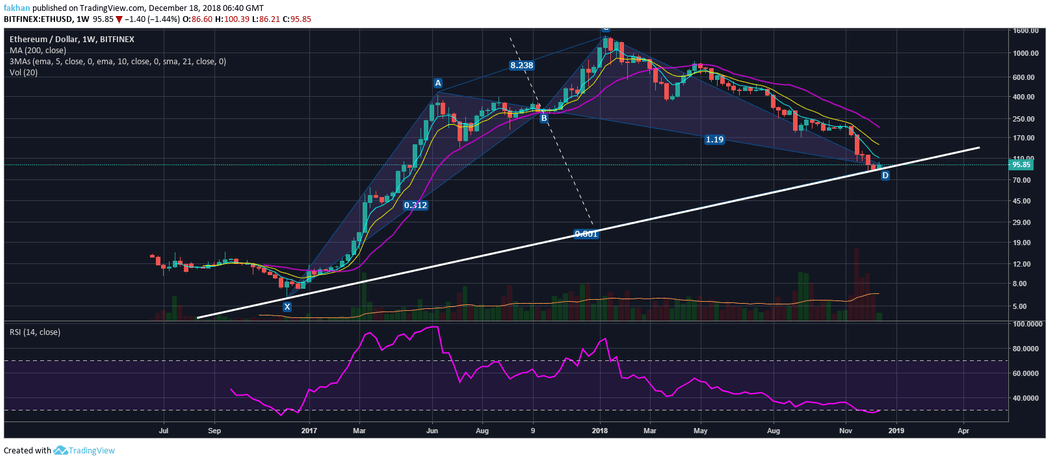

Ethereum (ETH) has just completed its correction and the price has already started to recover. Future prospects for ETH/USD do not seem as bright as before for a number of reasons. First of all, Ethereum (ETH) has ceded it market share to its competitors. Platforms like Cardano (ADA), Ethereum Classic (ETC), Lisk (LSK) and Quantum (QTUM) are some of its direct competitors that claim to do what Ethereum (ETH) can and a lot more. Second of all, Ethereum (ETH) has just lost its second place in terms of market cap to Ripple (XRP). This sends a clear message that Ethereum (ETH) no longer has the muscle to fight back on its own. Interest in Ethereum (ETH) itself is not the same as it once was. However, there are other reasons to believe that this cryptocurrency may rise to its all-time high in 2019.

As a platform, Ethereum (ETH) is no longer the hottest investment in the market. However, as a cryptocurrency to raise funds for ICOs, Ethereum (ETH) has not yet lost its place. As the bear market draws to an end, a lot of new ICOs are preparing to flood the market. Almost all of those ICOs are raising funds in Ethereum (ETH). This means that a large number of cryptocurrency investors participating in those ICOs will first have to buy Ethereum (ETH). This will drive up demand for Ethereum (ETH) in the near future. As long as the market stays net long, we will continue to see new ICOs entering the market. Most of these ICO companies will not cash out anytime soon because they would like to take advantage of the bull market, hoping that the ETH they have raised will grow in value over the months ahead.

Just the ICO factor alone is likely to raise demand for Ethereum (ETH) like never before. We have seen in the past how Ethereum (ETH) rose from $15 to $1500 within one year. This was all down to ICOs raising millions of dollars via Ethereum (ETH). When those ICOs were done raising money, they started dumping their coins for fiat and we saw the price of Ethereum (ETH) fall down to $83. The companies that sold early are still afloat; those that held bags of Ethereum (ETH) hoping the price will recover soon have already declared bankruptcy.

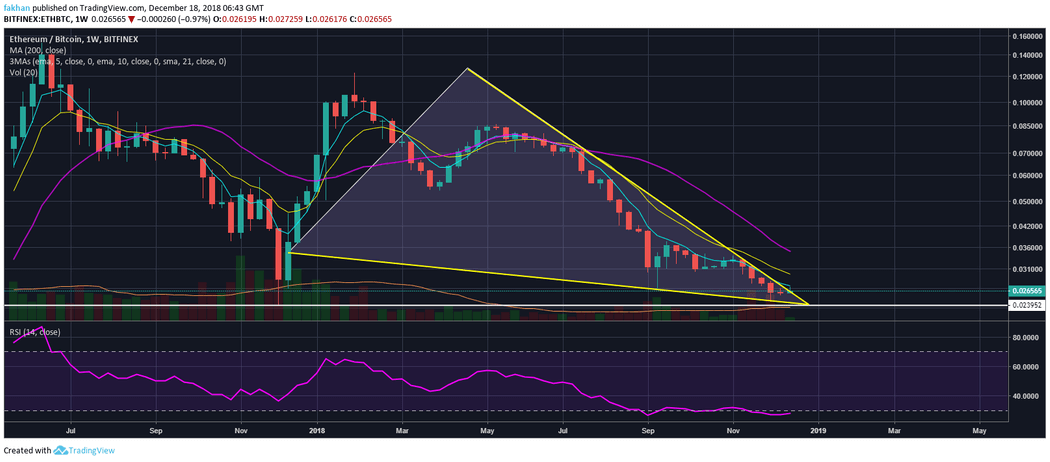

Ethereum (ETH) has now bottomed out against Bitcoin (BTC) and has already started to recover. The weekly chart for ETH/BTC shows that the price is now likely to rally hard against Bitcoin (BTC) in the weeks ahead. The price is ready to break past the 5 Week EMA resistance as it has now already broken out of the falling wedge. Ethereum (ETH) has long been due for a recovery against Bitcoin (BTC). During the next few weeks as the bullish momentum prevails, we are likely to see Ethereum (ETH) gain against Bitcoin (BTC). However, the actual trend reversal is expected when the price breaks past the 21 Week EMA. That is when we would expect the price to climb towards its all-time high in 2019.

Investment Disclaimer