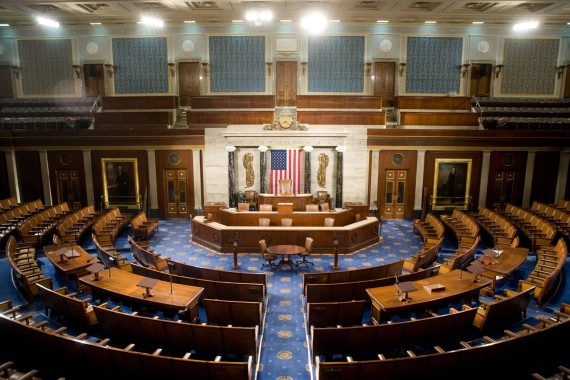

Democratic Party members of the United States House of Representatives are not mandated to vote against two upcoming pro-crypto bills, though they are strongly advised to do so.

A May 20 email from Democratic Party leaders to House members, shared by Politico, indicates the party has not insisted on a “no” vote for the Republican-led Financial Innovation and Technology for the 21st Century (FIT21) Act and the CBDC Anti-Surveillance State Act, known as H.R. 4763 and H.R. 5403, respectively.

Both bills are seen as favorable to the crypto industry if passed. FIT21 would clarify the classification process for cryptocurrencies as either commodities or securities, primarily placing regulatory control with the U.S. Commodity Futures Trading Commission (CFTC).

The U.S. crypto industry and lobbyists back this bill, with 60 companies advocating for its passage in a May 16 letter.

The CBDC act aims to prevent the Federal Reserve from issuing a central bank digital currency.

However, the email noted that Representatives Maxine Waters and David Scott “strongly oppose” FIT21, and Waters also opposes the CBDC act.

Politico later obtained a letter from the pair urging a vote against FIT21.

“House Democratic leaders said today they will NOT whip against House Republicans’ crypto bill, I’m told,” Politico reporter Eleanor Mueller wrote on X, referring to FIT21.

In the email, Democratic leaders expressed concerns about parts of the bill, particularly its provision for trading digital commodities in the secondary market if they were initially offered as investment contract securities under the SEC’s Howey test.

READ MORE: Notorious Crypto Drainer Pink Drainer Retires After Stealing Over $85 Million

“This language undermines decades of legal precedent and case law, thereby creating uncertainty in our traditional securities market,” the email stated.

Leaders argued the bill “weakens investor protections and opens the door to fraud and market manipulation” by providing a “safe harbor” for entities to register intent, effectively shielding them from the SEC until crypto rules are finalized by both the SEC and CFTC.

Meanwhile, the CBDC Anti-Surveillance State Act aims to prevent the Federal Reserve from issuing a CBDC, even in pilot programs.

Democratic leaders contend that stopping CBDCs could undermine the “primacy of the U.S. dollar,” as other countries with CBDCs seek to evade sanctions.

“According to the Congressional Budget Office (CBO), the bill’s overly broad definition of CBDC raises concerns the bill could undermine the Fed’s ability to conduct monetary policy,” the email added. “Particularly concerning as it attempts to navigate a soft landing in regard to inflation.”

Floor debate and passage of FIT21 are expected on Wednesday, May 22, according to Politico’s Mueller.

To submit a crypto press release (PR), send an email to [email protected].

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Read on Crypto Intelligence Investment Disclaimer