There are now dozens, if not hundreds, of payment apps that transfer money for goods and services across the globe. These projects provide electronic solutions that connect separate transaction parties and allow users to store their coins in secure wallets or convert them into fiat currency and send it directly to their bank accounts. Either way, you shouldn’t be concerned with how easy it is to store your funds, you should be concerned with how easy it is to spend them!

The advantages of these systems vary, but most of them have indisputable advantages over bank or credit cards such as lower fees and better-encrypted transactions. Some platforms are commercial, some offer a free number of transactions, but most have support for different coins. That's a very important factor since there are thousands of tokens transacted online, so you don’t want to limit yourself by being able to work with only one type of cryptocurrency. Other important features are built-in trading alerts, accounting solutions, secure wallets, and tons of other useful options incorporated into these applications.

A growing and competitive market

The statistics show that the number of crypto wallets has increased sixfold over the past five years, attracting almost 55 million users in 2020.

- Over the course of the last year, 12 million more blockchain.com wallets were created. That’s only one wallet service out of all the available choices.

- Leftronic states that the daily volume of Bitcoin transactions in the beginning of 2020 amounted to $6.2 billion. That is less than MasterCard with $30.3 billion, but more than American Express at $3.2 billion.

- The Square payment platform also accepts crypto-to-fiat and has $200 million in total daily volume. According to a study by JPMorgan, the platform has processed $858 million worth of crypto purchases in Q2 of 2020, compared to Grayscale, an investments asset manager that processed only $700 million during that same period.

According to Electronic Payments International, people need better solutions to make payments with their coins. Let’s just look at a few statistics regarding the use of cryptocurrencies.

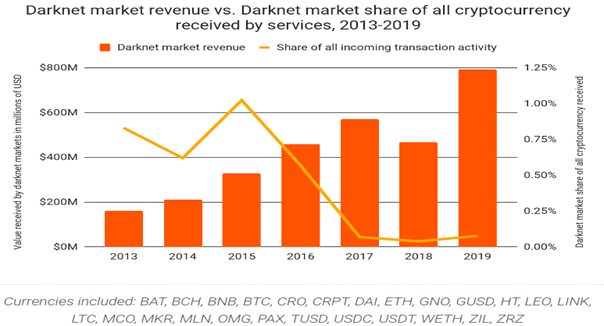

Over $275 billion worth of cryptocurrencies, and growing, is already in circulation. The statistics from a Chainalysis report of 2020 show an increase of 0.04% of incoming darknet market sale transactions to $790 million worth of crypto in 2019 after a decline in 2018. The greater revenues are owing to the increased number of transactions rather than their sizes – up from 9 to 12 million transactions for the same period. That’s absolutely huge for any kind of alternative market!

The global demand for using secure and less expensive crypto transactions has driven fierce evolution within old payment methods; a movement that sparked the interest for DeFi applications and other decentralized services. As a result, we have more financial services that support cryptocurrency.

Today, BitPay is one of the most popular payment apps, as it makes it easy to set up email payments through a web form with functionalities for delayed, recurring, or multiple payments. The BitPay checkout app also carries out basic payments across portable devices, supports iOS and Android operating systems, and issues email invoices. Sellers can integrate “Buy now” buttons onto their websites and other web apps with a detailed description of the product and the amount of crypto to pay. QuickBooks integration is a helpful resource for keeping your history of the payments. Users can also order a prepaid MasterCard and transfer from Bitcoin and Bitcoin Cash to fiat, which happens at a flat rate of 1%.

Another highly rated platform is Coinbase Commerce, where Bitcoin, Ethereum, Bitcoin Cash, Litecoin, DAI, and USD Coin are accepted. It also has a straightforward and easy-to-use interface. The platform generates a code for website integration that can be embedded or shared to an email address via a link. It has a plug-in that can be embedded in various electronic services such as WooCommerce and Shopify, which are already used by millions of people today. If Coinbase manages to bring the same accessibility to cryptocurrency it can improve the overall experience for the masses. For additional access protection, a unique seed phrase is required that consists of a combination of 12 words. There is also a checkout button and a fiat conversion option. Although Coinbase Commerce has more convertible coins and payment options when compared to BitPay, integrations are more limited. Users will need a third-party wallet to retrieve their balances.

Electroneum (ETN) is a UK-based payment platform that is also a cryptocurrency. After starting out in 2017, it now has millions of users and targets the unbanked population as well. ETN can be transferred almost instantaneously for a fee of less than a cent. The very low fees made ETN desirable to many traders who are transferring funds from one platform to another almost on a daily basis. To receive or send payment with Electroneum, users just need to scan the QR code on their phone. It works in the background and requires little technical experience and no excessive documentation to join. The bottom line is that users can still mine crypto without a powerful rig on their phone or PC. The platform has an application wallet, free multiple offline wallets, and windows wallets. An open-source blockchain explorer is implemented to verify crypto transactions and third-party APIs that allow acceptance and payouts (for example, in online games and casinos).

Obviously, a new player is needed to make the transactions between digital money and fiat currency work better for both sellers and end-users with a click of a button.

Cyclebit Group offers high-speed and reliable e-commerce solutions. The company has been on the market since 2012, having started in Eastern Europe and Southeast Asia, and is now expanding its services to more users in Europe, the United States, and Canada. The platform is integrated with some major exchanges: Okonto, Bitex, Gemini, Liquid, Coinberry, CEX IO, and others. The multi-currency wallet supports Bitcoin, Litecoin, Bitcoin Cash, Etherium, DASH, as well as more than 20 other top cryptocurrencies. Turnover is reportedly more than $1 billion.

Recently, Cyclebit launched a new combined solution for crypto and fiat payments for businesses and customers. Tap2go is a SoftPOS Android application with built-in NFC (near-field communication) module; a technology used by most people who are using their mobile devices for payments.

Tap2go

To accept payments from contactless bank cards, the tap2go application has to be installed from Google Store. Payments can be made between phones and other NFC-enabled devices like tablets or smartwatches, and contactless payment cards. The devices need to be close to each other, but no physical contact is required for the transaction to take place. The NFC antenna is essentially a chip installed on the back of the device or on the side of credit or debit cards (usually there is an antenna sign marked on the top of the card). There will be a signal marking a successful transfer, which is both visible to the sender and receiver. No additional equipment is required. The payment platform can be very useful for coffee shops, bio shops, retail stores, as well as for freelance professions like fitness training, private lessons, or beauty services.

CyclePOS – Crypto and fiat

For brick-and-mortar stores, the solution is the mobile point-of-sale terminal – the Cycle POS terminal. It allows QR payments, the use of a 2D scanner, and accepts a variety of payment methods such as Apple Pay, Google Pay, and Samsung Pay. The tap-pay service and the Cycle Card are developed in collaboration with the Swiss company Tangem. The Bluetooth-enabled device is connected to a cloud in order to manage accounts in real-time and also allows buying, selling, and exchanging cryptocurrencies for fiat money, which could be an essential feature given the high volatility of cryptocurrency.

Cyclebit has already connected to more than 200,000 devices. With Cycle Online, stores can manage prices, sales, and discounts.

There are many other innovative accounting and marketing tools integrated into the platform as well. The cryptocurrency exchange rate is fixed at the time of purchase to assure both parties they are not losing due to volatility changes. The processing fee is as little as 0.5%. Customer payments are settled the next business day and in the local currency. The encryption and protection of payment data are performed according to the latest standards and requirements.

Different market segments and channels

There are also other crypto payment platforms, like Coinomi, Blockonomics, B2BinPay, and CoinGate, that offer various advantages, such as multi-currency live support, transferring cryptocurrencies to virtual gift cards for a variety of retail chains and other useful instruments that target different market payment channels. These include desktop web browsers, mobile apps, in-store shopping apps, mobile POS payments, and other terminals, coupons, direct mobile billing, e-cards, etc.

A University of Cambridge study shows that there is a bigger percentage of cross-border crypto payments compared to intra-country ones for amounts over $100, while payments under $100 are used for payments of services inside countries. Findings also show that the average size of the payments between C2C individuals is a bit larger than the payments to C2B businesses; however, B2B transactions average almost $2,000.

One of the reasons why people held back on the use of cryptocurrencies was because they could not use them to easily buy everyday goods like food or clothing. But these new payment services are here to change that! In addition, the current process bound with operations that seem complicated for most users is being replaced by more efficient modern ways of transacting with each other.

For retailers, some of the issues behind accepting cryptocurrencies used to be the absence of a connected interface system that uses both crypto and fiat and allows users to quickly manage payments and thus increase revenues. But the new breed of payment terminals entering the market is poised to change that state of affairs and set crypto payments on par with bank card transactions in terms of convenience and fees. When the blockchain was invented a decade ago, this seemed like a distant future. But today we are living it, and the one who will adapt the fastest will be the first to take advantage of the growing cryptocurrency market!

Investment Disclaimer