Ripple (XRP) has just faced a strong rejection at the 21 day exponential moving average against Bitcoin (BTC). This is a strong setback for XRP/BTC considering the price is already in a do or die situation. The only thing that could save Ripple (XRP) from significant further downside is a rise above the 50 day moving average. If it fails to do that and faces a rejection at the 50 day moving average, we might see a strong decline below the 200 day moving average. If the price falls below the 200 day moving average, we could see it flash crash to the previous support. On the other hand, if XRP/BTC climbs above the 50 day moving average, we could see a short term rally to the upside that would lead to a higher weekly close.

So far, the probability of a decline below the 200 day moving average for XRP/BTC before a break above the 50 day moving average seems quite low. This is because the daily chart shows that Ripple (XRP) has significant room for a short term rally. This rally would also help Ripple (XRP) reach overbought conditions on larger time frames so a strong decline to the downside can begin. Ripple (XRP) like most cryptocurrencies have declined more than 90% from its all-time high but that does not mean that the price has bottomed yet. In fact, we believe that the price has a long way to go before it bottoms. This week’s close is likely to determine the fate of Ripple (XRP) for the weeks ahead. The trading activity for the past few weeks for Ripple (XRP) has been rather confusing. Some investors and analysts have blamed it on manipulation while others have chalked it up to a lake of interest in the market at the moment.

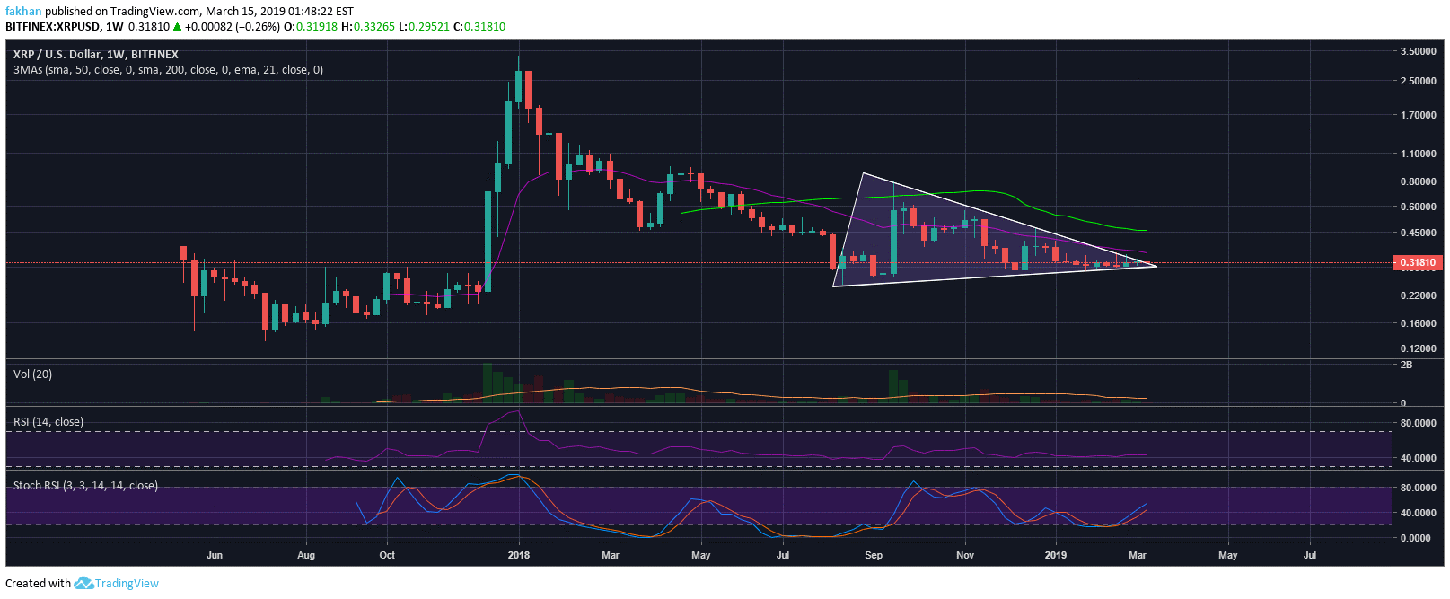

The weekly chart for XRP/USD shows that the price of Ripple (XRP) has failed numerous times in its attempts to break out of the symmetrical triangle it has been trading in since August, 2018. The price has also been facing constant rejections around the 21 Week EMA. This goes on to show that the bulls have a hard time pushing the price of Ripple (XRP) above the symmetrical triangle. With this kind of weakness in the market, it is unlikely that we might see a significant break to the upside. It would not be surprising to see XRP/USD break to the upside and shoot towards the 50 week moving average.

However, it is likely that this move will be short lived and the price will retrace significantly before the weekly close facing a strong rejection at the 50 week moving average. The Stochastic RSI on the weekly time frame shows that Ripple (XRP) unlike most other cryptocurrencies has a lot of room for significant room to the upside. However, the majority of people in the market at this point are professional traders who know how to knock out mainstream investors and have their way. The wicks that we have seen in the past few weeks will thus only get longer in the weeks ahead as we see more signs of market manipulation as we get closer to the bottom.

Investment Disclaimer