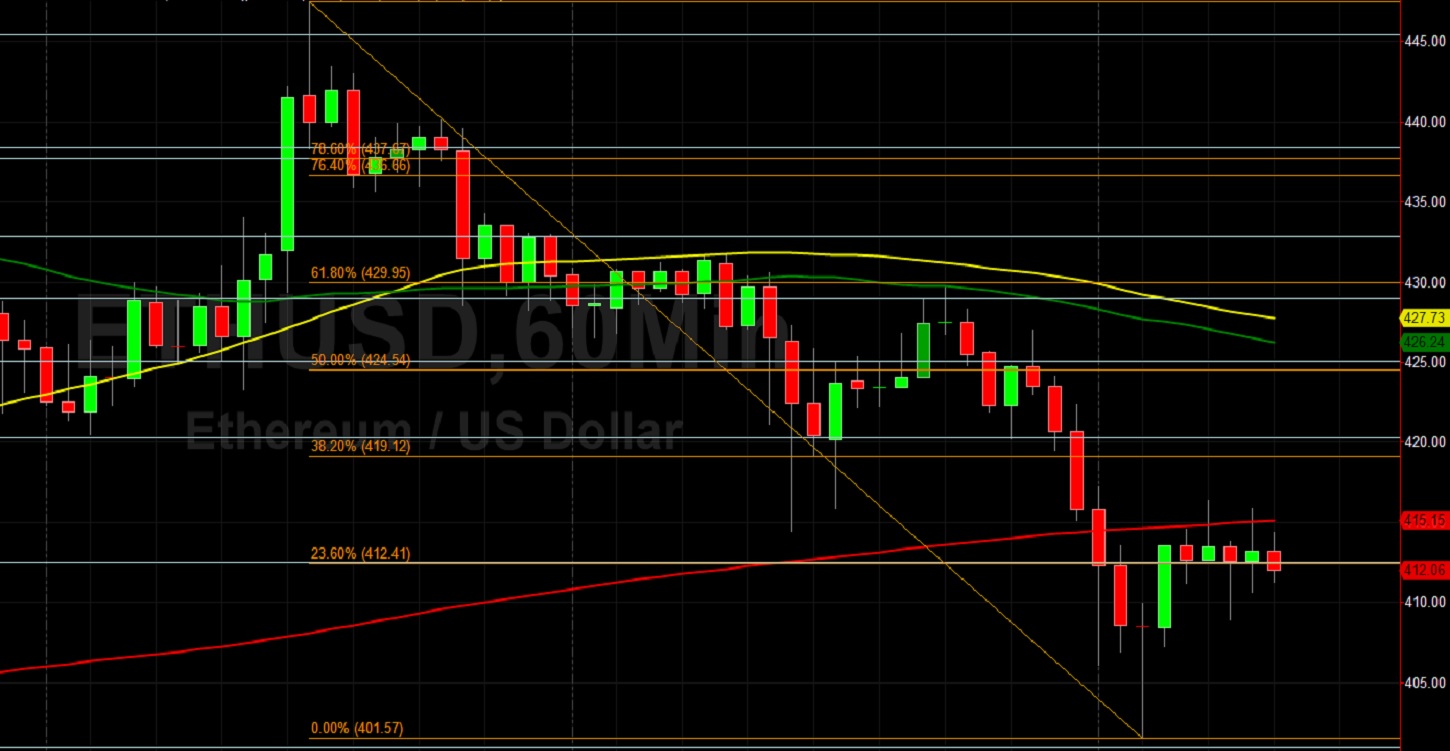

Ethereum (ETH/USD) traded sideways early in today’s North American session as the pair depreciated to the 408.91 area after trading as high as the 429.68 area earlier in the Asian session. Traders drove the pair to an intraday low around the 401.57 area during the European session, testing a previous relative recent high from 9 August. Following the pair’s recent depreciation from the 447.50 level to the 401.57 area, traders are eyeing upside retracement levels around the 412.41, 419.12, 424.54, 429.95, and 436.66 areas. The 396.69 area remains an important technical level, representing the 23.6% retracement of the historical depreciation from 1419.96 to 80.60. Stops were recently triggered below the 380.40 area, representing the 23.6% retracement of the appreciating range from 268.39 to 415.00, and stopped just short of testing the 374.08 and 372.25 levels, key retracement levels related to buying activity that emerged around the 241.62 and 233.85 levels. Following the pair’s recent run-up, important technical levels include the 414.17, 396.12, 392.67, 383.53, 376.90, 363.13, and 358.75 areas. Recently, the pair has encountered buying pressure around the 23.6% retracement of the appreciating range from 268.39 to 415.00. Downside retracement levels in this appreciating range include the 373.89, 364.70, 355.50, 344.13, and 342.42 areas.

Afte recently taking out the 445.45 level, one upside price objective is the 454.79 areas. Stops were recently elected above the 336.10, 337.33, 342.29, 350.44, 354.22, 366.48, and 369.26 areas during the move higher. Recently, bids emerged just above the 314.07 area, a level that represents the 50% retracement of the broad historical depreciation from the 547.54 to 80.60. A couple of interesting levels that traders will observe during retracements lower include the 301.20 and 301.40 areas, and they are related to buying pressure that emerged around the 241.62 and 319.86 areas. Likewise, the 312.82, 316.32, and 322.16 levels are areas with important technical significance. Chartists are observing that the 50-bar MA (4-hourly) is bullishly indicating above the 100-bar MA (4-hourly) and above the 200-bar MA (4-hourly). Also, the 50-bar MA (hourly) is bearishly indicating below the 100-bar MA (hourly) and above the 200-bar MA (hourly).

Price activity is nearest the 50-bar MA (4-hourly) at 415.74 and the 200-bar MA (Hourly) at 415.15.

Technical Support is expected around 349.75/ 331.95/ 315.08 with Stops expected below.

Technical Resistance is expected around 454.79/ 487.55/ 498.68 with Stops expected above.

On 4-Hourly chart, SlowK is Bullishly above SlowD while MACD is Bearishly below MACDAverage.

On 60-minute chart, SlowK is Bullishly above SlowD while MACD is Bearishly below MACDAverage.

Investment Disclaimer