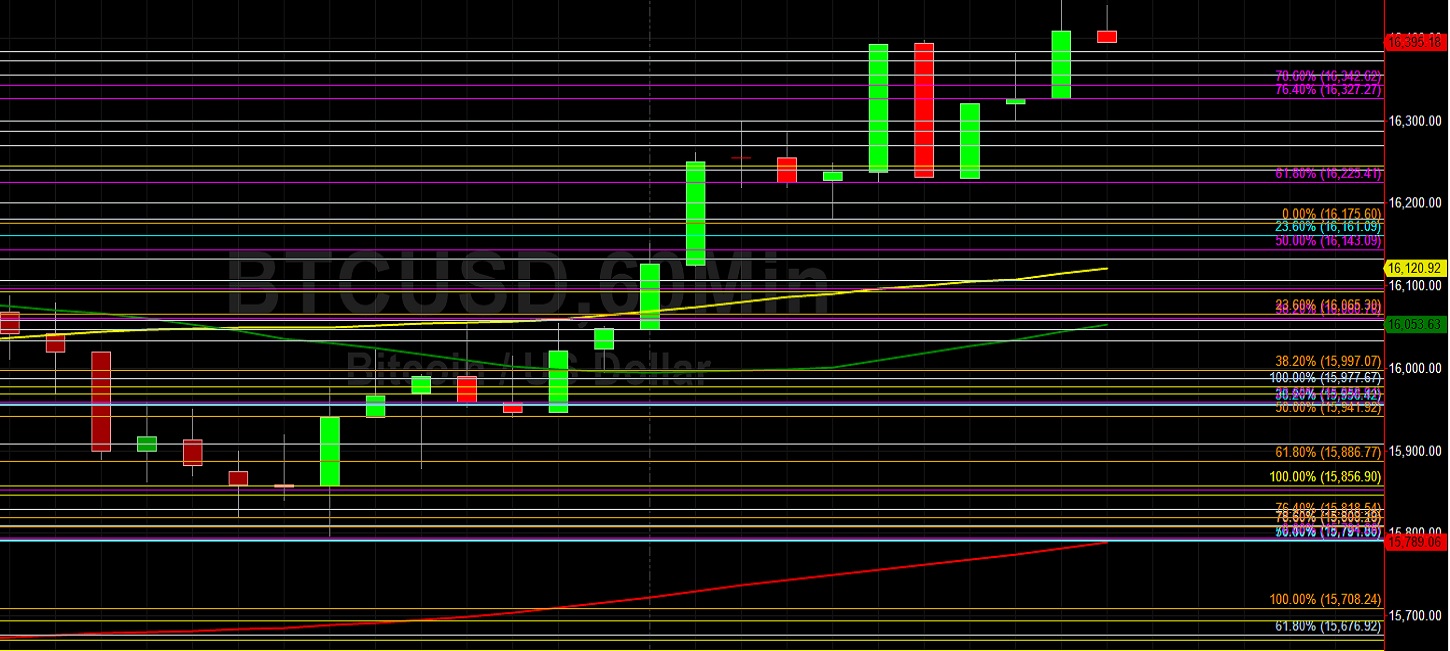

Bitcoin (BTC/USD) extended recent gains early in today’s North American session as the pair appreciated to the 16447.00 area after trading as low as the 15796.09 area in the Asian session, a test of the 50% retracement of the appreciating range from 15090.08 to 16491.92. Stops were elected above the 16275.77 and 16293.88 areas during BTC/USD’s climb, upside price objectives related to buying pressure that emerged several months ago around the 6854.67 and 7671.00 levels, and this follows a series of Stops that were recently elected above the 15611.52, 15634.39, and 15676.92 areas. Additional upside price objectives include the 16690.89, 16815.04, 16945.67, 17035.36, 17306.03, 17657.16, and 17891.76 areas. During BTC/USD’s recent downward pullbacks, Stops were elected below important technical levels including 16092.69, 16057.89, 16046.30, 15969.37, 15955.45, 15856.90, 15846.05, and 15791.00. Traders are observing some downward retracement levels related to the appreciation from 14310 to 16489.00 and these include 15974.76, 15656.62, 15399.50, 15142.38, and 14824.24.

Below current market activity, traders are monitoring the 15143.84, 15062.52, 14947.05, 14817.14, and 14703.57 levels as possible areas of technical support. Additional downside retracement levels include the 14922.33, 14753.84, 14596.34, and 14465.02 areas. Stops were also recently elected below the 13609.26, 13451.74, 13224.44, and 13197.13 levels during the recent pullback, levels related to the recent appreciating range from 12785.00 to 13863.87. Further below current market activity, traders are paying close attention to additional potential areas of technical support during pullbacks and these include the 14273.50, 14259.01, 14101.50, 13989.55, 13892.29, 13705.50, 13663.43, and 13594.42 levels. Another important technical level includes the 11510.44 area, representing the 50% retracement of a historical depreciation from 19891.99 to 3128.89. Chartists are observing that the 50-bar MA (4-hourly) is bullishly indicating above the 100-bar MA (4-hourly) and above the 200-bar MA (4-hourly). Also, the 50-bar MA (hourly) is bearishly indicating below the 100-bar MA (hourly) and above the 200-bar MA (hourly).

Price activity is nearest the 50-bar MA (4-hourly) at 15805.74 and the 100-bar MA (Hourly) at 16121.03.

Technical Support is expected around 15459.71/ 15214.33/ 15062.52 with Stops expected below.

Technical Resistance is expected around 16690.89/ 16815.04/ 16945.67 with Stops expected above.

On 4-Hourly chart, SlowK is Bullishly above SlowD while MACD is Bullishly above MACDAverage.

On 60-minute chart, SlowK is Bullishly above SlowD while MACD is Bullishly above MACDAverage.

Investment Disclaimer