The top 20 best-performing ETFs this month are all from the cryptocurrency sector.

According to investment research company Morningstar, crypto ETFs have made a “clean sweep” of the top 20 positions for ETFs in Europe.

The number one spot on the top 20 list for October was claimed by SEBA Polkadot ETC (SDOT), which was launched last July. In fact, the top 3 places were occupied by Polkadot ETF products.

In third place was VanEck Vectors Polkadot ETN A, with a 51.13% gain. 21Shares Polkadot ETP was the second best performing with a 51.64% increase over the month, and the SEBA Polkadot ETC came top with 52.38%.

Bitcoin and Ethereum ETFs took all the remaining 17 top-performing places. It would have helped that Ethereum made an all-time-high at the end of October, by topping $4400. Since then, it has climbed to around $4740 at time of writing.

Bitcoin was helped back into the limelight last month by the SEC granting a licence for the first Bitcoin futures ETF in the US. However, given that this is a futures, and not a spot ETF, the Proshares Futures ETF will just invest in Bitcoin futures contracts rather than buy the underlying asset.

According to the Morningstar report, we have to go all the way down to 34th place in the best-performing ETF list in order to find the first non-crypto fund, which belongs to the First Trust Nasdaq® Clean Edge® Green Energy UCITS ETF (QCLU).

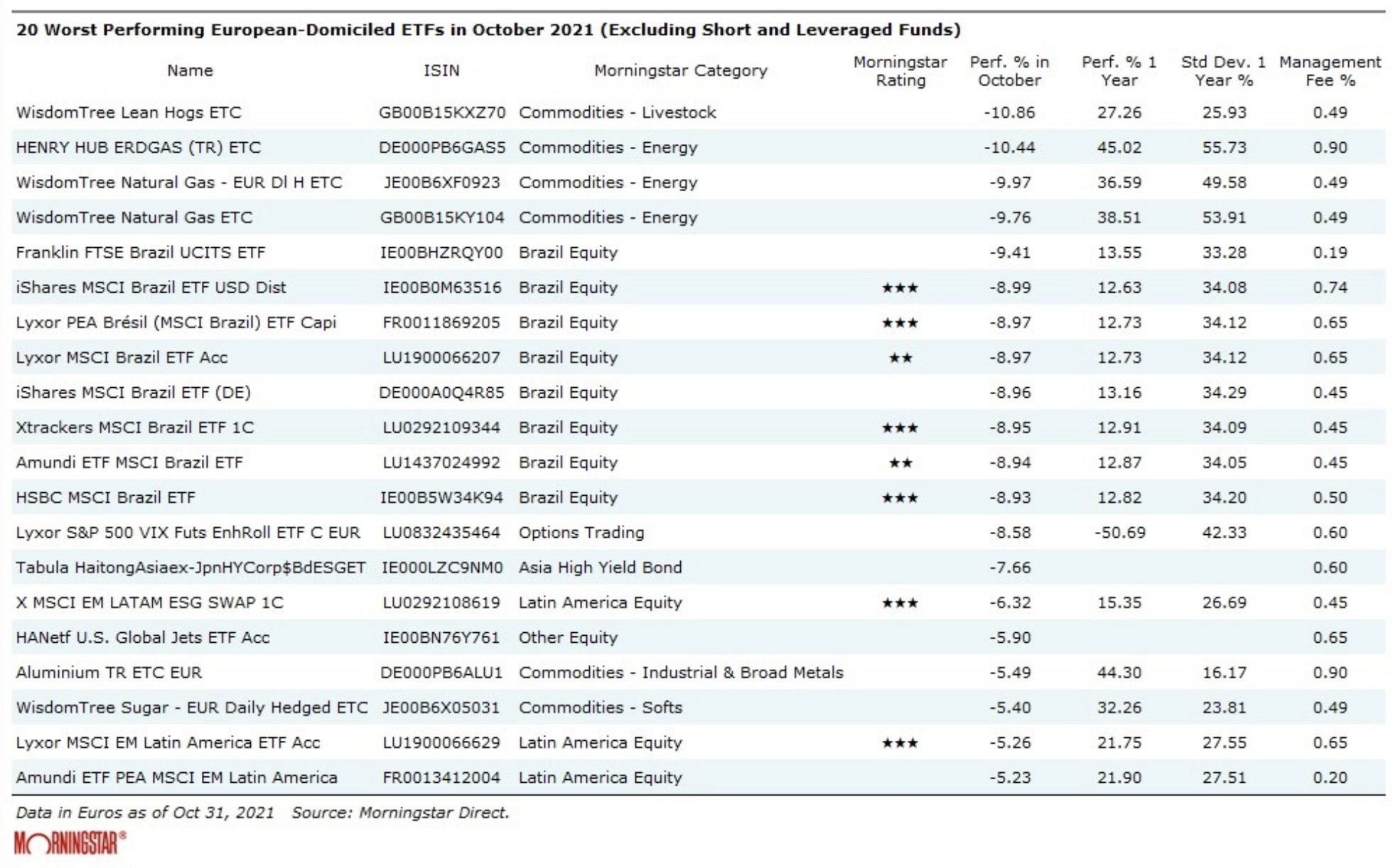

The worst performing ETFs are those that track natural gas and Brazilian stocks. For natural gas an issue is the milder than expected late autumn, and for Brazilian stocks, the slow-down in China is having an impact, as is the uncertain political environment.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Investment Disclaimer