When an asset declines in price, investors often look for a quick recovery because if that does not happen, things are likely to get worse in the near future. BTC/USD declined sharply in the past 48 hours but we did not see any quick recovery after the decline. The price continued to trade in a tight range below a critical support turned resistance. This is not a good beginning after a devastating rally that led to a decline of more than $400 in the price of Bitcoin (BTC) in a matter of minutes. As the price continues to trade sideways below a strong resistance, it will paint a bear flag that should see it decline further before it has a chance to recover short term.

As BTC/USD continues to consolidate, it will be at an increased risk of a sell off as the RSI cools off on larger time frames. This means that it might become easier for the bears to knock the price down from current levels to the December, 2018 lows. A lot of traders and analysts have blamed it all on market makers and are busy debating how the whales have polluted this market. It might be true and the whales might have taken advantage of overexcited retail traders but we also need to see why the retail traders gave the whales the opportunity to take advantage of them. The greed of retail traders before the last pull back made them rush into leveraged positions most of which were liquidated as a result of the recent crash.

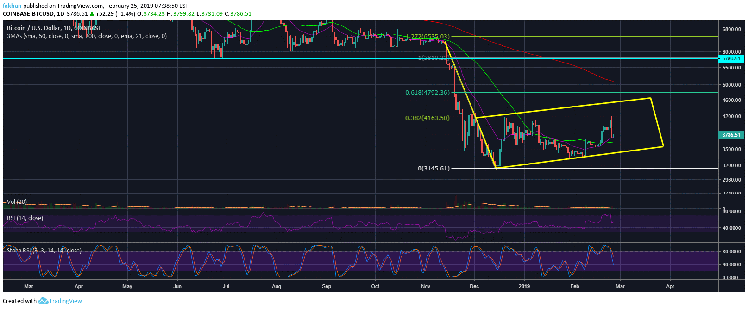

The previous rally took BTC/USD close to the 38.2% Fib level as shown on the daily chart. However, in order to fully paint a bear flag, we may still see the price rally towards the 61.8% Fib level. That being said, it is not likely to break past it and will likely retrace a lot sooner than it did during the previous rally. All the market makers are doing at this point is to let the retail traders think there is hope until the price is back at a point where the bear flag can be completed. That is when the whales will pull the plugs and the price will start declining below the bear flag.

RSI and Stochastic RSI on the daily time frame are both pointing to room for a rally to the upside. However, as we have mentioned before, this rally will most likely be short lived and very difficult to catch. One thing that is important to mention at this point is that the 50 day and 200 day moving averages are still very close and if the price shoots above the 200 day moving average in the same manner that it crashed, it might completely turn the tables on the bears and we might see a strong bullish reversal. The chances of that happening are very slim but it is still a possibility and should be accounted for in risk management.

Investment Disclaimer