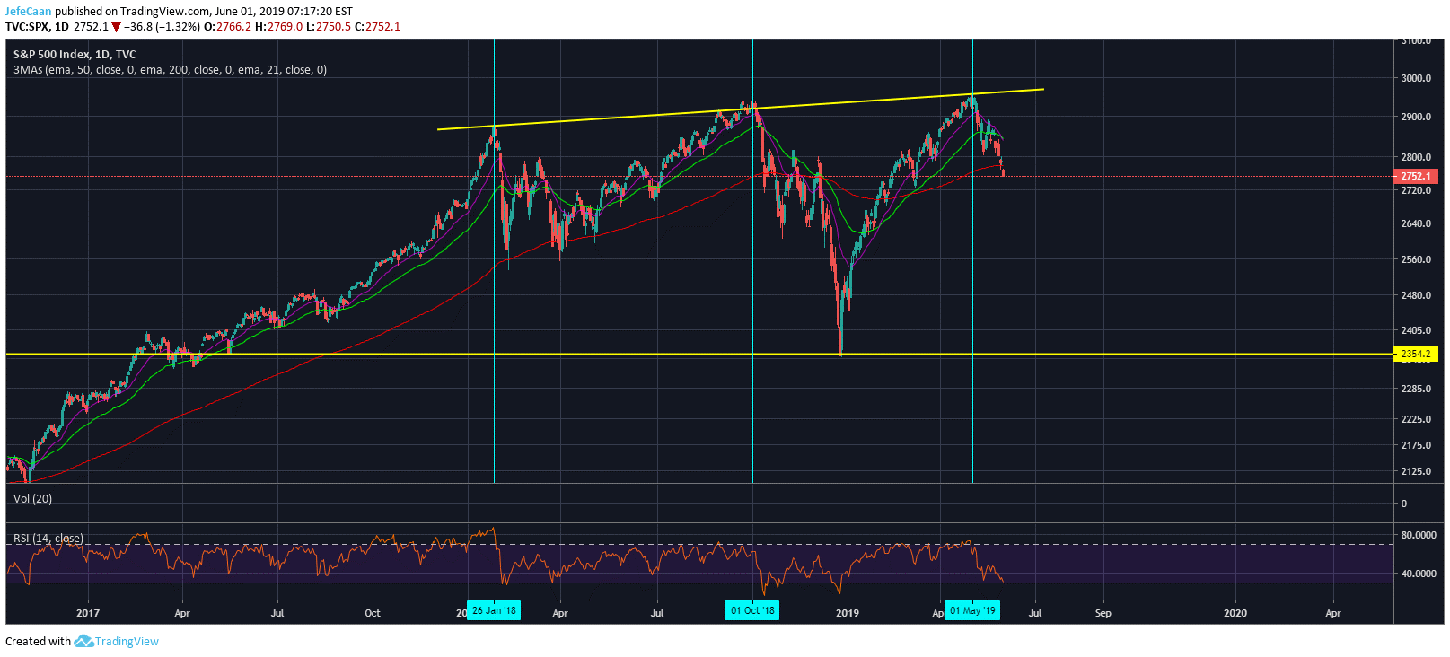

The S&P 500 had its second worst May since 1960s with yesterday’s extremely bearish close. The stock market continues to suffer as a result of President Trump’s self-imposed wars. There are a lot of speculations as to what it is really about. To some this is about bringing manufacturers back to the US, to some it is about maintaining a strong dollar and to other it is about keeping China’s expansion in check. Regardless of the reasons, it is becoming clear that the US is not prepared to back down and it will continue to look for trouble. This of course will not reflect well on an already overbought stock market. The daily chart for the S&P 500 Index (SPX) shows that the index closed below its 200 Day EMA for the first time since the beginning of the year.

The last time we had a close like this; it was followed by some temporary sideways movement and then a sharp decline. We are extremely likely to see the same thing happen again but we are more interested to know what all of this means for Bitcoin (BTC). The S&P 500 Index (SPX) formed its first recent top in January, 2018. It started to crash after that and we all know what happened to Bitcoin (BTC) when that happened. Then it recovered and staged a rally till October, 2018 but the smart money never trusted this rally. It was clear to professionals and large financial institutions that it is going to top out again. Sure enough, it did form another top in October, 2018 and started to decline. It declined for the next three months leading to the yearly close.

Meanwhile, most Bitcoin (BTC) investors were expecting a strong bounce off $6,000 and a rally towards the previous all-time high in October, 2018. BTC/USD traded sideways for a while and eventually it crashed hard following in the footsteps of the S&P 500 Index (SPX). We have seen a strong correlation between the S&P 500 Index (SPX) and Bitcoin (BTC) because Bitcoin (BTC) is not digital Gold, at least not yet. Gold does not crash 20% overnight which is why it is Gold, a safe haven asset. Bitcoin (BTC) is a highly speculative asset not much different than penny stocks. One might argue that this market is even more corrupted and manipulated than penny stocks but that is another debate.

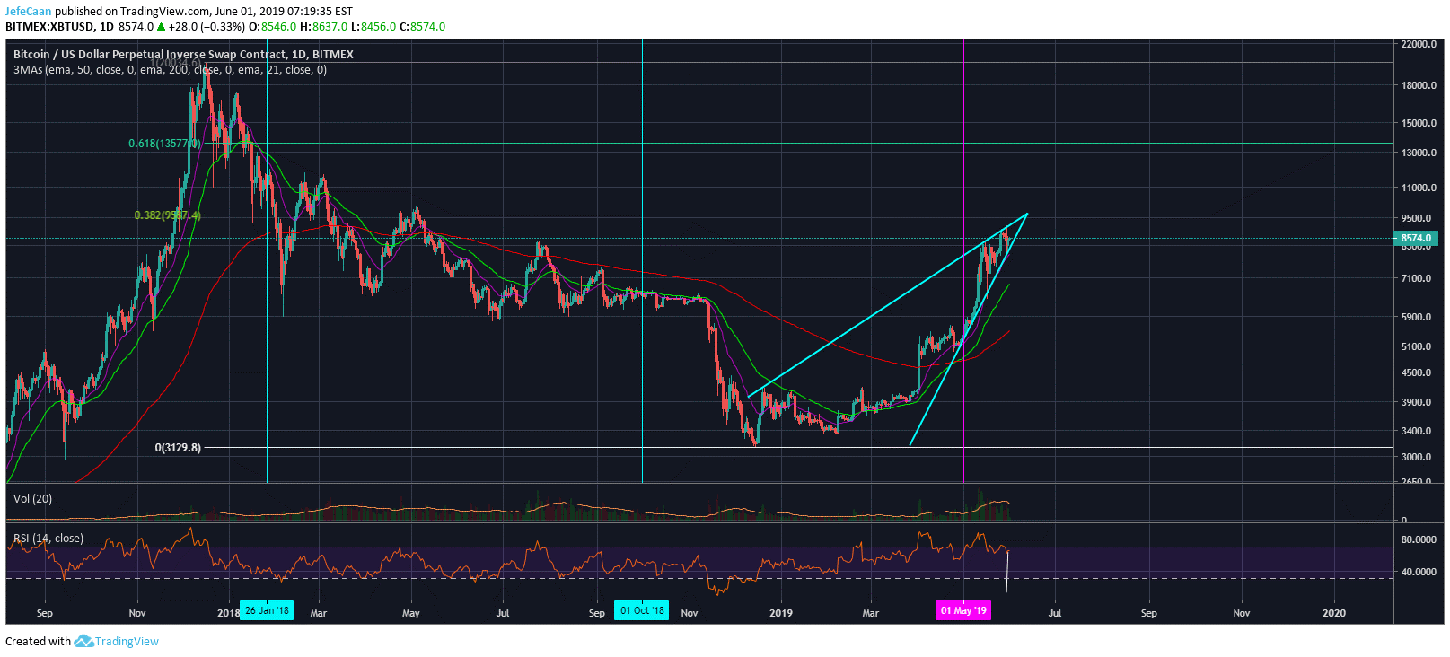

We have seen a strong correlation between the S&P 500 Index (SPX) and Bitcoin (BTC) for a long time now but recently that correlation was broken. If you look at the daily chart for the S&P 500 Index (SPX) for May 1st onwards, it is in a strong downtrend. However, if you look at the BTC/USD chart from that point onwards, it is in a strong uptrend. Interesting right? So, you might be wondering, “what changed?” Here is what changed. On April 24th, NYAG sues Ifinex (parent company of Bitfinex) for fraud. On April 30th, Tether’s lawyer admits to being only 74% USD backed. What happened after that is right in front of you. Just around this time, the drop Gold campaign was started and it was made to appear that Bitcoin (BTC) is behaving like digital Gold.

On May 16th, NYAG ordered Tether to halt transfers to Bitfinex and we saw a big crash in the price of Bitcoin (BTC). It continued to rally afterwards but at this point in time, BTC/USD is long overdue for a massive decline. Some people have argued that the price was pumped because Tether or Bitfinex were trying to recover losses, but there is another more important reason. The whole Bitfinex and Tether controversy made a crash too obvious so a lot of people went short on BTC/USD on high margins. If those traders were allowed to cash out, they would have wiped out most of these exchanges. There was no reason they could have allowed that to happen.

This is why we saw the price pump on extremely bad news and no wonder it took even the bulls by surprise. That story is not complete yet. Everyone knows that the price is going to come down and a lot of people might want to short this, but this time there is not much room to pump it further, so it has to come down. However, if it were to come down slowly, a lot of people might get the opportunity to short it. This is why we expect a deadly decline in BTC/USD in the weeks ahead that will pull the price down before most retail traders have the opportunity to short it.

Investment Disclaimer