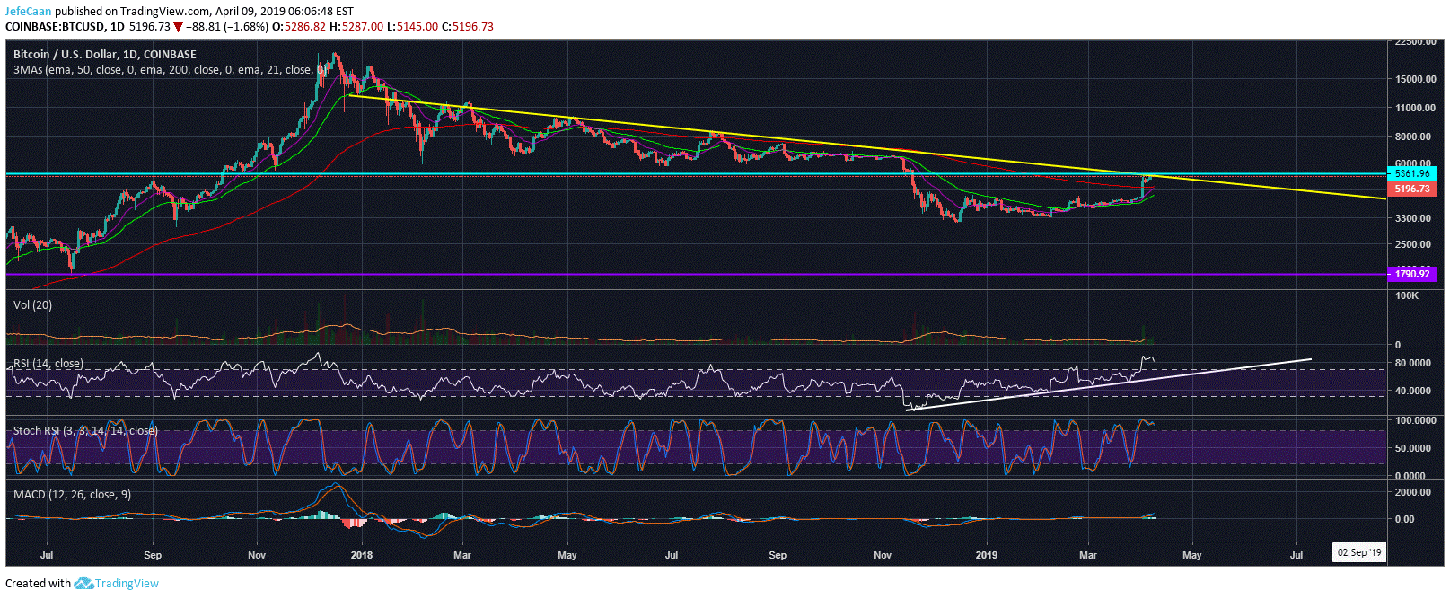

Bitcoin (BTC) has run its course trading within an ascending triangle and will now have to break out. Needless to say, the majority of the crypto community expects the price to break above this ascending triangle. A lot of people seem to be completely unconcerned about the manner in which the price is growing. If it keeps moving sideways and then keeps pumping, most of them will not mind as long as it doesn’t begin to do the same thing in the other direction. However, that is the thing about pumps and dumps. There is a pump which is followed by a dump and the price reverts to its mean. The way in which BTC/USD has pumped the past few days is not sustainable in any way. The price is due for a sharp decline which is an eventuality that we are going to see sooner or later. There is no other way around it.

That being said, we could see the price rise towards $5,500 or even $6,000 short term although that is very unlikely. It would also be very obvious as the majority of traders and investors are already expecting that. If something is this obvious, it rarely happens and markets have a way of surprising both bulls and bears at the same time. If Bitcoin (BTC) falls from current levels and breaks below the ascending triangle, it will have to settle atop the previous trend line support. This level could be easily broken and the price might plunge further into the red to trade in the $3,000s. A lot of traders assume that we are near the end of the bear market even though that would make the current cycle a lot shorter than the previous one. The price has closed below the 50 Week EMA, it is below the 21 Month EMA but it is hard to understand why traders are so eager to jump to conclusions.

If anything, traders ought to be more bearish than bullish considering how overbought BTC/USD is on both the daily and weekly time frames. If we look at the RSI on the daily chart, it has come back to test the trend line support every time it has shot up. This means that no matter how high the price goes, it will still have to fall back to this very trend line support. This is why it is important note to chase the price but to let it come to you.

The Stochastic RSI on the daily time frame is also extremely overbought and every time it has been this high, we have seen a reversion to mean. This time that reversion could mean a sharp decline below the 200 Day EMA which is going to unnerve a lot of traders and the panic selling we might see would be extraordinary. The reason I say it will be extraordinary is because very few people are prepared for that. Everybody is thinking this is the end and the price is going to shoot up in the next few weeks to begin a new cycle. When that hope bubble pops, it is not going to be a good day for a lot of retail traders.

Investment Disclaimer