Ethereum (ETH) is at risk for significant downside risks as the price has been falling without any immediate support in sight. The 4H chart for ETH/USD has the word failure written all over it as the bulls have miserably failed to protect the price against such aggressive sell off. If we just look at the bullish gartley pattern between December 17, 2018 and January 27, 2019 it is quite obvious to see that the bulls did not even put up a fight to capitalize on the bullish gartley pattern which has historically led to a correction to the upside however small it may be. To make things worse, the bulls allowed the bullish gartley pattern to convert into a descending triangle which as expected broke to the downside.

The price has now entered a falling wedge but the bulls should not put too much emphasis on it as the trend line support of the wedge has been tested only at two points and there is a strong probability that the price may end up breaking below this wedge to invalidate another pattern as it has in the past. It would appear that retail bulls are too afraid to step in at this point, retail bears are too confident to let go and the whales are just enjoying the two beat one another to death so they can collect their coins. The bulls may not be much to blame for not staging a successful comeback or defending the price against significant declines because they are aware of the machinations of the whales at this point and nobody wants to catch a falling knife.

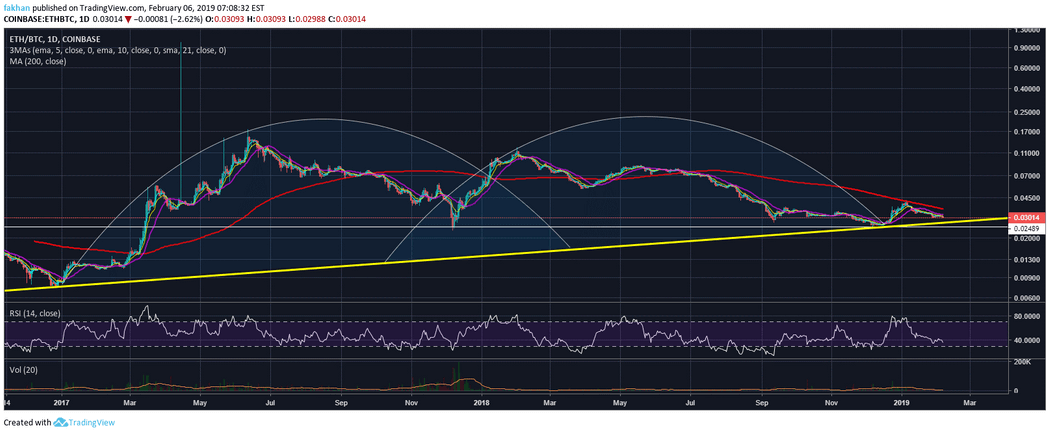

Chart for ETH/BTC (1D)

That being said, a lot of people are buying cryptocurrencies over the counter. Ethereum (ETH) and Bitcoin (BTC) are the two coins that have seen the most trading activity in OTC markets over the past few months. If we take that buying into account, the actual price of Ethereum (ETH) would be several times its current price. However, no one wants to be the one holding the bags when the price falls further. Besides, most people buying on OTC markets are professional investors who understand that markets have to complete a cycle before any recovery can begin. So, they do not want to get in the way of that for their own good and for the good of the market.

Many people believe that it was market manipulators or the whales that dragged the price of Ethereum (ETH) from its all-time high to current levels. They blame these people for being one of those that do not want to see projects like Ethereum (ETH) succeed. However, they fail to realize that the market had to correct at some point. So, whether it was the whales that accelerated the fall or the Mt. Gox trustee that dumped his coins, we should all be thankful that we now once again have an opportunity to buy Ethereum (ETH) at lower prices. Besides, tough times create tough investors, which means they are also more likely to hold on to their coins during tough times.

Investment Disclaimer