Table of Contents

Let’s be honest, the entire reason we thought cryptocurrencies would be a great idea was to get away from centralized control over our finances, right? But here we are, a decade later and we’ve given the reigns back to a new master: a crypto exchange. Is this the path we are destined to suffer, or will 2019 be the year when we can finally break free?

Centralized exchanges are, without a doubt, in control of the crypto world. We give them seemingly unending, and unfounded, trust. We rely on them to power the crypto economy. We turn to them because they are the most convenient option. And, for some reason, we just send them our money (hundreds of millions of dollars) and expect them to do the right thing with it. But has anyone thought to ask: what are they doing with it?

Source xkcd.com

Show me the money

I don’t mean to beat a dead horse here, but can we take a moment to really think about how absurdly messed up the entire Mt. Gox situation is? Crypto was essentially founded to prevent giant corporations (banks) from controlling our finances, yet millions of users still somehow got the short end of the stick thanks to Mt. Gox. The lawsuits to recover the lost funds are still being processed, but at the end of the day, it’s the average user who is being punished by this whole ordeal.

Mt. Gox, unfortunately, wasn’t an isolated incident. There are many situations where centralized exchanges either take advantage of users’ funds, abuse users' trust, or even create such absurdly asinine protocols that they lock themselves (and the users) entirely out of their funds. Here’s the data:

- Mt. Gox - An auditor’s computer was hacked, and hot wallets were drained - over 850,000 bitcoins were stolen.

- Exchange CEO dies - Quadriga’s CEO dies, and with him the key to their cold storage is lost - $137 million locked away forever, spread between over 100,000 users.

- Binance hacks - Phishing, viruses, and stolen KYC data have led to two Binance hacks. The first costing them 7,000 bitcoins, the second costing them KYC data for 10,000+ users.

- Libra -They are going to use the money users spent to purchase the coin to invest in low-risk accounts to make money for their corporate partners - users won’t see any of the profit.

- Seized by authorities - Tons of instances of the authorities shutting down “illegal” exchanges and seizing the crypto. France, United States, Italy, etc…

It should be obvious from the examples above that we need to change the way we interact with cryptocurrencies, specifically what we are interacting with them through. Exchanges are pivotal to the success of a tradable asset, but that doesn’t mean we have to be subject to the whims of corporations who may not share our interests. Cryptocurrencies and decentralization go hand-in-hand, so isn’t it time we started fully utilizing this technology?

DEXs and our money

The short story is this: decentralized exchanges (DEX) are safer than their centralized counterparts. Safe, in this instance, relates to a combination of things: safety from hackers, safety from nefarious authorities, safety from centralization, safety from corporate interests, and most importantly, safety from human stupidity.

Simply by decentralizing an exchange, you make it far less hackable since the number of targets that a hacker would have to penetrate increases. So DEXs, by definition, already remove some of the aforementioned problems from the equation. They come in a few shapes and sizes, and it’s easier to understand how they function as a whole by relating them to real-world examples such as Volentix, IDEX, and Binance DEX.

IDEX is a pretty basic, straightforward exchange that offers decentralized interactions between users. It is managed semi-automatically by platform participants, and users on IDEX rely on the platform to connect them to other users to engage in trading. DEXs never store cryptocurrency or personal information on them, like a centralized exchange does, and the only function of the server is to be a bridge between trades.

Binance released a DEX on their own blockchain, which is riding the fine line of [de]centralization, as it will still be under centralized control. This chain uses Binance’s token to fuel their consensus protocols, of which Binance holds the majority. In conjunction with this, in order to use this DEX you have to pass Binance’s existing KYC/AML procedures, and considering that Binance just had 10,000+ KYC accounts hacked, this isn’t good news. The perks of using this DEX are that your coins will never be in a hot wallet and you’ll be able to avoid some price slippage since Binance Chain has 1-second conformation times that are comparable to centralized exchanges.

Volentix’s VDEX is part of a DAE (Digital Assets Ecosystem), which as a whole offers its users more opportunities and tools than a basic DEX. With VDEX, a DAO (Decentralized Autonomous Organization) is used to create a self-regulating network that serves the users by creating and managing new tools and features. VERTO, for instance, is a multi-currency wallet that is paired with VDEX to allow users to trade across blockchains in more currency pairs than a basic DEX. To make things easier, VDEX’s DAO manages their own cryptocurrency, VTX, which can be used as a trading bridge when necessary.

VDEX, in essence, has all the same features of a DEX but adds more layers to increase usability for users. Think of it as having most of the perks of a centralized exchange without having all the pitfalls like hacks, hot wallets, fund seizures, etc.

Future of our money

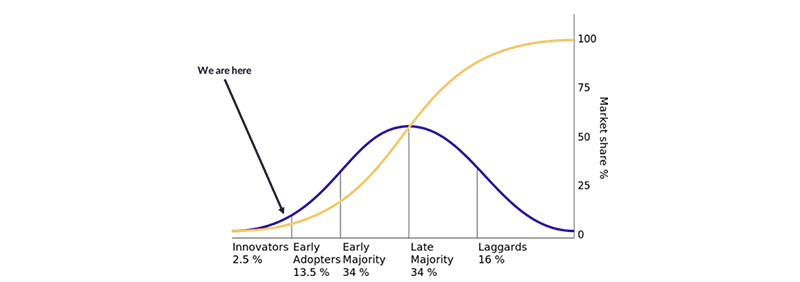

Even though they are far safer than their centralized counterparts, statistics show that DEX utilization is less than 1% in regards to the total global trading market. This is due to a few reasons. First, they haven’t always been as functional as they currently are. When DEXs first came out they were far slower and far more expensive than their centralized counterparts, making them less desirable at the time. Secondly, the market got too comfortable with centralized exchanges - we’re stuck with what feels familiar.

Source maven11.com

The truth of the situation is that DEXs are the better option, we just seem to be too lazy to take the time to make the shift. We continually suffer hack after hack, negligent CEO after negligent CEO, but eventually we’ll give up on centralized exchanges and say “enough!” However, it often takes a long time for new and better technology to overtake an existing system (looking at you, internet), but once it does we all let out a collective sigh and wonder why we didn’t make the switch sooner. The future is already here and your money deserves better than what centralized exchanges have to offer. The choice is, and it will always be, only yours.

Investment Disclaimer