Table of Contents

- What will the future of crypto look like?

- Bitcoin halving cycles

- Rainbow chart

- Bitcoin and Ethereum price predictions

- Innovation in the crypto and blockchain sector

- Regulation

- The bottom line

Predicting the future of crypto is a very difficult task — the technology is just over a decade old, and the cryptocurrency markets are known for their extreme volatility. In addition, many countries across the globe are still exploring how to best regulate cryptocurrencies, adding to the uncertainty of the future of this exciting asset class.

We’ll provide scenarios for the future of crypto in the next 5 years based on both price movements and fundamental developments we can expect to see regarding regulations and technical improvements in the technology underpinning blockchain networks.

We’ll first begin by taking a look at the future of crypto from the perspective of cryptocurrency prices. Then, we will also look at the key fundamental factors that will likely shape the future of crypto in the next 5 years.

Key highlights:

- Bitcoin's future market trends may be influenced by its 4-year halving cycles, with a potential bull run after the 2024 halving and bear market periods in 2026 and 2027.

- Price predictions for Bitcoin and Ethereum indicate bullish trends for the remainder of 2024 and 2025, with new all-time highs expected.

- Scalability improvements in blockchain networks, particularly through Layer 2 solutions, are anticipated to be a key focus in the next 5 years, enhancing mainstream adoption.

- Regulations, especially in the United States, will significantly impact the crypto and blockchain sector, with ongoing developments, like the SEC's actions against major crypto platforms, playing a pivotal role.

What will the future of crypto look like?

In the next 5 years, we can expect the crypto market to continue revolving around Bitcoin and its 4-year halving cycle. We can also expect most countries to adopt more or less clear regulations regarding crypto assets and either limit their use or pave the way for digital transformation, depending on their political and economic situation. In addition, the development of Layer 2 and Layer 3 systems, addressing the scalability limitations of blockchain systems, will likely remain the focal point of development efforts.

Bitcoin halving cycles

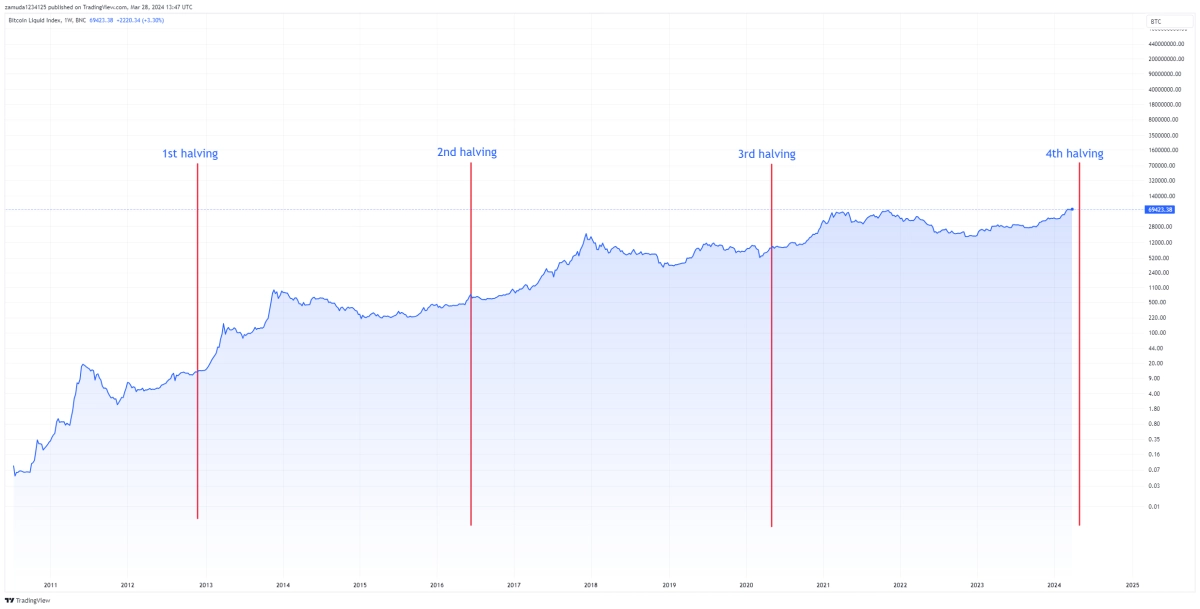

Many cryptocurrency investors like to think of the long-term fluctuations in the cryptocurrency market in terms of Bitcoin halving cycles.

Approximately every four years, a mechanism is triggered in the Bitcoin protocol that reduces the amount of BTC received by miners in half. Since this means the influx of new BTC coins on the market decreases, halvings are usually interpreted as very bullish events and as a precursor to a bullish turn in the markets.

The next Bitcoin halving is currently forecasted for mid-April 2024 (more specifically, April 20). If history is going to repeat itself, we would see a cryptocurrency bull run start taking shape a few months after the halving, and reach its peak sometime in the second half of 2025. In such a scenario, 2026 and 2027 would likely be bear market periods, which would eventually pass in the lead-up to the 5th Bitcoin halving in 2028.

Of course, we’ve only seen three Bitcoin halvings thus far, so the sample size is not exactly large. This is why future projections based on Bitcoin halvings should not be taken as a certainty.

Rainbow chart

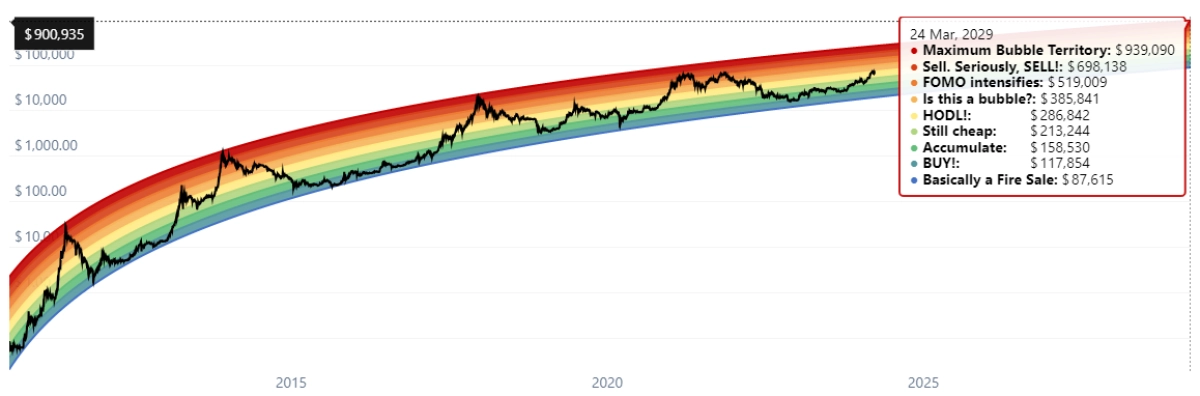

Another way to get a long-term perspective on the BTC market is the Bitcoin rainbow chart, which is a unique price chart that consists of several colored bands. The Bitcoin rainbow chart is based on a logarithmic regression, which assumes that that the price of Bitcoin will keep increasing at an increasing rate in absolute terms and at a decreasing rate in relative terms.

Let’s take a look at the assumptions the Bitcoin rainbow chart makes for the Bitcoin price five years from now (March 2029). The upper band of the rainbow chart is located at a price of just below $940,000, while the lowest band is situated at around $87,600 (which is still higher than the Bitcoin all-time high at the time of writing this article).

Meanwhile, the most neutral band (yellow) corresponds to a Bitcoin price of about $286,000, which would be nearly 4 times higher than the current BTC all-time high price.

It’s important to understand that the Bitcoin rainbow chart is only a projection based on historical price activity and does not account for any external factors that can have an influence on the price of Bitcoin, such as news events, changes in regulation, upgrades, hard forks and so forth.

Bitcoin and Ethereum price predictions

Now, let’s look at the cryptocurrency price predictions provided on CoinCodex. These predictions are based on a combination of past price movements and current market conditions. First, let’s consider the price prediction for Bitcoin.

According to this Bitcoin price prediction, the BTC will be quite active for the remainder of 2024, only to proceed to gain additional momentum in 2025. The prediction is even forecasting Bitcoin to reach a new all-time high at $175,000 in July of 2025 before retracing to around $76,000 in coming years

According to this prediction, 2026 and 2027 will mostly consist of consolidation and a sideways-moving BTC market with no defined price trend. In 2028 and 2029, Bitcoin might experience another bullish cycle, reminiscent of what we've seen in previous halvings.

Now, let’s take a look at the Ethereum price prediction as well. According to the Ethereum price forecast on CoinCodex, the remainder of 2024 will be quite bullish for ETH, with the price of the second-largest cryptocurrency advancing past the $5,900 level.

The prediction also currently expects Ethereum to record a new all-time high in Q2 of 2025, peaking at a price just below $7,000. This is projected to be the highest price Ethereum will reach between now and the start of 2028, although it does expect ETH to reach as high as $10,000 later on in 2028 and climb to $12,000 in 2029.

Innovation in the crypto and blockchain sector

In the next 5 years, we expect that scalability will be the main fundamental theme for the cryptocurrency and blockchain sector. If cryptocurrency is to truly be embraced by the mainstream, we will need to see significant improvements in the efficiency of blockchain networks.

Right now, it seems likely that the problem of blockchain scalability will be tackled through layer 2 platforms, which are secured by an underlying layer 1 blockchain (for example, Bitcoin or Ethereum).

Bitcoin enthusiasts are mostly banking on the Lightning Network, while Ethereum scalability is being tackled by a variety of layer 2 projects (examples include Arbitrum, Optimism and Starknet). When it comes to Ethereum, there’s especially interesting potential in layer 2 solutions based on ZK (zero-knowledge) tech, which promises to deliver truly significant efficiency improvements.

The other option would be for layer 1 blockchains to launch with innovative designs that provide much better scalability on the base layer. Examples of such platforms include chains like Solana and Aptos, although they’re currently all dwarfed by Bitcoin and Ethereum.

We would also expect to see improvements in the user experience for cryptocurrencies. For example, there’s still quite a lot of room for improvement when it comes to cryptocurrency wallet design.

Regulation

In the next 5 years, another factor that will play a crucial role in how the crypto and blockchain space will develop is regulation.

In terms of crypto regulation, the United States has been the most controversial jurisdiction in recent years. The country’s securities regulator SEC (Securities and Exchange Commission) has made it very clear that they consider many of the largest cryptocurrencies by market capitalization to be unregistered securities.

In 2023, the SEC brought lawsuits against Binance and Coinbase, which are the two biggest players in the cryptocurrency industry. The regulator is alleging that both platforms are operating as unregistered securities exchanges. While Binance signed a massive $4 billion settlement with the SEC, and its long-time CEO Changpeng Czhao stepped down from its executive position, the SEC cases are still ongoing.

Even though it’s quite clear that the SEC is looking to crack down on the crypto sector, there have also been some positive developments for the crypto side of the equation. In late 2023, the judge presiding over the lawsuit between the SEC and Ripple issued several rulings in favor of Ripple, although the lawsuit is yet to be concluded.

The bottom line

The cryptocurrency space is known to be extremely unpredictable, making it very difficult to forecast what will happen even 1 year away from now, let alone 5. Still, we hope that we outlined the current market situation from a broader perspective and helped you identify the most important crypto and blockchain trends to look out for in the next 5 years.

If you’re also looking to explore the cryptocurrency markets in a more near-term perspective, make sure to check out our list of the best cryptocurrencies to buy now.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Read on CoinCodex Investment Disclaimer