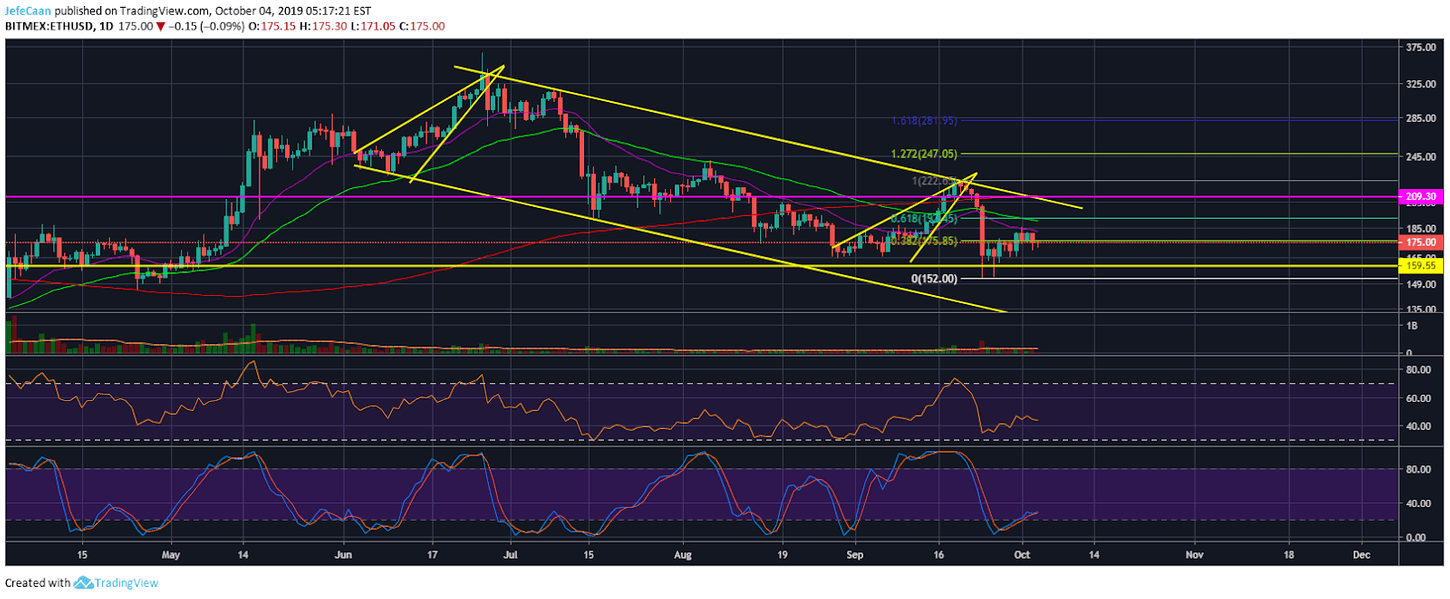

Ethereum (ETH) has just faced a strong rejection at a key resistance level. This level is the 38.2% fib retracement level from the recent top at the top of the descending channel. For the price to have failed to break past this level is a very big deal as it indicates that we might have a downtrend in the offing because there is a lot of room for that to happen. RSI on the daily time frame indicates that there is plenty of room for that. Stochastic RSI on the daily time frame indicates that we are very likely to see a bearish crossover that would accelerate the decline of ETH/USD towards the support at $159.55. That being said, I do not expect the price to fall towards the bottom of the descending channel just yet.

The move that I see in Ethereum (ETH) here is a sharp decline from current levels down to the support at $159.55 or to the previous lows. If that level holds, then I would expect a rally towards the top of the descending channel. However, at this point, I’m not going to bet on the price rallying towards the top of the descending channel because the outlook is far too bearish and the risk/reward is just not worth it. If the price succeeds in rallying to the top of the descending channel, then that would be another good opportunity to short sell ETH/USD. However, the move that we need to focus on at the moment is the inevitable decline if the price fails to break past the 38.2% fib retracement level.

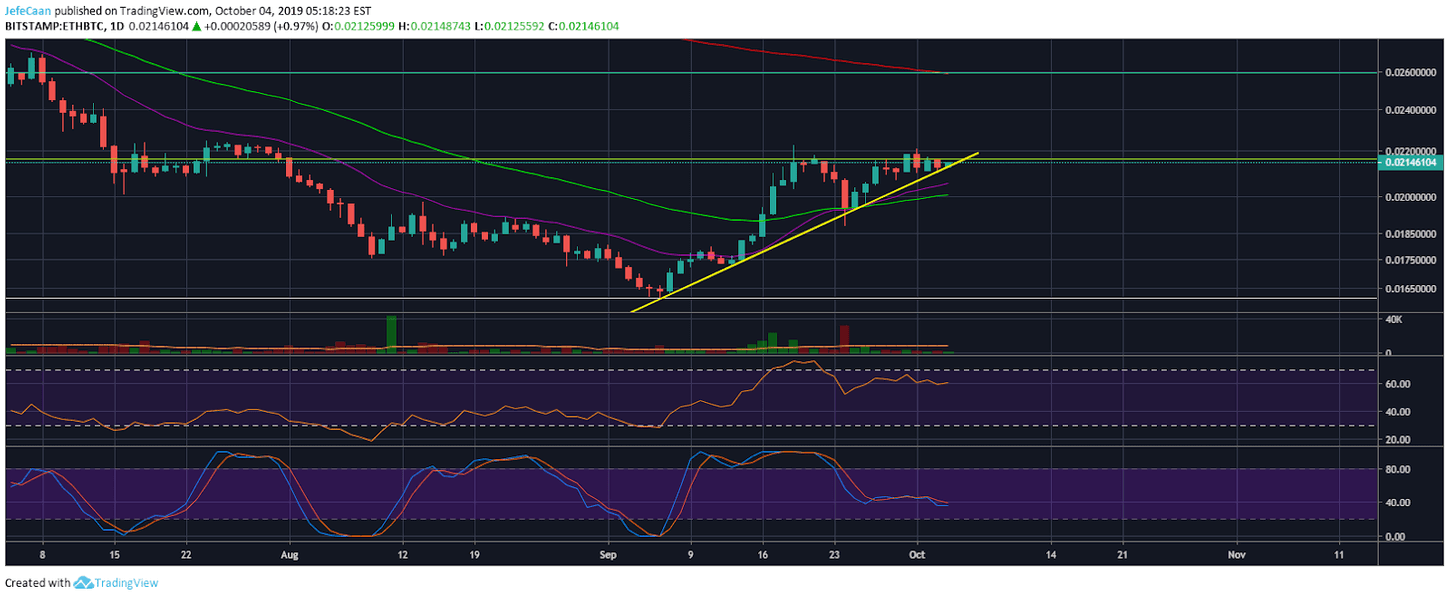

The case for Ethereum (ETH)’s inevitable decline is also corroborated by the ETH/BTC daily chart. A sharp decline below the trend line support after rejection at the 38.2% fib retracement level would be extremely devastating for the price. We might see a sharp decline follow that would potentially pull ETH/BTC down to new yearly lows. This is all in line with our view that Bitcoin (BTC) dominance is expected to rise while Ethereum (ETH) dominance is expected to fall as the market braces for another downtrend.

Ethereum (ETH) risks a brutal decline both against the US Dollar (USD) and Bitcoin (BTC) and it is only a matter of time before we see that happen. The price has already formed a double top against Bitcoin (BTC) and is now likely to decline sharply below the 21 day EMA and the 50 day EMA. When that happens, there would be little hope of a trend reversal and a lot of altcoins will suffer really hard. This is why it is a good idea to adopt a wait and see approach and see what happens in the cryptocurrency space for the next few weeks and months. In my opinion, we are just entering the second half of the bear market we are in and this time many altcoin projects can be expected to be wiped off the market.

Investment Disclaimer