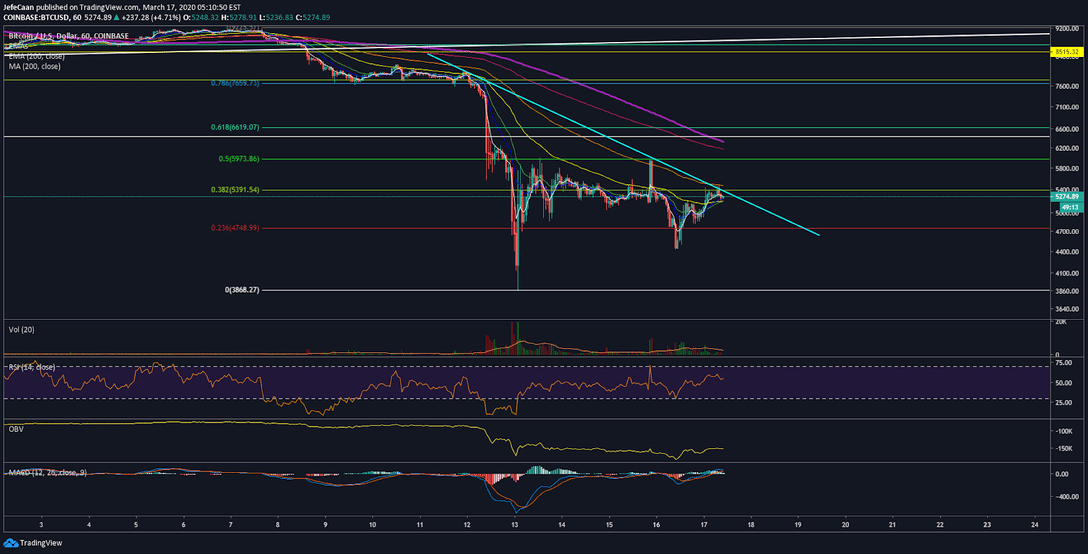

Bitcoin (BTC) risks further downside as the recent FED injection of $1.5 trillion failed to restore market confidence. The S&P 500 (SPX) remains in a free fall and BTC/USD appears to be in a vulnerable position now that it has run into a key resistance. The most probable scenario here would be the beginning of another downtrend that could see the price of Bitcoin (BTC) decline below the previous low of $3.8k. For now, the probability of BTC/USD declining below $3k is quite low but things could change quickly and it would all depend on the outlook of the stock market. There is already too much fear and panic in the market and a lot of long positions have been liquidated which means that there is not much to gain from dragging the market lower.

The most probable scenario at this point is for the market to form a new yearly low just below the previous low of $3.8k. The altcoin market would fall even harder meanwhile and this in my opinion would mark the end of the current correction, preparing the market for a move to the upside as we move closer to halving. The vast majority of traders are quite scared at the moment. Most of them having lost a lot on the recent crash are open to the idea of BTC/USD declining down to $1k so they can scoop up more coins at cheaper prices but that is not how it works. The game here is the one that the whales and market makers play. Retail traders are the ones that get played; they don’t make the rules.

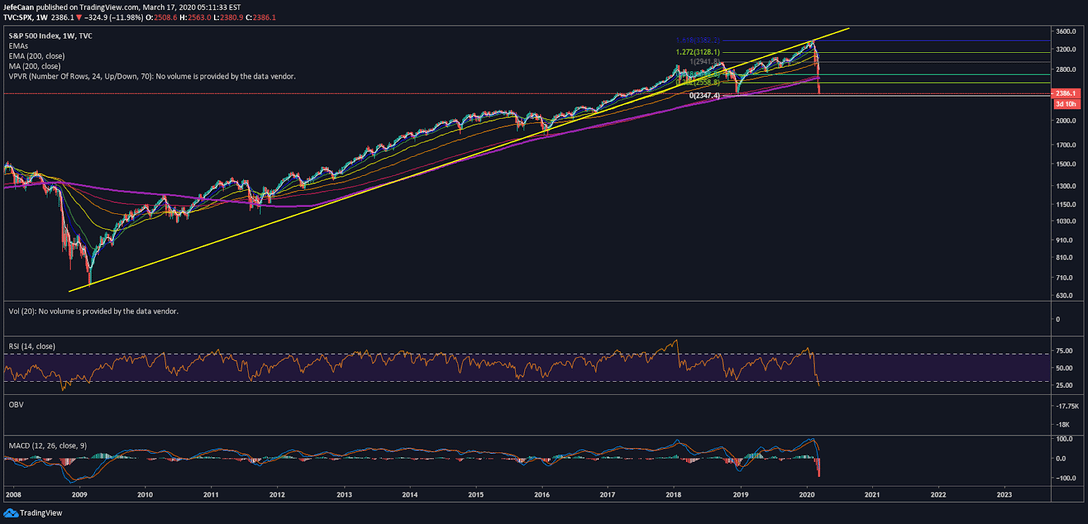

The S&P 500 (SPX) has just declined below the 200-week moving average again. Last week’s close sparked some hopes of the market rallying higher next week but now things are back to where they were. In fact, they might even get worse if the market declines further today because we could see the index form a new yearly low much like the cryptocurrency market. None of this is favorable for Bitcoin (BTC) and the rest of the cryptocurrency market which is why investors ought to remain vigilant.

Previous declines in the index have led to eventual declines in the cryptocurrency market. This time is likely to be no different. The situation seems to be out of hand despite the Fed’s attempt. This has investors even more worried because if the Fed can’t save the market like it did the last time, this is going to be a big problem. Fund managers are reducing exposure to equities which could put more pressure on an already tanking market. As for Bitcoin, we now know for sure how good of a safe haven asset it really is.

Investment Disclaimer