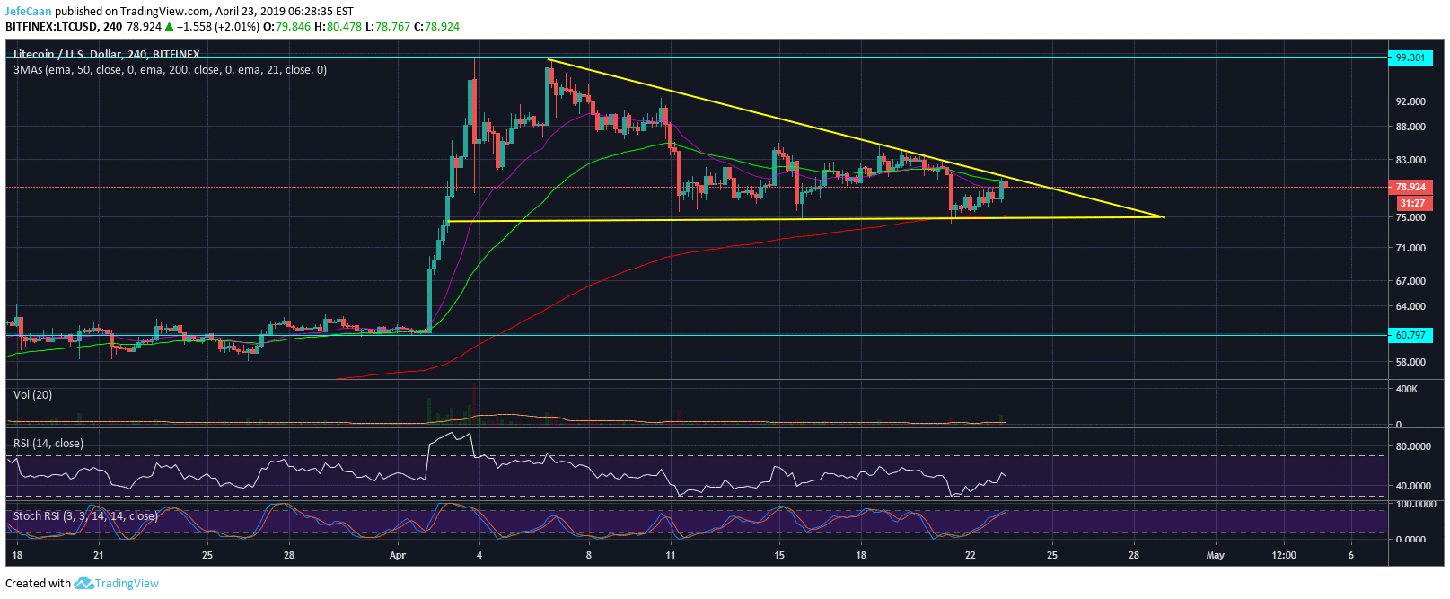

Litecoin (LTC) has recently been ahead of the market which is a good thing because sometimes it helps us see which way the rest of the market is going to go. It has done this on numerous occasions and we think it can do that again. The 4H chart for LTC/USD shows that the price is trading within a large descending triangle. Most of the descending triangles have a history of breaking to the downside especially when it comes to cryptocurrencies. The price is likely to decline to the 200 EMA on the 4H time frame to say the least. However, the price action shows that it might end up falling below this triangle to settle around $60 by end of this week or the next. The price is now heavily overbought on most time frames and is due for a sharp decline.

Cryptocurrencies like Litecoin (LTC) that lack long term unique use cases are going to experience the most pain towards the end of this bear market. So far that has not happened and a lot of people are calling for a rally to the moon. Litecoin (LTC) has its halvening event in August, 2019 which is what has got most people excited. Most of the times in the history of Litecoin (LTC), we have seen the price rally hard after the halvening. This time we expect the same to happen but the price will already be a lot lower when that happens, so it would not make much of a difference. Litecoin (LTC) is the sixth largest coin by market cap but it is still heavily overbought at its current price and market cap. For a cryptocurrency like Litecoin (LTC) that has no use case other than being a faster and cheaper fork of Bitcoin (BTC) for now is ludicrous. The same goes for Bitcoin Cash (BCH) as these cryptocurrencies will not have any use case at all once Bitcoin (BTC) starts being faster and cheaper with upcoming upgrades.

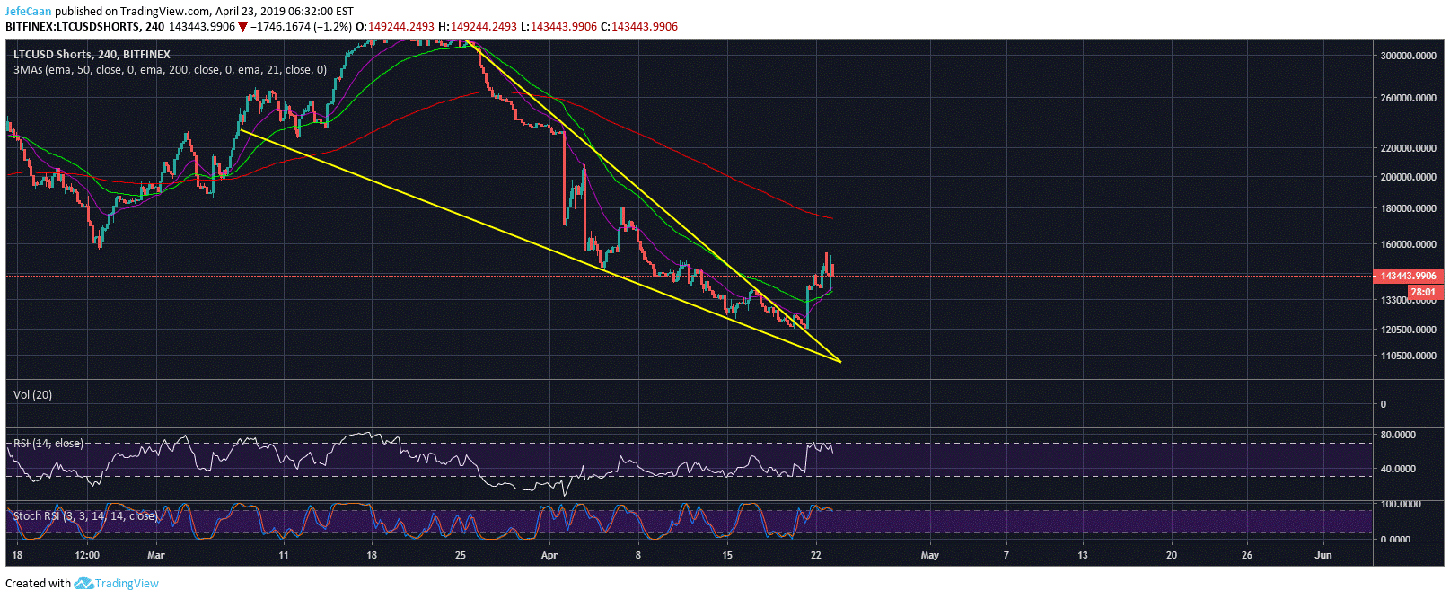

Interestingly enough, the 4H chart for LTCUSDShorts also shows us what the bears are likely to do with the rest of the cryptocurrencies. Litecoin (LTC) has already seen LTCUSDShorts break out of a falling wedge and is now trading above the 50 EMA on the 4H time frame. The number of margined shorts is expected to keep on rising in the days and weeks ahead which will put more sell pressure on Litecoin (LTC) and force the price to decline to new lows before it bottoms.

So far, Litecoin (LTC) bulls are very confident because the golden cross pushed the price from $60 to $100 in a matter of weeks. However, that rally now seems to have come to an end as the price is having trouble getting past the 21 day EMA. The price will have to decline sharply from here if it fails to break above that level. It is hard to understand what has the bulls so excited at this point when Litecoin (LTC) is up against a strong resistance zone and has failed to break past the support turned resistance that came into existence after the price broke its market structure in November, 2018.

Investment Disclaimer