There has been a lot of talk of golden cross on Bitcoin (BTC) in the past few days, but that remains a far cry because Bitcoin (BTC) will have to make some big moves to form a golden cross. However, there is one cryptocurrency that many not have to struggle as hard to form a golden cross. That cryptocurrency is Ripple (XRP) which is currently trading above its 50 day moving average and is ready to break out of a large symmetrical triangle that goes back to August, 2018. The daily chart for XRP/USD shows that the price might at least rally towards the 200 day moving average if not higher when it breaks out of the symmetrical triangle. Stochastic RSI for XRP/USD shows that the price has ample room for a rally to the upside in the near future.

Daily trading volume for XRP/USD has been in a steady decline since it began trading within the symmetrical triangle. This has made Ripple (XRP) vulnerable to big moves that could push the price either way in a matter of minutes. If the price breaks above the symmetrical triangle, we could see a big spike that goes all the way towards the 200 day moving average. On the other hand, if the price breaks below the symmetrical triangle, we could see it drop towards the previous support around $0.30. If that support is breached, we may see a sharp fall towards the $0.26 support. That might be part of the final corrective wave for XRP/USD that we expect is yet to come. That being said, the near term outlook for XRP/USD is far bullish than most other cryptocurrencies.

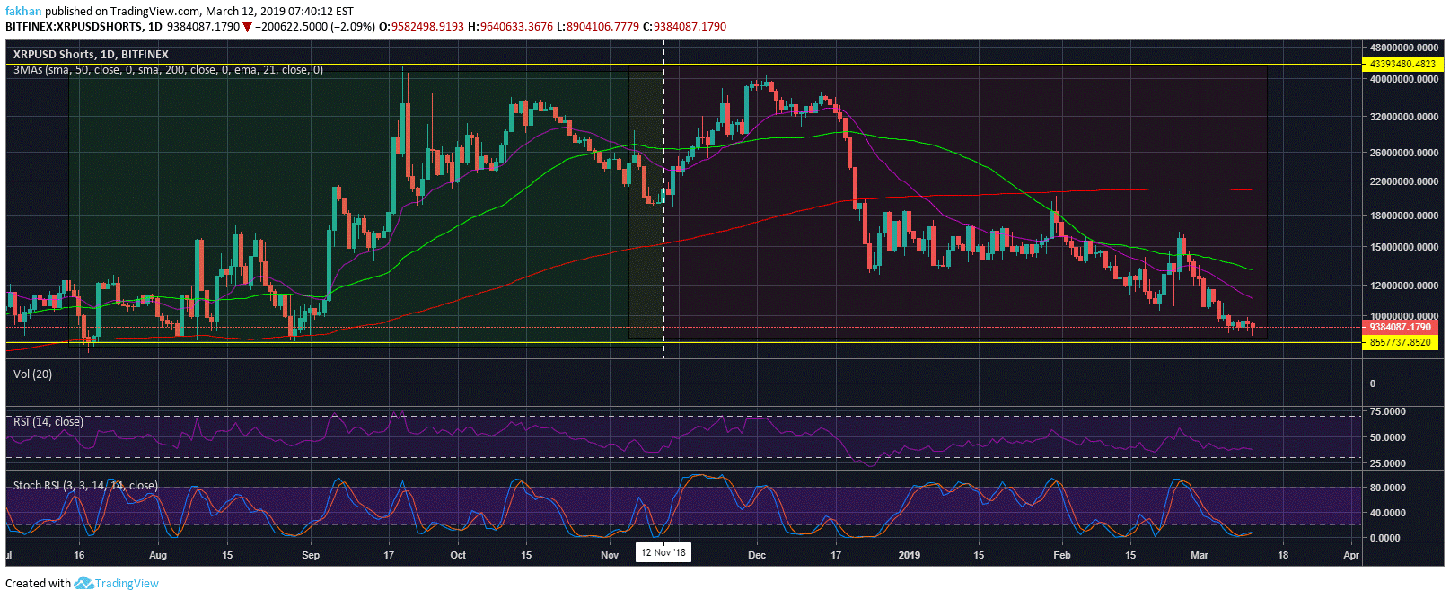

This means that the probability of a move towards the 200 day moving average at this point far outweighs the probability of a move to the downside. This might be Ripple (XRP)’s last chance to make a strong move to the upside as the daily chart for XRPUSDShorts shows that the number of margined shorts has declined significantly and is now ready for a trend reversal. It is likely that we may see XRPUSDShorts decline in the same way that it rallied. This means that as XRP/USD shoots up in the days ahead, we may see XRPUSDShorts shoot up in anticipation of a decline.

The daily chart for XRPUSDShorts shows that the number of margined shorts has ample room for a strong rally in the days ahead. Ripple (XRP) has seen a lot of bearish developments in the past few weeks especially after the whole JPM coin debate. We expect a correction to the upside in XRP/USD is long overdue and we might see a strong move to the upside in the days ahead. It is pertinent to note that near term outlook for XRP/USD is far more bullish compared to Bitcoin (BTC) or other cryptocurrencies. This is because XRP/USD has been out of sync with the rest of the market for a while now. We expect this to play out in favor of Ripple (XRP) in the days ahead which is why this might be a good time to accumulate Ripple (XRP) before the next short term run up.

Investment Disclaimer