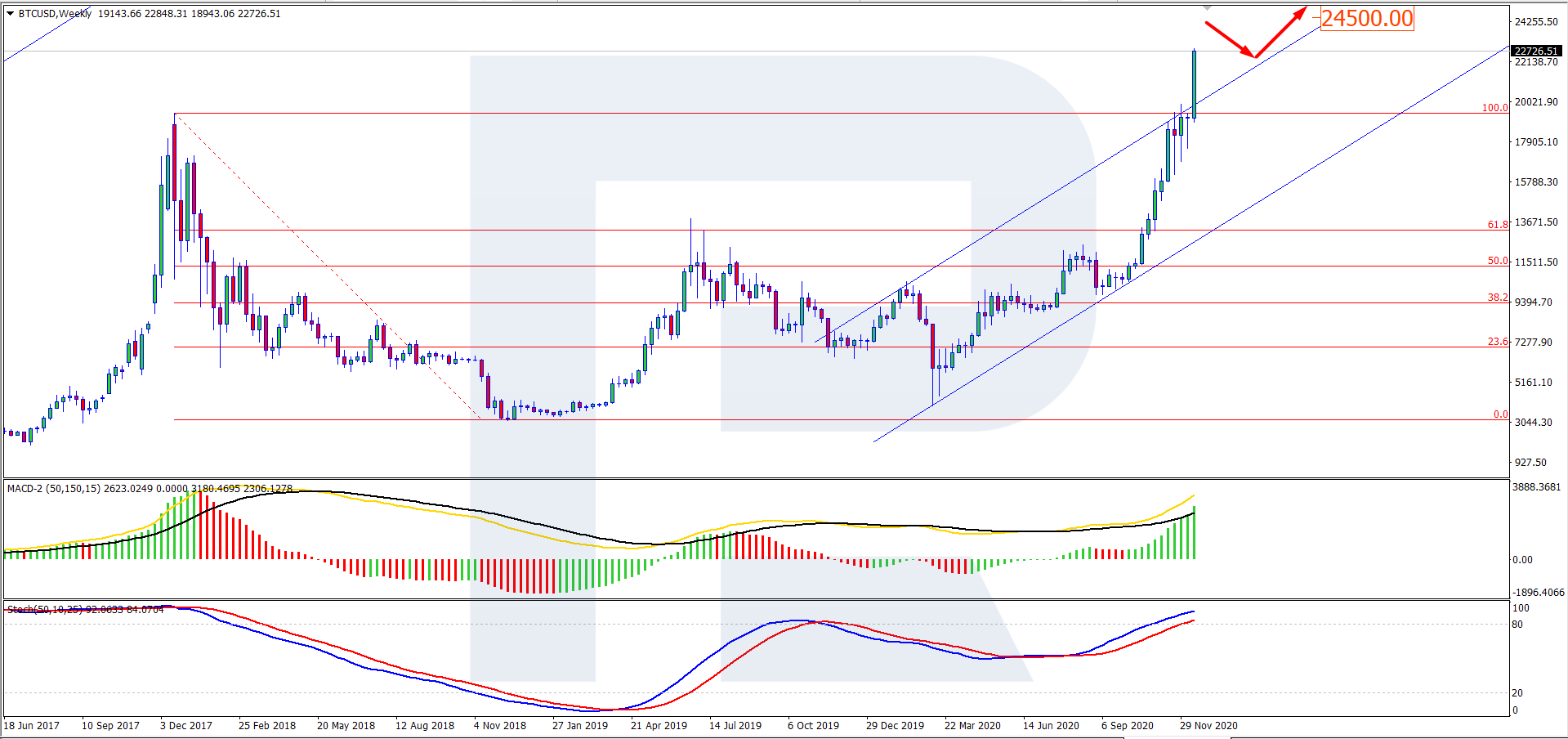

On W1, the uptrend is going on. The nearest aim of the growth might be 24,500 USD. The MACD histogram is positive, which is another signal for the increase in the crypto price. The signal lines of the indicator keep growing upon forming a Black Cross, which again enforces the ascending dynamics. The Stochastic rests in the overbought area, promising a chance for further correction in the nearest future. Judging by all the factors, the cryptocurrency, upon testing 24,500 USD, might correct and then go on developing the ascending dynamics.

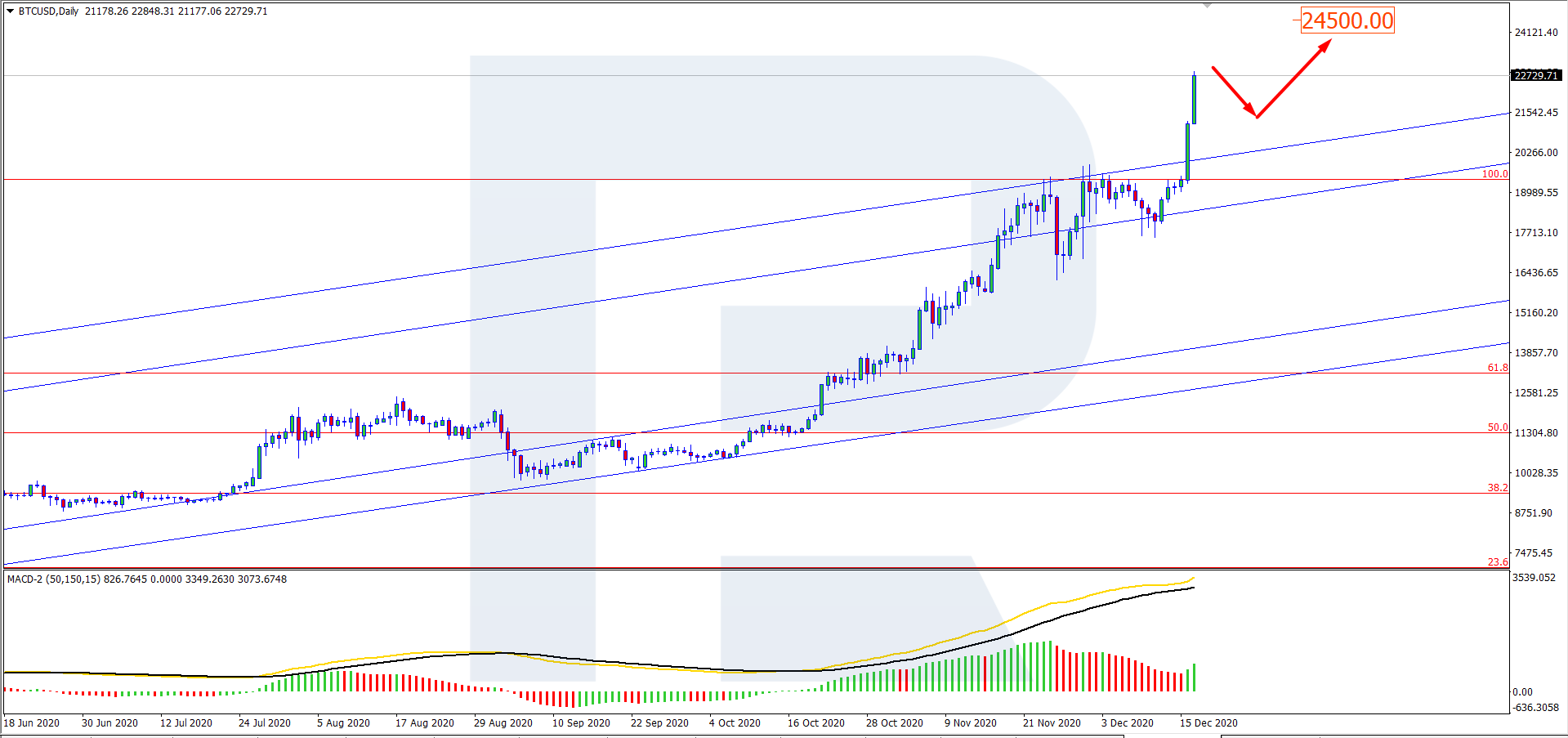

On D1, BTC/USD keeps developing the growth. The quotations have broken through 100.0% Fibo; the aim of the growth is 24,500 USD. The MACD histogram is, again, above zero, which signifies further growth. The signal lines of the indicator are forming a Black Cross, supporting a correction of the quotations. All the factors taken together, a correction midway the growth to the resistance level looks more probable. The aim of further growth, as on the larger timeframe, is 24,500 USD.

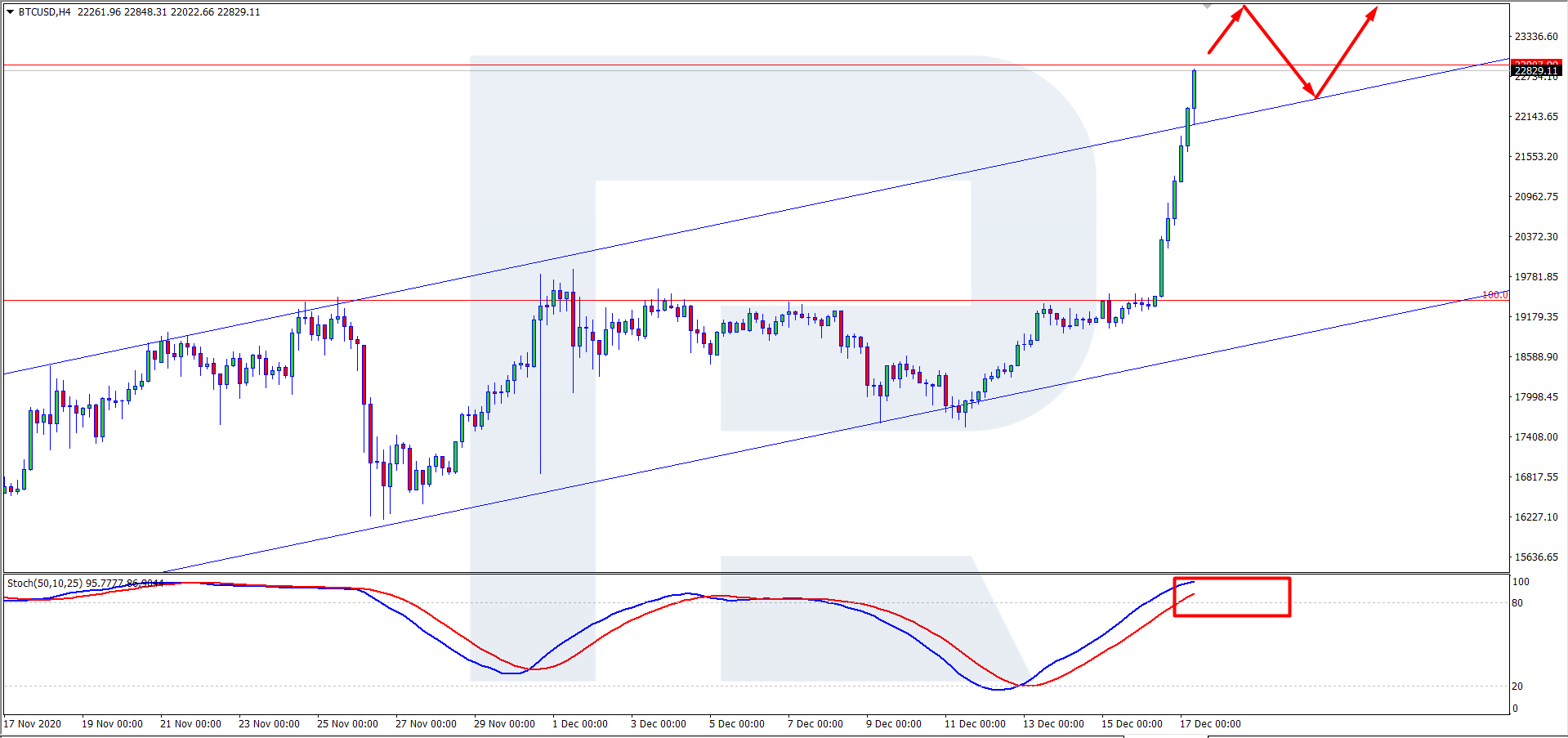

On H4, the perspectives of further growth look promising. The Stochastic is in the overbought area, giving an additional signal for a pullback. The price might correct to the support at 22,500 USD. The aim of the growth after the correction remains the same as on larger timeframes – 24,500 USD.

This December is definitely special, even with all the craze of 2020. Firstly, the BTC price rose to 20,800 USD, fully covering for the whole decline that started in 2017. Today, the price of the flagship cryptocurrency is nearing its peak – 22,168 USD. And the BTC rate keeps growing.

Apart from the obvious supporting factor (the market is looking for alternative investments), the fact that institutional investors and hedge funds got interested in crypto attracts more and more attention to the market.

There is one more foothold for growth. The Chicago Board Options Exchange (Cboe) is planning to launch an index for options in 2021. The service will be designed together with CoinRoutes, and the final index will reflect the dynamics of the price for the digital asset, collecting historical data.

Initially, it was planned to include in the index only the indices with clear and high capitalization (i.e. the BTC and ETH). However, it has become clear that the index will include about 10 cryptocurrencies. The service is planned to be launched in the second quarter of 2021.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

The Bitcoin price has fully covered its two-years gap and keeps growing at the full scale. On Thursday, December 17th, it is generally trading at 22,193 USD.

On W1, the uptrend is going on. The nearest aim of the growth might be 24,500 USD. The MACD histogram is positive, which is another signal for the increase in the crypto price. The signal lines of the indicator keep growing upon forming a Black Cross, which again enforces the ascending dynamics. The Stochastic rests in the overbought area, promising a chance for further correction in the nearest future. Judging by all the factors, the cryptocurrency, upon testing 24,500 USD, might correct and then go on developing the ascending dynamics.

On D1, BTC/USD keeps developing the growth. The quotations have broken through 100.0% Fibo; the aim of the growth is 24,500 USD. The MACD histogram is, again, above zero, which signifies further growth. The signal lines of the indicator are forming a Black Cross, supporting a correction of the quotations. All the factors taken together, a correction midway the growth to the resistance level looks more probable. The aim of further growth, as on the larger timeframe, is 24,500 USD.

On H4, the perspectives of further growth look promising. The Stochastic is in the overbought area, giving an additional signal for a pullback. The price might correct to the support at 22,500 USD. The aim of the growth after the correction remains the same as on larger timeframes – 24,500 USD.

This December is definitely special, even with all the craze of 2020. Firstly, the BTC price rose to 20,800 USD, fully covering for the whole decline that started in 2017. Today, the price of the flagship cryptocurrency is nearing its peak – 22,168 USD. And the BTC rate keeps growing.

Apart from the obvious supporting factor (the market is looking for alternative investments), the fact that institutional investors and hedge funds got interested in crypto attracts more and more attention to the market.

There is one more foothold for growth. The Chicago Board Options Exchange (Cboe) is planning to launch an index for options in 2021. The service will be designed together with CoinRoutes, and the final index will reflect the dynamics of the price for the digital asset, collecting historical data.

Initially, it was planned to include in the index only the indices with clear and high capitalization (i.e. the BTC and ETH). However, it has become clear that the index will include about 10 cryptocurrencies. The service is planned to be launched in the second quarter of 2021.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex