Table of Contents

Since inception, LEVEL has designed a protocol to serve as a functional alternative to centralized counterparty risk. After half a year of product testing, it’s finally time to expand, and the LEVEL DAO has determined that Arbitrum will be the next ecosystem where Level will be deployed on.

LEVEL’s Success Story

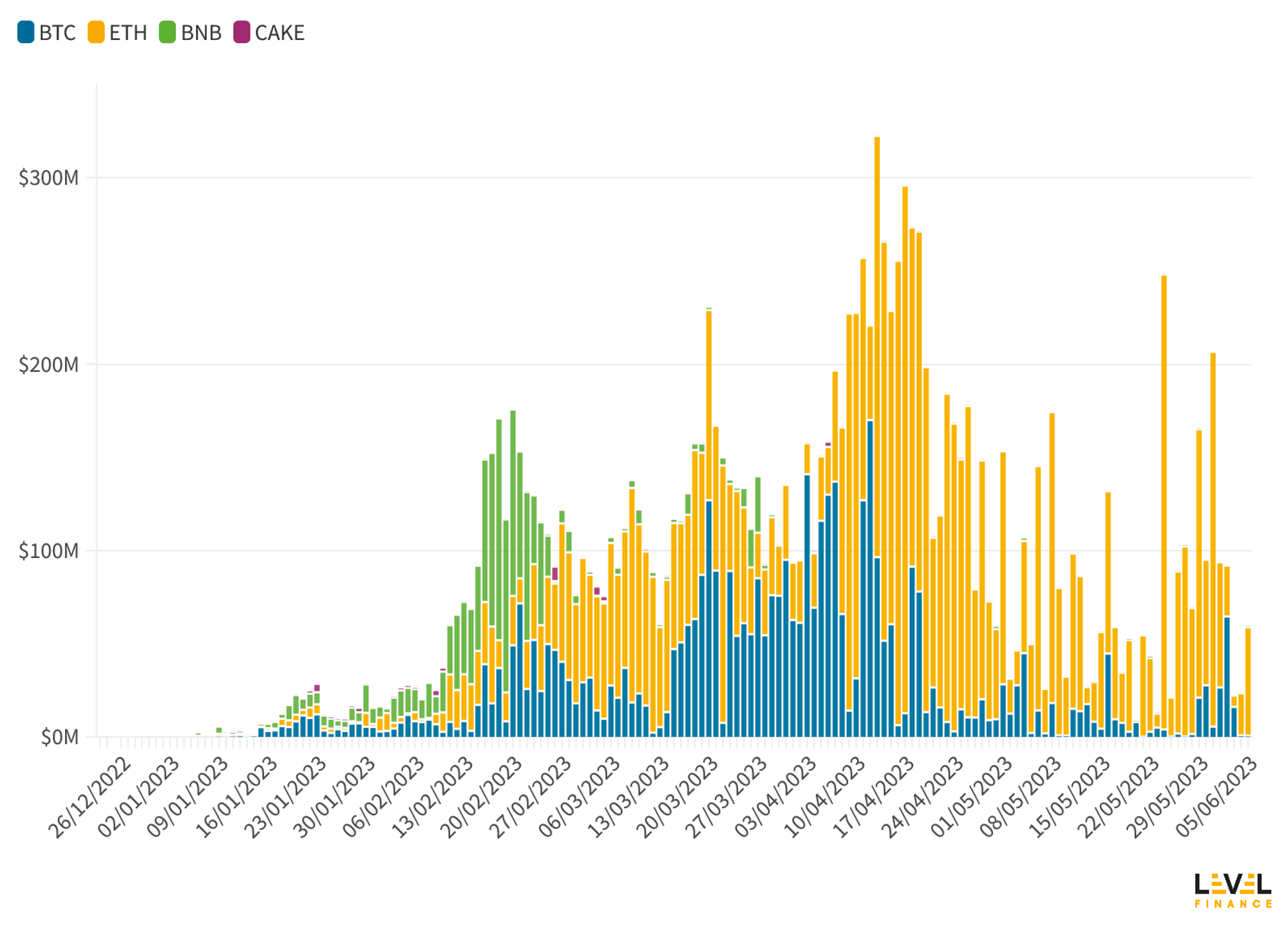

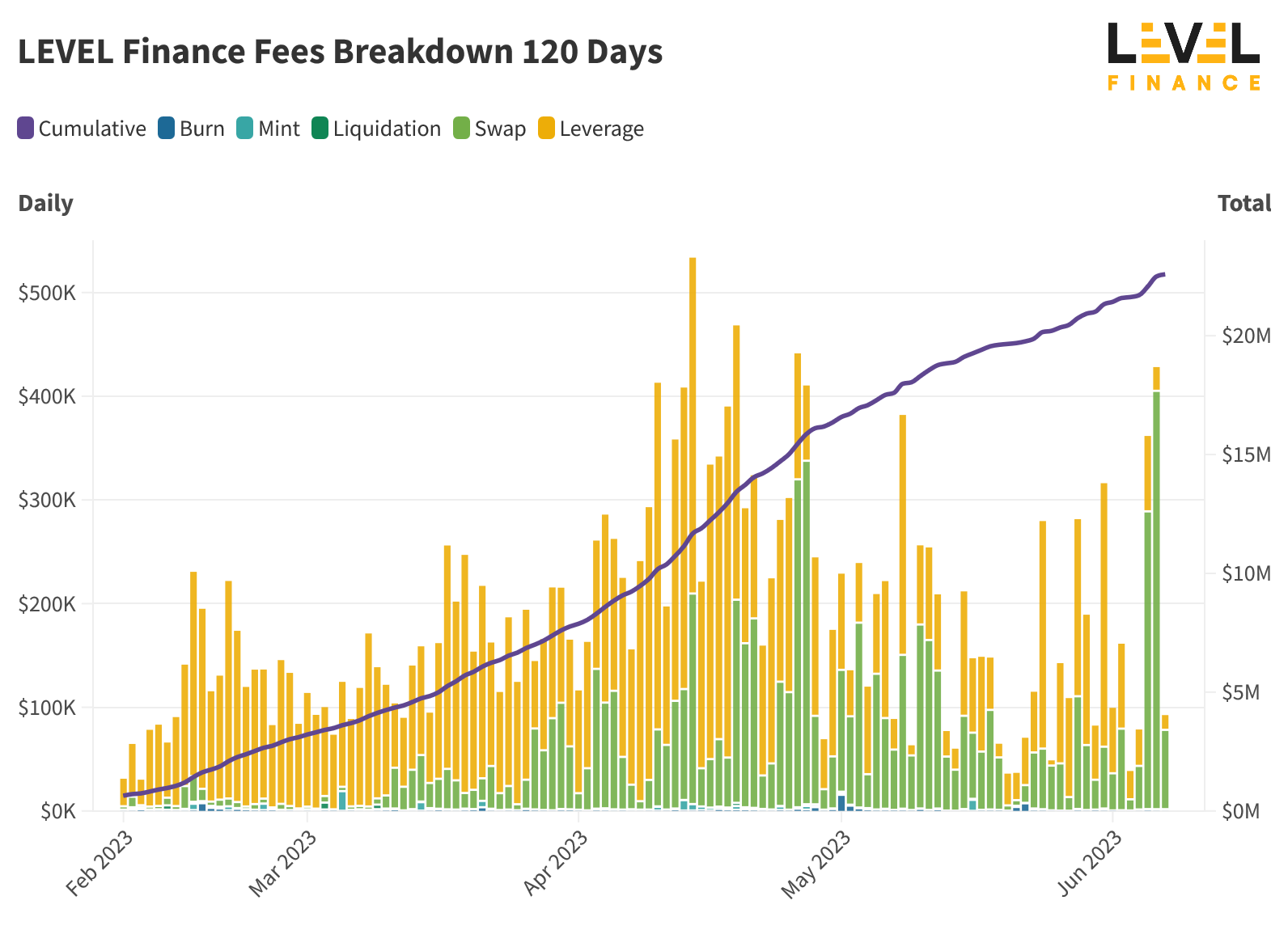

LEVEL has experienced phenomenal growth. In just the first month, LEVEL witnessed a notable $320 million in volume traded, generating over $400k in fees and bringing in more than 1000 community members.

As a testament to the product-market fit they found, it took just 55 days for the ecosystem to hit $1 billion in trading volume, leading to collecting $8.3 million in fees during that time – going from strength to strength with over $20 billion traded in the first half of 2023 alone!

Impressively, the most significant daily trading volume was $339 million on April 14, 2023, accounting for around a third of the total volume across Perp DEXs (Delphi Digital).

A Quick Look On-Chain

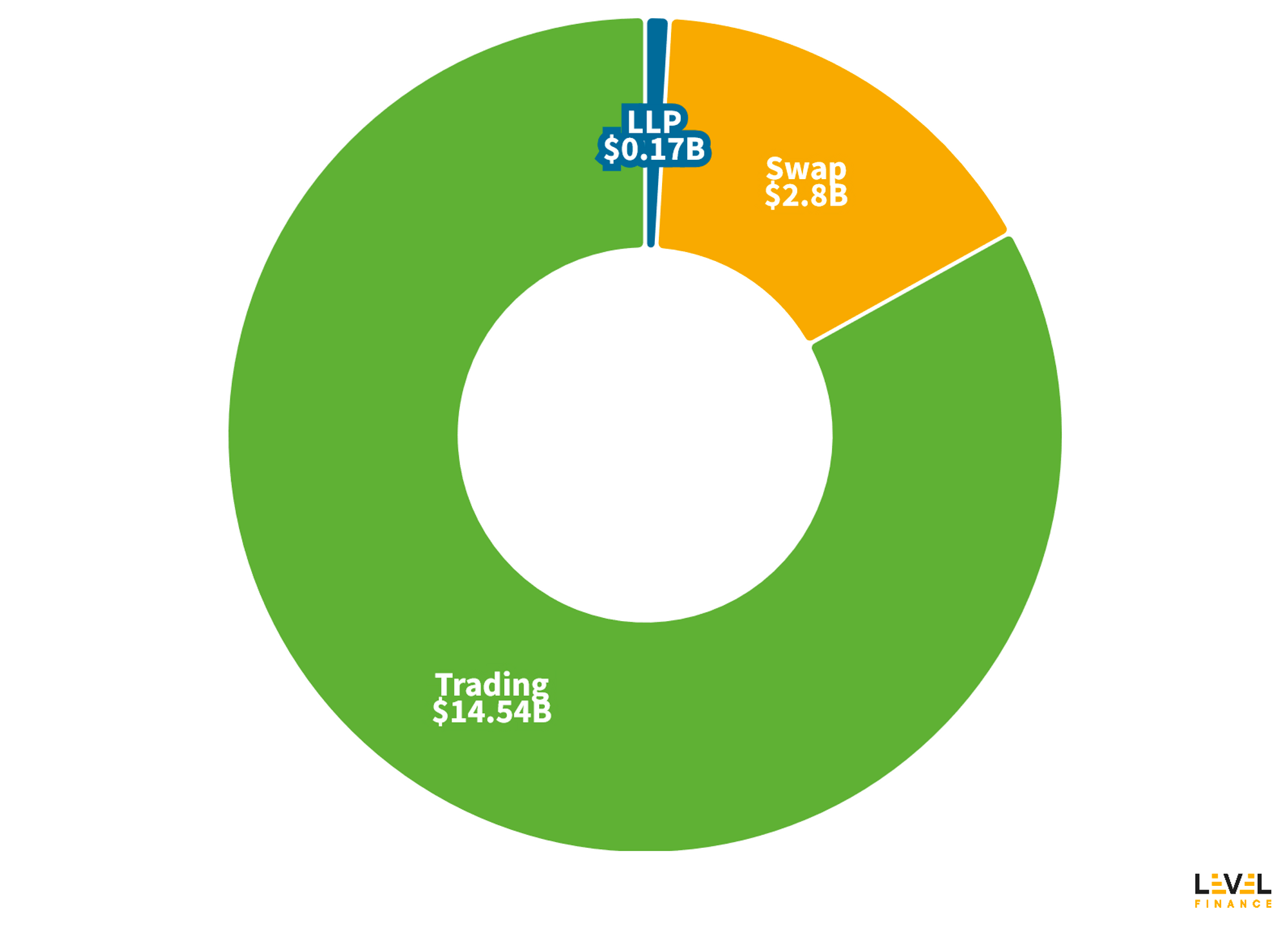

Total Volume: $17.4 billion, of which leverage trading volume accounts for $14.5 billion

Total Collected Fees: >$22 million

Interestingly, these collected fees are distributed to:

- LLPs (supply-side revenue) = 45%

- LVL Stakers (protocol revenue) = 10%

- LGO Stakers (protocol revenue) = 10%

- DAO Treasury (protocol revenue - redeemable against LGO) = 30%

- Reserved for Protocol Development (5%)