Ethereum (ETH) is at risk of significant further downside as it remains heavily overbought. However, what’s more alarming is that the fading volume as well as bullish momentum could end badly for retail traders that are all charged up after the recent few pumps. Even if we assume that the price has already bottomed which is highly unlikely, the manner in which it has pumped in the past few days is hardly sustainable. This is nothing new and those of us who have been around for long know how it ends. Whenever a market sees a trend reversal, the sentiment most of the time is highly pessimistic. We have the exact opposite here as every mainstream investor is calling for a rally towards $200.

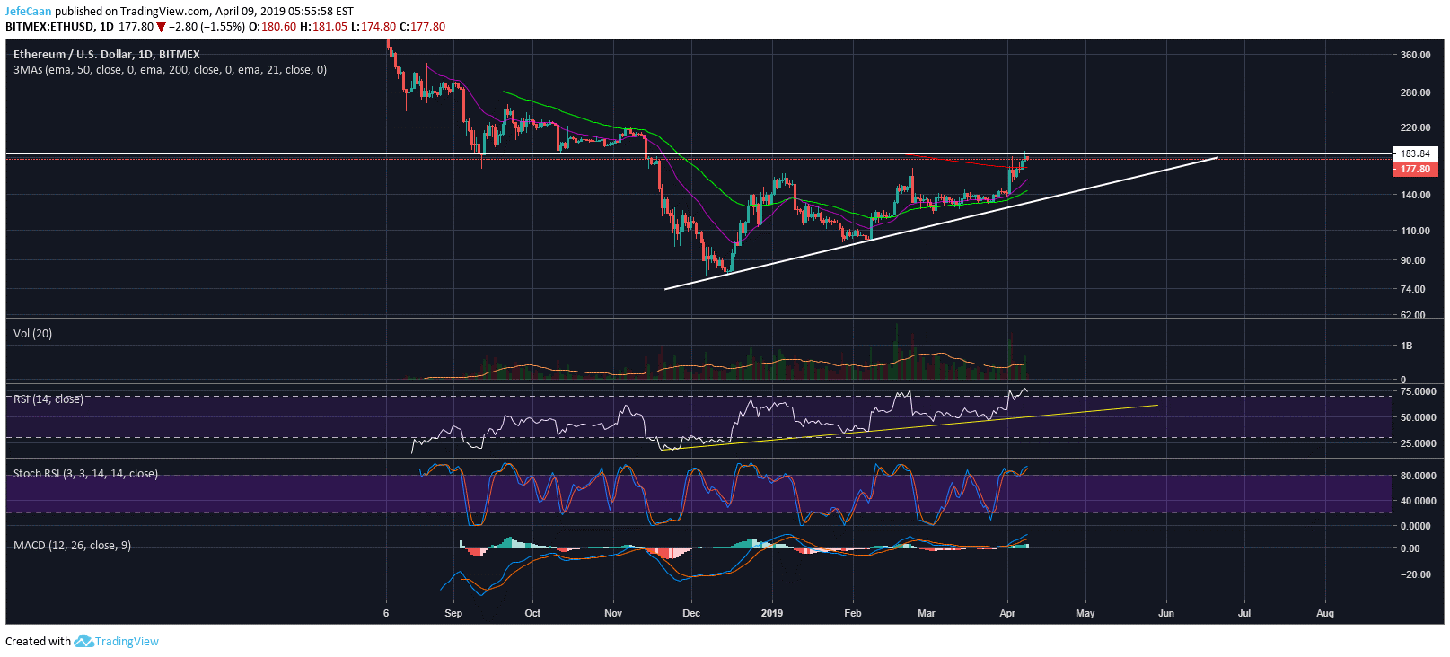

It is important to realize that the price rallied this far mostly at the expense of greedy bears that opened aggressive short positions at the wrong time. When those positions were liquidate by the whales, ETH/USD continued to pump hard and the average investor became more confident. Now, we have reached a point where the shorting interest in Ethereum (ETH) is at an all-time low. The number of margined shorts has already declined below their all-time low and retail traders do not want to short Ethereum (ETH) as they are scared they will get wiped out. On the other hand, the retail bulls are too confident about that rally to $200 without realizing how overbought the price is. Ethereum (ETH) has never been this overbought since the beginning of the bear market, not even when it topped out.

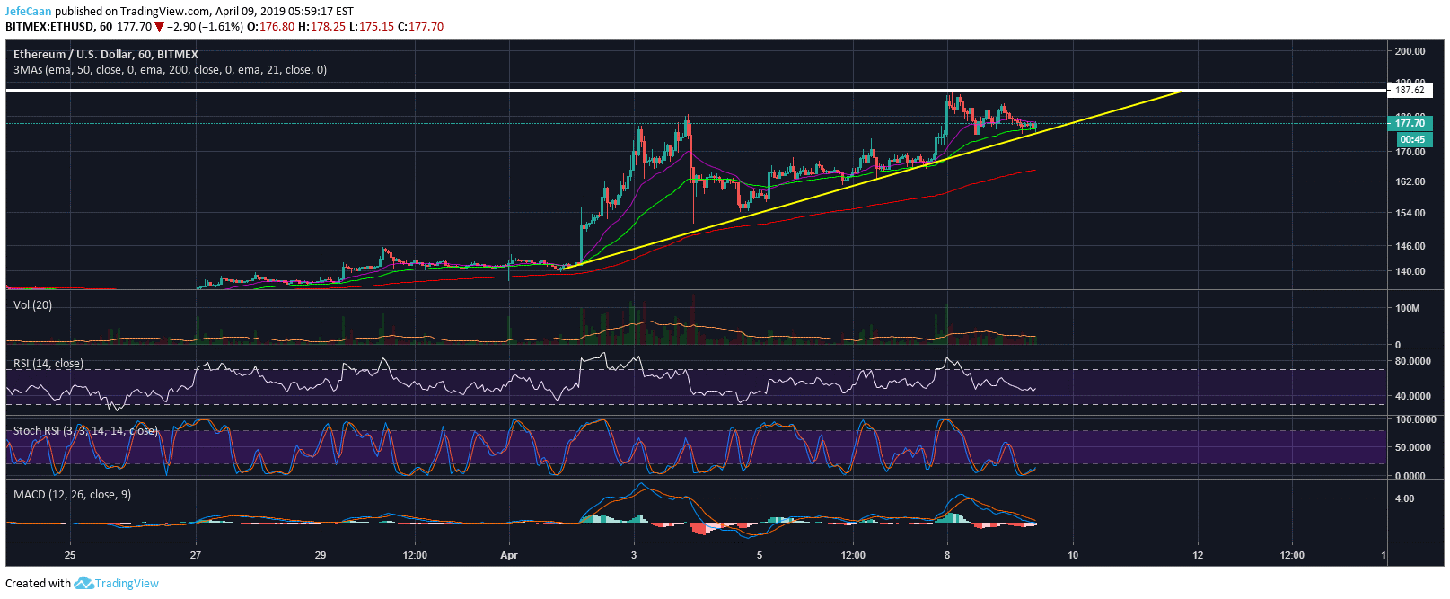

The 1H chart for ETH/USD shows the price trading in an ascending triangle that the majority is expecting to break to the upside. In my opinion, this triangle breaking to the upside or the downside has little consequence compared to the fact that the price is heavily overbought on larger time frames and will have to decline sooner or later. The cryptocurrency market has been able to profit off a rally in the S&P 500 that began around the end of last month. That rally now seems to have run its course and the next few months are going to be bloody. Reputed derivatives trader and early crypto adopter, Tone Vays expects the price of Bitcoin (BTC) to decline below $3,000 and to remain there till March, 2021.

Considering how overbought altcoins are against Bitcoin (BTC), if something like that happens, Ethereum (ETH) will be hit hard and the price will settle somewhere around $50 to find its true bottom. A lot of people reject such bold statements without giving them much thought. However, it is very important to note that if we consider this to be the end of the bear market that would mean that the current bear market cycle is a lot shorter than the previous one. We have season market cycles expand and not contract throughout the history of cryptocurrencies. Moreover, the stock market is yet to see further decline till the Fed is done unwinding its balance sheet which means cryptocurrencies like Ethereum (ETH) have yet to see more pain.

Investment Disclaimer