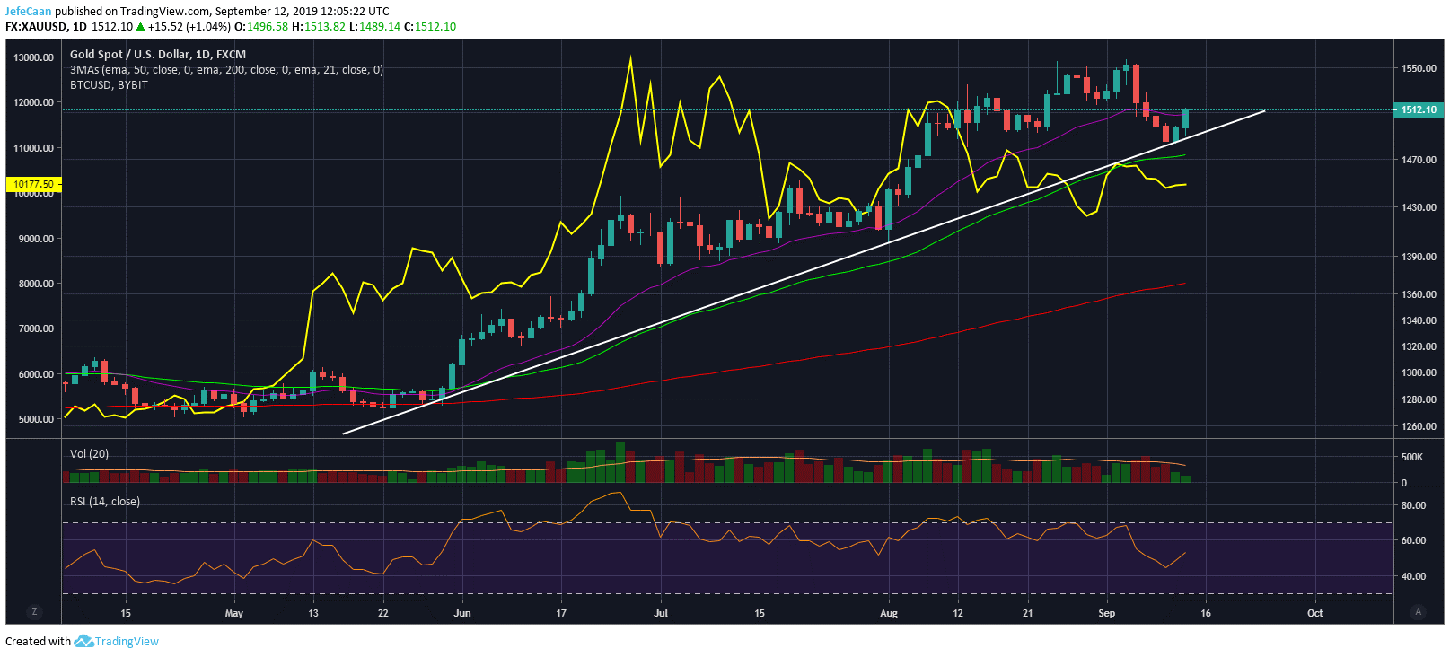

Bitcoin (BTC) has long followed in the footsteps of Gold and this is why the recent rally in Gold has investors wondering if this means a rally in going to follow in BTC/USD as well. This narrative is further strengthened by the fact that Bakkt is expected to be launched on September 23, 2019. I am of the opinion that it will be rescheduled again but there are many that would disagree with me. Well, we would have to wait till then to see how it plays out but for now, Gold (XAU/USD) has established a strong support and has started to rally again. Yesterday’s move caught the eye of investors and today’s rally past the 21 day EMA just got their attention.

Since the beginning of the year, BTC/USD has been closely following Gold and therefore it would not be unreasonable to think that the price of Bitcoin (BTC) might still rise further if Gold keeps on rising. However, that is a very big if considering Gold production is rising at a rapid pace. I would not be surprised if this is just temporary manipulation and we see an extensive bear market in Gold follow after this. Well respected traders like Paul Tudor Jones have been talking about Gold recently which is what hyped it up but I think it is primed for a strong correction after the recent buying frenzy. The same goes for Bitcoin (BTC) and if we think Bitcoin (BTC) rises as Gold does, then it also makes sense to think Bitcoin (BTC) will fall when Gold does.

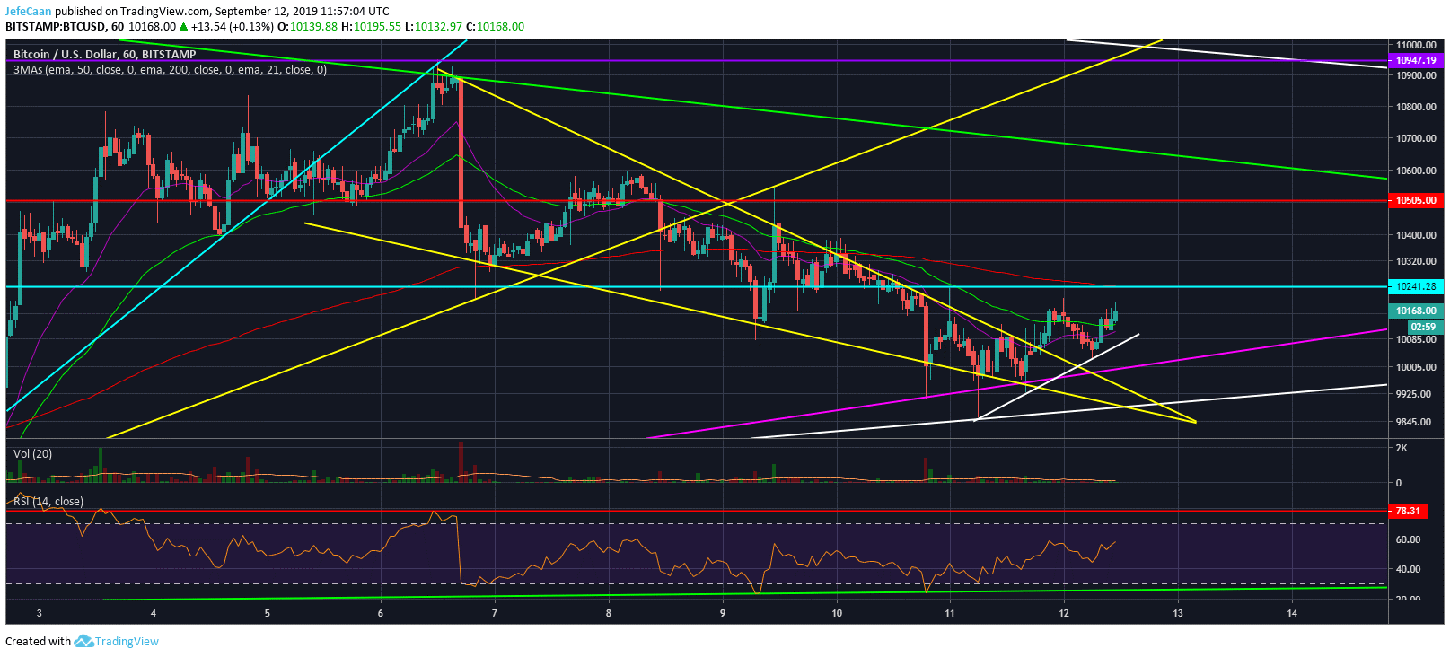

On the shorter time frames, we see that BTC/USD does not have any real bullish momentum to push the price meaningfully higher. The bulls have been very successful at holding the price above $10,000 but it does not seem to be going anywhere. In fact, it is quite risky to be holding BTC/USD at the moment because we are getting closer to the middle of September which is the time we could see a big move to the downside in BTC/USD and other cryptocurrencies to formally kick off the downtrend.

A lot of traders are still talking about price targets in the $8,000s or $7,000s zone for the price to find a strong support and shoot towards a new yearly high. That is all just wishful thinking. If the price closes below $9,400, forget about a new yearly high, BTC/USD is falling below $3,000. Again, some people might disagree with this view thinking BTC/USD has already bottomed but I still think we are in the 2014 part of the previous cycle and we are not even half way in the bear market just yet. The upcoming months leading to Bitcoin (BTC)’s next halving are going to be extremely devastating for Bitcoin (BTC) and other cryptocurrencies. I would not be surprised to see exchange hacks, bans and similar events to accelerate that decline as they have in the past.

Investment Disclaimer