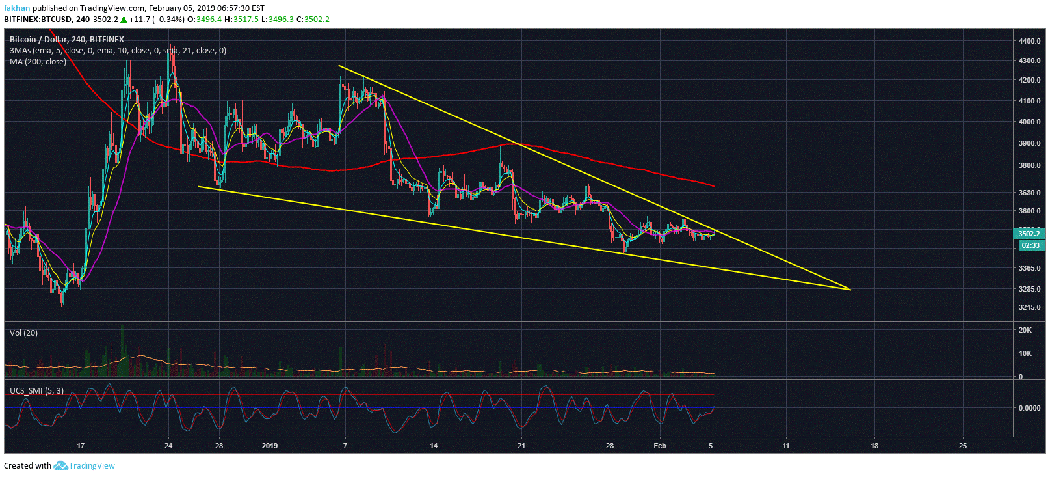

The Dollar Index (DXY) is a strong indicator of the strength or weakness of the US Dollar compared to other major currencies. As the price of Bitcoin (BTC) is predominantly paired to the US Dollar on most exchanges, it is reasonable to see that movements in the Dollar Index (DXY) have important consequences for the price of Bitcoin (BTC). The daily chart for the Dollar Index (DXY) shows that the price is trading within a rising wedge and is thus at risk of significant sell off in the weeks or months ahead. However, short term there is a lot of confusion and it is hard to tell what its next move might be. The Dollar Index (DXY) closed below the 21 Day EMA yesterday but today it is back above the 21 Day EMA. It has also found strong support atop the 200 Day MA.

As long as the Dollar Index (DXY) remains between $96.24 and $94.81, we will continue to see Bitcoin (BTC) in a similar state of confusion. That being said, both of them are running out of time and will soon have to take a definitive direction. As things stand, the Dollar Index (DXY) is not likely to continue trading higher for a long time even if it does manage to climb above the $96.24 mark for now. In that case, we could expect BTC/USD to fall back to $3,300 territory. However, that will not last for long and sooner or later the price will have to move up. This is nothing out of the ordinary as markets are cyclical in nature. If Bitcoin (BTC) were to fall further or the Dollar Index (DXY) were to break above the rising wedge that would be out of the ordinary.

The Dollar Index (DXY) also hints at a few more interesting developments that could materialize over the weeks ahead. One of such developments is a break below the 200 Day MA. If the Dollar Index (DXY) falls below the 200 Day MA, we could see a 2017 styled rally repeat again with the price skyrocketing from current levels to reach a new all-time high a lot sooner than expected. This may have more to do with changing economic conditions globally than with BTC/USD itself. A break and close below the 200 Day MA seems to be inevitable for the Dollar Index (DXY) and all that we see happening now is an artificial interest to keep the price above certain levels to protect the status of the US Dollar as a global reserve currency.

Such artificial manipulation cannot last for long as the United States is running out of moves to save the US Dollar from losing its position as the global reserve currency. The recent adventure in Venezuela to oust President Maduro is the epitome of the desperation to save the global reserve status of the US Dollar. Considering the level of adoption Bitcoin (BTC) and other cryptocurrencies have seen just over the past few years, it is not hard to see whether people will fight to protect something that has no value and can be printed countless times or something that has a limited supply and no centralized control.

Investment Disclaimer