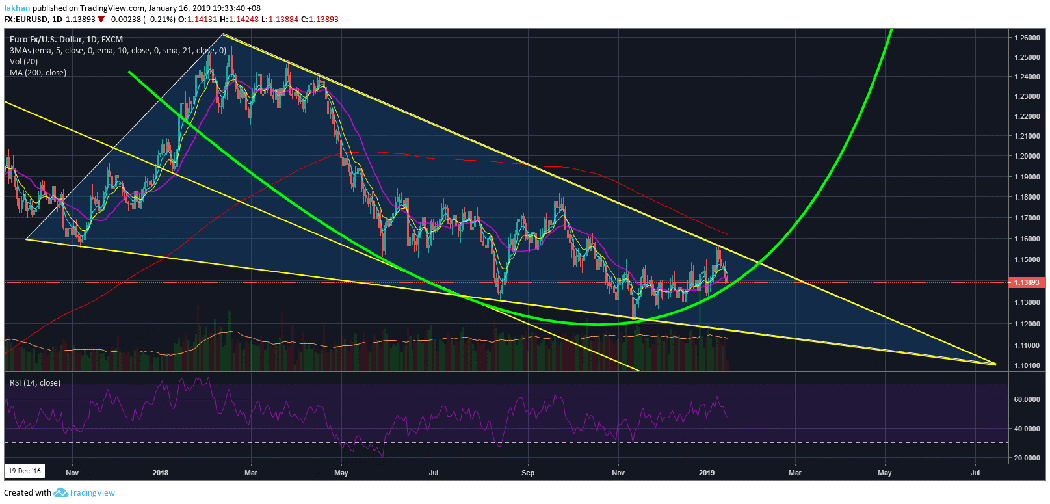

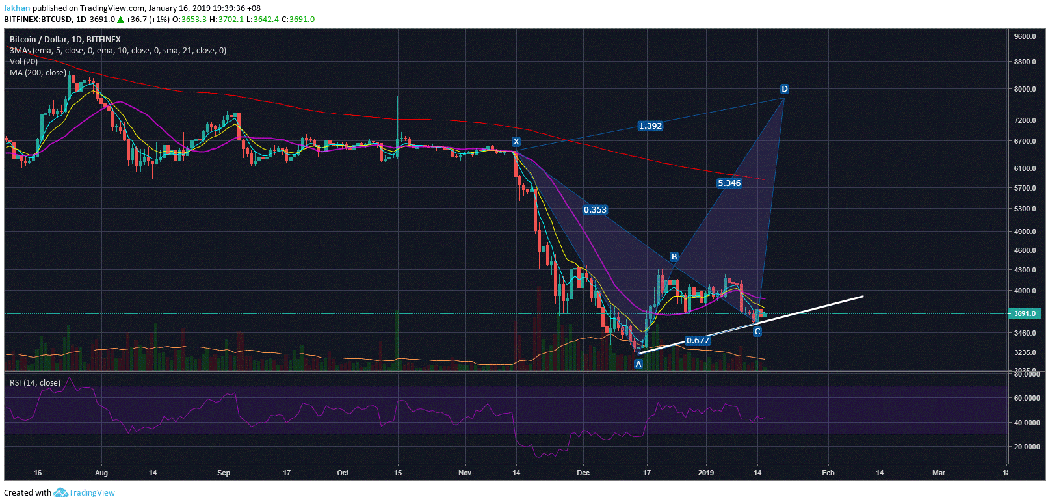

The future outlook of Bitcoin (BTC) is looking brighter in the months ahead as EUR/USD is likely to begin an aggressive rally as early as this week. It has already bottomed out over the past few weeks and is now ready to climb towards February, 2018 levels. This forecast has got many thinking whether such a parabolic rise in EUR/USD would also mean that Bitcoin (BTC) would repeat the 2017-18 cycle instead of trading sideways for the next few years. Well, we believe that to be the case because things are happening at a much faster pace than before. Commodities in general have never been this undervalued against stocks in over 50 years! Bitcoin (BTC) is also classified as a commodity.

So, if we think about commodities gaining against stocks, we can expect that Gold, Silver or even Oil will have their rallies in the months and years ahead but this is not what all of this is about. First of all, if commodities were to rise against stocks to complete a correction to the upside, that would mean putting a stop to growth and the expansionist style of economy we have witnessed over a long period of time. As that cannot happen, it has to be Bitcoin (BTC) and the cryptocurrency market that will replace the stock market with commodities that can also serve as stocks. So, this way, the growth will continue and the innovation will lead to a new market.

Traditional commodities on the other hand will see their demand decline one way or the other and we can already see some patterns. Millennials are more interested in electric cars than gasoline powered cars. Similarly, they see Bitcoin (BTC) as Gold 2.0 and have little to no interest in traditional gold or silver. They spend most of their lives on the internet in a digital space. With platforms like Decentraland, they would soon be buying and developing real estate online. There are already plenty of games and other simulation software where all things that used to happen in the outside world are now being confined to a digital space. The point is, we may see a trend reversal in commodities but we have to be careful about what it means. The upcoming generations are not much likely to be interested in oil or gold.

Bitcoin (BTC) is ready to begin its next big rally against the US Dollar (USD) as prospects for EUR/USD look brighter in the weeks ahead. This rally is not likely to last for long and will face stern resistance as soon as price nears the previous market structure but if BTC/USD continues to look up to the Euro for direction, then we will see a 2017-18 styled scenario repeat instead of a repetition of the 2015-15 cycle. We cannot expect the past four years to be the same as the next four years, not in the light of all that is going to happen over the next few years.

Investment Disclaimer